Nifty, Bank Nifty, Fin Nifty & NIFTY Midcap Expiry Report 28th October 2025 by Motilal Oswal Financial Services Ltd

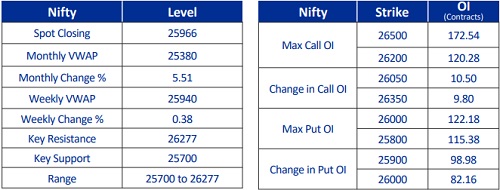

NIFTY : 25966

Nifty opened positive and buying emerged to stretch the index to 26000 marks in the first half of the session. It witnessed minor profit booking but again picked up momentum from 25900 zones in the last hour and closed with gains of around 170 points. Bulls reattempted at support levels and the index floated above the support levels. It formed a bullish candle on the daily frame and recouped all the losses of the previous session. Now it has to hold above 25900 zones for an up move towards 26100 then 26277 zones while supports can be seen at 25800 then 25700 zones.

Expiry day point of view : Overall trend is likely to be positive and Now it has to hold above 25900 zones for an up move towards 26100 then 26277 zones while supports can be seen at 25800 then 25700 zones.

Trading Range : Expected wider trading range : 25700/25800 to 26100/26277 zones.

Option Strategy : Option traders can initiate monthly Nifty Bull Call Spread (Buy 26000 CE and Sell 26150 CE) to play the upside move.

Option Writing : Sell monthly Nifty 25700 PE and 26300 CE with strict double SL.

Weekly & Monthly Change : Nifty is up by 0.38% at 25966 on a weekly basis. Nifty VWAP of the week is near 25940 levels and it is trading 25 points above the same. On the monthly scale, the Index is up by 5.51% while VWAP is near 25380 levels and it is trading 580 points above the same which indicates overall bullish stance with buy on dips for the expiry day point of view.

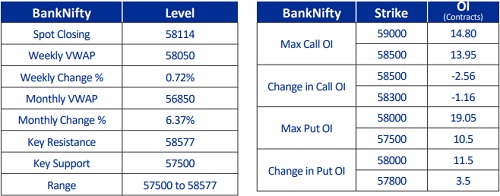

Bank Nifty : 58114

Bank Nifty index opened on a positive note near 57800 zones and extended the momentum towards 58200 levels in the first half of the session. Later, it remained consolidative in a narrow range of 200 points between 58000 to 58200 zones with overall positive bias. It formed an Inside Bar pattern on daily scale but buying interest is visible at lower levels and it is holding well above its 10 DEMA. Now it has to hold above 58000 zones for an up move towards 58250 then 58577 zones while on the downside support is seen at 57750 then 57500 levels.

Expiry day point of view : Overall trend is likely to be bullish and now till it holds above 58000 zones, up move could be seen towards 58250 then 58577 zones while on the downside support is seen at 57750 then 57500 levels.

Trading Range : Expected wider trading range : 57500/57750 to 58250/58577 zones.

Option Strategy : Option traders can initiate Bull Call Spread (Buy 58200 CE and Sell 58500 CE) to play the upswing.

Option Writing : Option writers are suggested to Sell Bank Nifty 57600 Put and Sell 58900 Call with strict double SL.

Weekly and Monthly Change : Bank Nifty is trading up by 0.72% at 58114 on weekly basis. Bank Nifty VWAP of the week is near 58050 levels and it is trading 65 points above to the same. On monthly scale Index is up by 6.37% while VWAP is near 56850 levels and it is trading 1250 points above to the same which suggests positive bias for expiry day point of view.

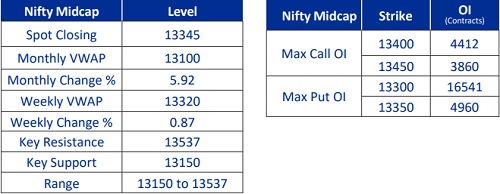

NIFTY Midcap Select : 13345

Nifty Midcap Select index opened with a strong gap-up of over 80 points, and buying was visible right from the first tick. Sustained accumulation continued throughout the day as the index kept inching higher, with even minor dips being bought into. It extended its rally even after the gap-up opening, closing with strong gains of 180 points near the day’s high. The index has now surged over 700 points in the current series and successfully crossed the previous month’s high, coming just a few points away from its all-time peak. It also appears to be on the verge of an inverse head & shoulder pattern breakout, signalling potential for further upside. On the monthly chart, it has formed a large bullish candle, supported by bullish formations on smaller time frames as well. Now it has to hold above 13300 zones for an up move towards 13450 then all-time high of 13537 zones while supports can be seen at 13250 then 13150 zones.

Expiry day point of view : Overall trend is likely to be positive and Now it has to hold above 13300 zones for an up move towards 13450 and then all-time high of 13537 zones while supports can be seen at 13250 then 13150 zones.

Trading Range : Expected wider trading range : 13150/13250 to 13450/13537 zones.

Option Strategy : Option traders can initiate Bull Call Spread (Buy 13375 CE and Sell 13425 CE) to play the upside move.

Option Writing : Option writers are suggested to Sell Nifty Midcap select Monthly 13250 Put and Sell 13500 Call with strict double SL.

Weekly & Monthly Change : Nifty Midcap select is up by 0.87% on a weekly basis. It’s VWAP of the week is near 13320 zones and it is trading 25 points above the same. On monthly scale Index is up by 5.92% while VWAP is near 13100 levels and it is trading 250 points above the same which indicates bullish stance for the expiry day point of view.

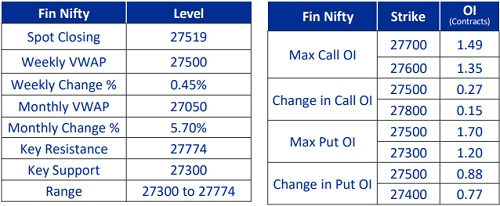

Fin Nifty: 27519

Fin Nifty Index opened on a positive note and it extended the up move towards 27600 in the first half of the session. Later, it remained consolidative in narrow range of 150 points in between 27450 to 27600 zones with overall positive bias. It formed a small bullish candle on daily scale as buying interest is visible at lower levels and holding well above its short term moving averages. Now it has to hold above 27500 zones for an up move towards 27600 then 27774 marks while on the downside support is seen at 27400 then 27300 levels

Expiry day point of view : Overall trend is likely to be bullish and now it has to hold above 27500 zones for an up move towards 27600 then 27774 marks while on the downside support is seen at 27400 then 27300 levels

Trading Range : Expected wider trading range : 27300/27400 to 27600/27774 zones.

Option Strategy : Option traders can initiate Bull Call Spread (Buy 27500 CE and Sell 27600 CE) to play the upswing.

Option Writing : Option writers are suggested to Sell Fin Nifty 27300 Put and Sell 27800 Call with strict double SL.

Weekly & Monthly Change : Fin Nifty is trading marginally higher by 0.45% at 27519 on weekly basis. Fin Nifty VWAP of the week is near 27500 levels and it is trading near to the same. On monthly scale Index is up by 5.75% while VWAP is near 27050 levels and it is trading 470 points above to the same which suggests overall positive stance for expiry day point of view.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Bank Nifty support is at 54750 then 54500 zones while resistance at 55250 then 55555 zones -...