Monthly Update : Metals & Mining - Imports at an all-time high By Elara Securities India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

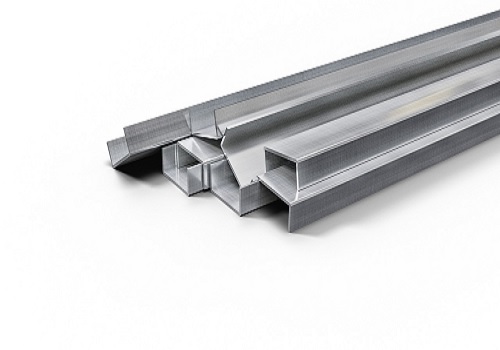

Imports at an all-time high

Global crude steel production up ~1% YoY in October

The World Steel Association (WSA) data shows global crude steel production saw a slight recovery of ~1% YoY to 150mn tonne in October, led by ~3% YoY rise in production for the rest of the world (ROW), even as China reported a fall of ~2% YoY. On a monthly basis, production was slightly down, hit by ~4% MoM fall in China while ROW rose ~4% MoM. India sustained its strong performance with double-digit production growth for the fifth straight month. In October, India’s crude steel production rose ~15% YoY and ~3% MoM. As per provisional data, India’s crude steel production rose ~13% YoY but fell ~3% MoM in November. India’s November steel imports was at an all-time high of 1.2mn tonne for the data series available since CY06. CY23 YTD volume has reached a six-year high of 7.0mn tonne.

Domestic steel prices remain weak in November

After a weak October, steel prices recovered in various regions in November, except in India. China registered ~1% MoM rise in export prices of hot rolled coil (HRC) in November, followed by Japan and North Europe up ~2% MoM and ~6% MoM, respectively. After a flat trend in October, HRC prices in the US jumped by ~23% MoM. In contrast, India was subdued with ~4% MoM fall in HRC prices while prices of primary long products were down ~3% MoM. Higher imports coupled with muted demand due to the festivals, elections in select States and construction restrictions in Delhi and nearby areas dragged prices. Current (December to date) domestic HRC prices are broadly flat MoM, but primary long product prices are down ~2% MoM vs the November average. In November, iron ore prices in Australia and China rose ~10% MoM and ~11% MoM, respectively. Current (December to date) iron ore prices in both regions are up ~2% MoM each. Domestically, NMDC announced a price hike of INR 200/tonne each for lumps and fines on 23 November.

Prices of key non-ferrous metals improve, barring LME aluminium

In November, prices of major non-ferrous metals, barring LME aluminium, improved MoM. LME copper and LME lead prices rose ~3% MoM each, followed by LME zinc up ~4% MoM. In contrast, LME aluminium prices were largely flat MoM in November.

Mix trend visible in coal prices in November

After a positive trend for the past two months for coking as well as non-coking coal prices, November was a mixed month. Coking coal prices in China rose ~5% MoM but fell ~10% MoM in Australia. Non-coking coal prices in China and South Africa fell ~6% MoM and ~13% MoM, respectively. Current (December to date) coking coal prices in China and Australia are up ~10% MoM and ~5% MoM, respectively, vs the November average. Further, current (December to date) non-coking coal prices in China are largely flat MoM but down ~3% MoM in South Africa, vs the November average.

Our view: domestic steel prices unlikely to fall from current levels

India has been a net steel importer for the third consecutive month in November. Thus, higher imports remain cause for concern for domestic steel prices. However, steel prices in China have shown a positive trend in recent times, which should trim the price gap between India and imported steel products. The absence of any major relief from elevated raw material prices should prompt steelmakers to sustain steel prices to safeguard profitability.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">