Monthly Market Outlook & Presentation November 2025 by SBI Mutual Fund

Financial market performance Year-to-Date: Broad based rally across multiple asset class

* 2025 have seen a broad-based performance with multiple asset classes spanning across DM and EM equities, EM fixed income, precious and industrial metals deliver healthy returns.

* Year-to-date, Brent, US dollar and global food hav been few key asset classes to deliver negative returns.

* In India, Indian equities have made some comeback in October, perhaps aided by a healthy earnings outcome. NIFTY and Sensex rose ~4.5% m-o-m each.

* Year-to-date, both global equities and global fixed income have out-performed India by a wide margin.

* The returns in Indian equities and fixed income at an index levels have been broadly similar thus far.

Tariffs and Their Ripple Effects: Inflation, Investment, and Geopolitics

* Seven months have passed since 2nd April –Liberation Day. Harvard Research has come out with a study to conclude that most of the tariff costs have largely been absorbed by US importers and consumers. This is still incrementally growth negative for the US economy.

* The study estimates that the impact of tariffs on US CPI is ~0.7%. In other words, inflation would have been closer to 2.3% (rather than 3%) without tariffs.

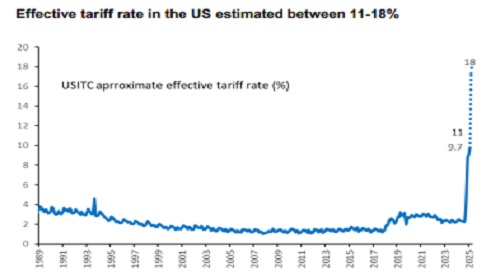

* There are two estimates of average effective tariff in the US. Yale lab estimates the cost to be 18% while current collection indicates tariffs closer to 10-11%.

* It seems likely that tariffs might be indeed stabilizing (at least for a while) but US CPI could continue to rise into 2026. In the lead up to mid-terms 2026, Trump might prefer to lower tensions, claim victories and reduce inflationary pressures. Depending on outcomes, disputes could then flare-up again.

* It is too early to judge the impact of tariffs and "trade deals" on investment. But, at this stage, non-AI gross fixed capital formation is stagnating while we view vague commitments on future investments with scepticism (source: Macquarie Research).

* Meanwhile on geopolitical front, US had to retreat on negotiations with Mexico and Canada. China-US relation is edgy, but the outcomes are still inconclusive. US EU relation has damaged meaningfully. Europe is strengthening its relationship outside of US and Mexico. Despite dependence on the US for security, signs of hedging are even emerging from long-standing allies, such as Japan, Korea or Australia. It is likely that trade policies have damaged US's network influence while accelerating global fragmentation.

* To sum, at least temporarily, tariffs are stabilizing at a lower than feared levels. Costs are borne by US importers and consumers while other policies (kickbacks, industry protection, immigration) are eroding key pillars of US exceptionalism. But, these inefficiencies do not fully negate structural strength of many US corporates. However, investors will likely keep hedging USD exposure.

* Near term volatility aside, unless the world addresses the global economic imbalance, these news flow could be the feature of present times. And eventually for US to shrink its CAD , dollar will have to depreciate (more so against China) , the country will have to engineer a slowdown in their growth.

Geopolitical shifts will continue: Root cause of the problem is economic imbalance

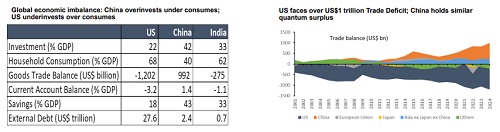

* The tariff issue highlights the deeper economic imbalance between the U.S. and China.

* US runs an annual trade deficit of ~US$1 trillion and China runs a similar quantum of surplus. Hence, US absorbs most of the worlds' surplus output of goods. This has led to rising levels of US overseas indebtedness. US administration wants to address this imbalance.

* China invests more than it spends while US consumption runs far higher than its investment. US acts as a consumer of last resort.

* The level of indebtedness in the US economy is rising to levels, which is perhaps getting difficult to sustain.

* Trump administration has initiated a fundamental debate- which is here to stay. There is a likely changing global order in the offing. Without robust demand from the US, global trade volumes may remain subdued for a prolonged period—unless China or the European Union undertakes substantial fiscal stimulus to boost demand.

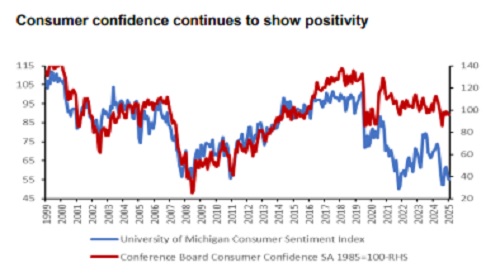

Some near-term de-escalation in global uncertainty

* The policy uncertainty has eased from its April peak.

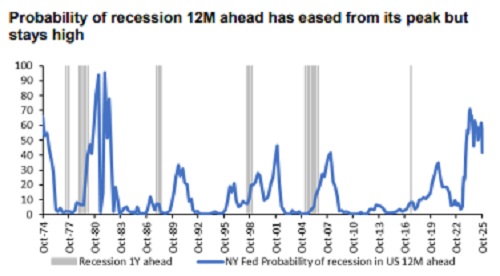

* In the immediate aftermath of the tariff announcement, recession risks surged in April. However, the U.S. economy has avoided a meaningful downturn thus far. While the corporate balance sheet in the US is running profitable, aided by AI boom, productivity gains and easy fiscal policy, there are increasing debates on US exceptionalism

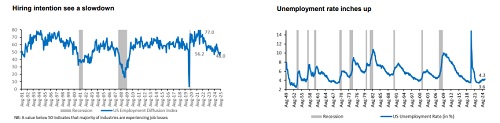

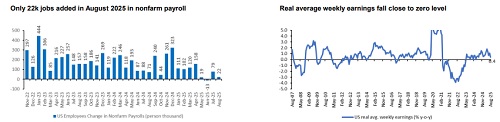

US labour market sees signs of weakness…

…prompting US Fed to cut interest rates

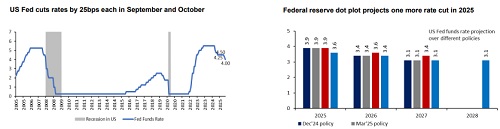

* The weakening in labour market prompted the Federal Reserve to deliver two consecutive rate cuts.

* The Federal Reserve cut rates by 25bps to 3.75-4.00% on expected lines. One more rate cut is projected in 2025, though Powell said that an additional cut at the December meeting “is not a foregone conclusion”.

* The Fed will end the quantitative tightening starting 1st December 2025.

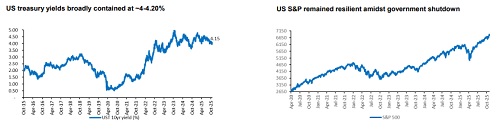

* The Fed’s second consecutive 25 bp cut was expected, but Powell’s press briefing signalled a pivot toward caution. A divided FOMC and limited data—due to the government shutdown—have raised the threshold for further easing. With growth stabilizing and inflation sticky, insurance cuts appear complete. Market pricing of 1 pp in additional cuts looks aggressive even as the Fed appears willing to tolerate modest inflation overshoots to preserve employment stability. In our view, UST 10Y yields below 4% are unsustainable as 1pp rate cuts are fully priced in and lower UST yields make long duration borrowing (borrowing mix to shift away from T-Bills) more attractive thus putting upward pressure.

US Fed actions keep yields stable. Gold prices surge and US equities resilient

A word on US government shut down:

* US government triggered an automatic shutdown on 1st October 2025 (first time in seven years) on failing to meet the deadline to pass the budget.

* Healthcare policy disputes, mainly Democrats demanding restoration of Medicaid cuts and an extension of Affordable Cares Act subsidies. Senate failed 13 times to pass a continuing resolution due to lack of bipartisan support.

* This led to many US government services to be temporarily suspended and approximately 1.4 million federal employees to be on unpaid leave.

* So far, US Fed rate cuts has supported the economy and markets, while the shutdown is expected to resolve by mid November. That said, this is one of the longest shutdowns and GDP growth is expected to fall by 0.1-0.2 % pt per week of shutdown. Historically, shutdowns have minimal lasting impact on equity markets and Treasury yields, but uncertainty can weigh on sentiment if prolonged.

Even as labour data is weakening, US consumption demand holds up likely supported by wealth effect

* While firms have slowed hiring, there hasn’t been a corresponding increase in layoffs—a typical precursor to recession.

* Even the consumer spending data remains inconclusive, leaving markets hesitant to abandon their cautiously optimistic stance. To sum, hard economic data paints a mixed picture on US growth skewed towards a modest moderation

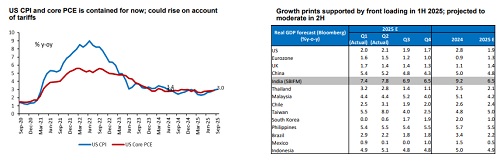

US inflation concerns remain; Growth projected to moderate in 2H 2025

* US inflation level rises marginally to 3.0% y-o-y in September 2025 (vs. 2.9% last month). Pre-emptive inventory buildup has temporarily cushioned the cost impact of new tariffs on consumer goods. Hence inflation readings remain subdued, not yet reflecting the full effect of current trade-related price pressures.

* On the other hand, inflation outside the US is going down owing to better trade deals and China dumping.

* De-globalization, including trade war and highly restrictive immigration policy is a headwinds to growth in the US, but artificial intelligence and the boost it is providing to investment and the stock market, household wealth and spending is a tailwind to growth. How these cross-winds play out is the key how US growth plays out.

* While front-loading supported growth in Q1 and early Q2, the impact of reduced U.S. imports may lead China and other economies to see softer growth in 2H 2025. As a broader narrative, the policy is growth supportive across most economies but global trade dynamics will play a crucial role in shaping overall growth.

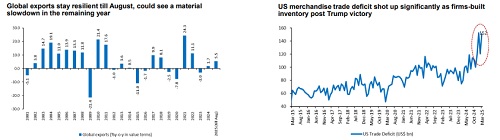

While trade shifts create a headwind for growth…

* U.S. goods trade deficit widened sharply as firms front-loaded imports ahead of Trump tariff implementation.

* Exports trend has held up well thus far until August but could be headed into material softness for rest of the year.

* One area of resilience in U.S. import demand has been AI-related IT hardware from Korea and Taiwan, which has surged despite ongoing uncertainty around semiconductor tariffs. This strength highlights how sector-specific booms have helped cushion headline trade figures.

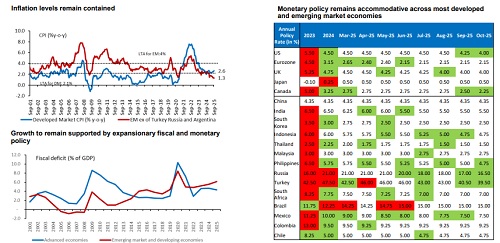

…pro-growth global monetary and fiscal policy provides some offsetting impact

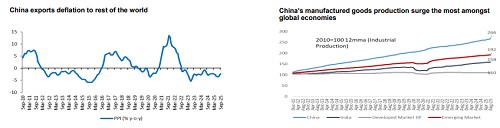

The World Faces the Fallout of China’s Industrial Overcapacity

* While inflation remains a concern in the US, much of Asia is in a disinflationary phase — partly driven by China’s rising exports to non-US markets.

* Some of these goods are destined for re-export to the US, while others serve Asia’s domestic consumption, contributing to deflationary pressures in the region, including India.

* Anti involution campaign in China to rein in unhealthy competition due to excess capacity in many industries.

* Main objective is to get China out of deflation. However, China’s measures aren’t as aggressive yet and demand is weak. Hence, could be a slow path to reflation

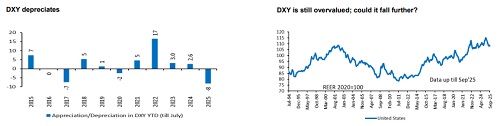

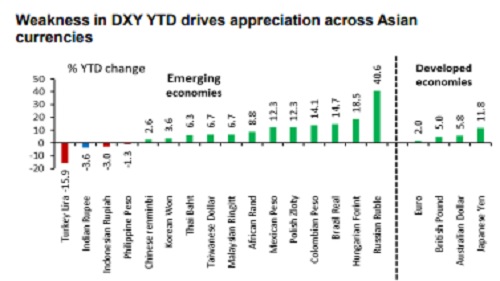

Dollar is weak, most currencies appreciate year-to- date though Indian Rupee is weak

* The adjustment to economic imbalance also warrants a weaker dollar. Despite the recent correction, dollar is significantly overvalued on REER basis. The debate on ebbing US exceptionalism is making investors re-assess their USD exposure. On a bore structural basis, USD could continue to weaken.

* Weaker dollar helps cheaper non-US assets to outperform.

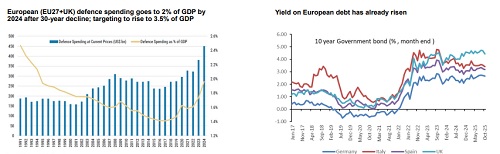

European Defence Spending

* Europe is ending its long-standing fiscal austerity with Germany leading the path. Market will be keenly watching if a looser fiscal policy can drive domestic growth in a far tougher environment with key partners like China and the US.

* Europe wants to increase its defence spending meaningfully. The nations have committed to take up their defence spending from currently 2% to 5% by 2035 in latest NATO summit.

* The core defence budget is expected to scale to 3.5% of GDP in next 10 years.. World over we see a rise in defence spending. EU commission has also relaxed the fiscal rules for the members. Thus, after US, Europe now seems to be supporting growth via looser fiscal policy. This could also mean higher imports from the bloc.

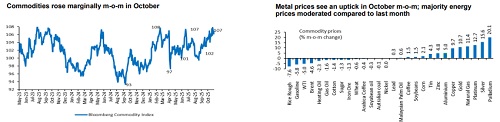

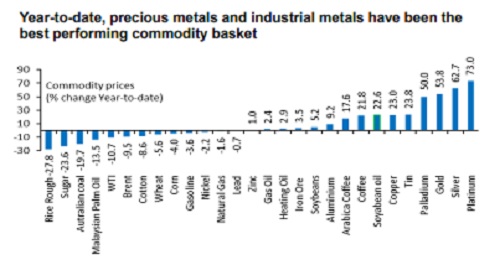

Commodity prices trends: precious metals and industrial metals have been best performers

* Commodities prices rose marginally m-o-m in October 2025 on account of metal prices rising.

* Precious metals continue to gain YTD.

* Global fiscal stimulus continuity and easing in trade tensions help commodity prices stay supported even as tariff related growth risks persist.

* Copper prices have swung sharply since July with US president’s announcement of a 50% copper tariff. However, the recent clarification that use of copper as raw input material will be exempted led to prices correcting.

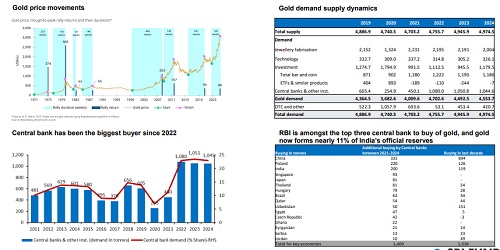

Gold Outlook: Strength Amid Geopolitical and Economic Uncertainty

Gold Outlook: Strength Amid Geopolitical and Economic Uncertainty

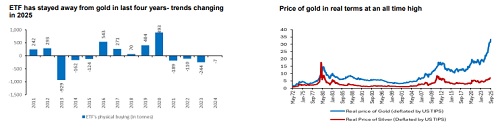

* Gold prices have surged since March 2025, driven largely by a weakening US dollar and escalating geopolitical uncertainty.

* Several underlying factors continue to offer solid support for gold. These include: 1) rising concerns for stagflation 2) shifting dynamic in traditional safe-haven assets 3) current tariff disputes may act as a further catalyst, encouraging investors to reduce reliance on US Treasuries in favour of alternative stores of value like gold.

* After a period of inactivity following the market volatility of 2022, US gold ETF investors are beginning to return.

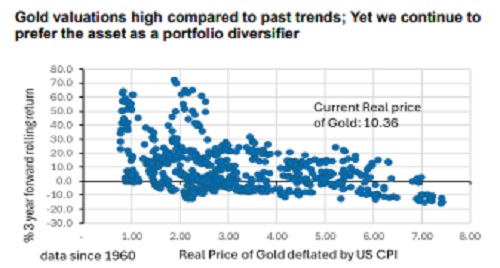

* Fading US exceptionalism and declining comfort in Treasuries enhance gold’s attractiveness, valuations are increasingly stretched.

* As a result, it is prudent to maintain gold as a core holding within diversified portfolios. However, investors should also be prepared for a potential pause or consolidation in gold’s rally over the near term.

Above views are of the author and not of the website kindly read disclaimer

.jpg)