Monetary Policy and Economic Outlook Briefing - Oct 1, 2025 by Choice Institutional Equities

Our View

RBI’s wait-and-watch mode is rational given recently enacted policy initiatives coupled with limited transmission of earlier rate cuts. We expect RBI to cut rates at least once in H2FY26E as signalled by a lower inflation target and low credit growth. RBI will also have to take cues from the freshly developing global easing cycle.

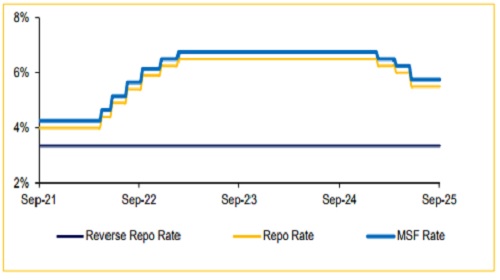

Policy Rates Maintained, Repo Rate at 5.5% with a Neutral Stance

* Short Term Repo Rate: 5.50% | Long-Term RBI Bank Lending Rate: 5.75%

* Over-night Rates: SDF Rate: 5.25% | MSF Rate: 5.75% (Votes: 6-0)

RBI holds rates constant, with a neutral stance

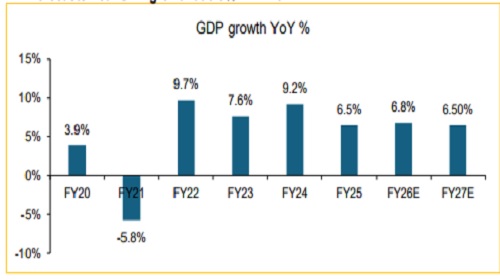

Evenly Balanced Risks & Upsides Impact Growth, FY26E GDP Growth pegged at 6.8%

* Q1 FY2026: Real GDP surged 7.8%, driven by consumption (+7.0%), capex (+7.8%). Sectorally, services (+9.0%) and manufacturing (+7.7%) came in higher.

* High-frequency Indicators indicate that rural demand is robust (tractor sales +17.3%, FMCG sales +8.3%). Investment sustained (steel +8.7%; cement +8.8%).

* Risks are expected to be evenly balanced; however, downside risks emerge from tariffs, global demand weakness and financial instability.

RBI forecasts Real GDP growth at 6.8% in FY26E

Striking a Balance Between “Lower Inflation, Growth Resilience” and “Global Uncertainty”

* RBI awaits interest rate transmission, while monitoring the frontloaded 100 bps cuts since Feb 2025.

* Weighted Average Lending rates fell by only 58 bps since then; while deposit rates dropped by 106 bps.

* In terms of GDP, H1 saw outperformance, driven by Q1’s superior growth; but H2 faces tariff-related and external demand headwinds

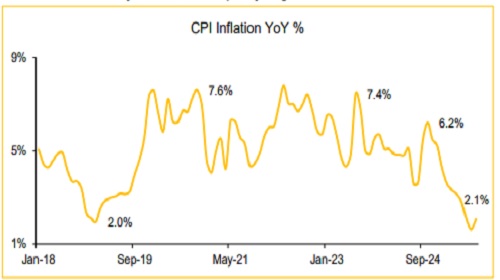

CPI Inflation at multi-year lows, below policy target of 4%

Inflation to Continue its Lower Trajectory

* CPI Inflation fell to 1.6% in July 2025, before rebounding to 2.1% by August, a multi-year low. Food price deflation (-15.9% vegetables, -14.5% pulses) was the primary driver.

* Inflation is expected to be benign in the near-term averaging to 2.6% in FY26E but expected to rise towards 4% in Q4 due to base effects. Inflation for FY27E is expected to be 4.5%.

* Core inflation was contained at 4.2% but would come in lower once precious metals are excluded.

* Good monsoon, higher reservoir levels, foodgrain stocks and GST rate rationalisation measures support a softer inflation trajectory. Upside risks emerge only as base effects fade.

Forex Reserves Comfortable, while FPI Outflows Continue Pressuring INR

* Current Account Deficit narrowed down to 0.2% of GDP in Q1, supported by services and remittances.

* FDI Inflows showed 33% YoY surge; July inflows hit a 38-month high (US $37.7 Bn Apr–Jul).

* FPI Outflows of US$3.9bn YTD.

* Forex Reserves of US$ 700.2 Bn (June 30, 2025), cover 11+ months of imports (94% of external debt).

* Indian Rupee is expected to be volatile and under depreciation pressure, RBI closely monitoring the situation

Liquidity Surplus to Support Credit Growth

* Liquidity surplus remains elevated; CRR cut is expected to ease liquidity further.

* Scheduled Commercial Banks enjoying a strong capital base with CRAR at 17.5% and GNPA at record lows of 2.2%. NBFCs also sound with aggregate CRAR of 25.7% and GNPA at 2.2%.

* Bank credit grew by +10.2% YoY. Further, NBFC lending rose by INR 2.66 Bn, against softer bank lending

Package of 22 Reforms to Improve Credit Growth, Ease of Doing Business and System Stability

RBI Promotes Credit Growth for MSMEs & Real Estate with Prudent Basel III Norms

* Expected Credit Loss provisioning framework made applicable to banks from FY2027, phased implementation till FY2031. This will increase the stability of the banking system with short-term pain for Banks in the form of higher provisioning.

* Basel III revision with lower MSME/real estate risk weights will be applicable from FY2027. Increased lending to MSMEs and Real Estate sectors is expected.

* Risk-based deposit insurance to incentivise prudent risk management.

* Relaxation of bank-group business overlap rules. Empowering board rooms to strategically allocate business streams.

Enhancing Credit Growth with Relaxations in Lending Operations

* RBI proposes to enable Banks to finance Indian acquisitions.

* IPO financing limit raised from INR 1.0 Mn to INR 2.5 Mn; proposal to remove regulatory ceiling for listed debt security lending.

* Withdrawal of disincentives on large borrower exposures (< INR 100 Bn).

* Reduced risk weights for NBFCs in infrastructure finance.

* New licensing framework for Urban Co-operative Banks after a two-decade freeze.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131