Monthly Equity Market Update September 2025 by ICICI Prudential Mutual Fund

Global Market Update

* US economy grew an annualised 3.0% in Q2CY25 vs a contraction of 0.5% in Q1CY25. Fed left rates unchanged at 4.25%–4.50% in Jul-25 meeting, as policymakers take a cautious stance to fully evaluate economic impact of President’s policies

* Eurozone economy expanded 1.4% Q2CY25, lower than a growth of 1.5% in Q1CY25. ECB kept interest rates unchanged in Jul-25. Main refinancing rate remains at 2.15%, lending rate remained unchanged at 2.40% and deposit facility rate at 2.00%

* UK economy grew 1.2% in Q2CY25, slight easing from of 1.3% in Q1CY25. BoE cut interest rates by 25 bps to 4.0% following a rare two-round vote, underscoring sharp divisions over how to address a sticky inflation and a softening economy

* Japanese economy grew 1.0% in Q2CY25 vs a revised contraction of 0.2% in Q1CY25. BoJ kept its key short-term interest rate unchanged at 0.5% during its Jul-25 meeting

* PBoC maintained key lending rates at record lows for third consecutive month at the Aug-25. The one-year loan prime rate was maintained at 3.0%, as was the case with the five-year LPR, which guides mortgage rates, at 3.5%

Indian Market Update

INDEX PERFORMANCE:

* Indian equity markets delivered a mixed performance. Persistent foreign fund outflows and threat of US tariffs on Indian exports were offset by combination of tailwinds, including proposed revision of GST rates, easing geopolitical uncertainties, softening inflation and hopes of rate cut by MPC. BSE Sensex shed 1.7% as compared to July-end, whereas the Nifty 50 lost 1.4% to settle at 24,427 points

* Markets saw subdued opening, dragged by weak global cues after US imposed 50% tariff on Indian imports, with penalty. Sustained foreign fund outflows and lacklustre corporate earnings also exerted pressure on bourses.

* Optimism over GST reforms, easing concerns over crude oil prices, and progress in peace talks between Russia and Ukraine also provided some support.

* Most key sectoral indices logged a monthly loss in Aug-25. Biggest losers were BSE Oil & Gas, BSE Power and BSE Capital Goods indices, with each of them seeing a 3.5% decline in value, pulled down by persistent concerns pertaining to US tariffs, including a sharp fall on August 26 after US administration issued a draft notice pointing to the imposition of up to 50% tariffs on Indian exports.

INFLATION

CPI inflation cooled down to 1.55% on-year in July-25 from 2.10% in June-25 India’s WPI inflation cooled down to -0.58% in July-25, compared with -0.13% in June-25

DOMESTIC & GLOBAL DEVELOPMENTS:

* India’s GDP growth 7.8% in the Q1FY26, compared with a growth of 7.4% in the Q4FY25

* In terms of gross value added, the economy grew 7.6% in Q1FY26 vs 6.8% in previous quarter

* Indian GDP growth is estimated at 6.5% in FY26 vs 6.5% in FY25 and 9.2 in FY24

* Income tax cuts, lower inflation and the RBI’s rate cuts are expected to support growth in FY26, assuming a normal monsoon and lower crude oil prices. Rate cuts by the RBI, lower inflation and softer crude oil prices are expected to lead to a mild softening of yields next fiscal.

* FIIs sold equities worth Rs 34.99 billion in Aug-25, following selling of Rs 17.74 billion in Jul-25. DIIs picked up equities worth Rs 75.53 billion in Aug-25, compared with Rs 56.60 billion in Jul-25, which supported markets

* US administration now imposing a higher-thanpreviously anticipated 50% tariff on Indian exports from end of month

Outlook & Triggers

Global Update: US equity markets rally continued in Aug 2025 supported by easing trade tensions, strong corporate results and hopes for Fed rate cuts. By the end of Aug 2025, the S&P 500 was up 1.9% on-month while the Nasdaq 100 rose 0.9% on-month. Following the US markets, the UK benchmark FTSE index also managed to inch up 0.6% owing to buoyant business activity and higher inflation. European indices like the German DAX and French CAC 40 were down 0.7% and 0.9%, respectively, amid political uncertainty in France and weak consumer confidence in Germany.

China equities staged a strong rally amid stronger-than-expected manufacturing data, easing trade tensions and optimism over economic recovery and stimulus. The Shanghai Composite index rallied 8.0% in Aug 2025. Japan’s benchmark index Nikkei 225 rallied 3.0% after higher-than-expected GDP, weaker yen and tariff and rate optimism

India Update: Indian equities faced downturn owing to impact of high tariffs of 50% by the US on Indian goods. FPI exits intensified with net outflows of Rs.34,993 crore in Aug 2025 compared to outflow of Rs.17,741 crore in Jul-25

Market barometers BSE Sensex and NSE Nifty50 rallied 1.7% and 1.4%, respectively, on-month in Aug 2025. Sector-wise, BSE Auto (+5.8%), BSE Consumer Durables (+2.0%) and BSE FMCG (+0.2%) were leaders, whereas, BSE Oil & Gas (-4.7%), BSE Power (-4.6%) and BSE Realty (-4.5%) were laggards

Our view going forward:

* Global macros at this point of time are more challenging which may impact global growth

* Contrary to this, India's fundamental attributes are robust and sustainable – Clean balance sheets, a structural increase in consumption, unwavering domestic demand, and fiscal prudence. Hence, long term structural story remains intact

* Recent RBI actions like liquidity injection; key policy rate cuts, large dividend to the Govt. are positive for India’s business cycle and in-turn may result in India growth and corporate earnings to pick-up.

* So, investors with a long-term view can remain invested in equity markets

* However, due to high valuations the fresh investments should be done in a prudent manner.

* Mid-cap and Small-cap valuations continue to remain high.

* Also we believe at this point, middle of the road approach should be followed as most of the asset classes are fully valued

* Therefore, we recommend investing in (a) Hybrid & Multi Asset allocation schemes and (b) staggered investment in large cap schemes or schemes with flexible investment mandate that can take high large cap exposure.

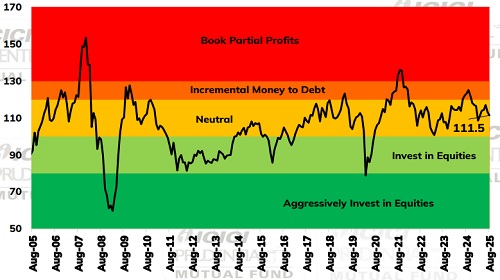

Equity Valuation Index

Above views are of the author and not of the website kindly read disclaimer