MCX Zinc March is likely to slip towards Rs.265, as long as it stays under Rs.271 - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to face the hurdle near $2925 and move lower towards $2860 amid strong dollar and higher treasury yields. Expectation of rise in inflation numbers would lower the chances of 2 rate cuts in this year. Meanwhile, tariff uncertainty and increasing ETF flows could provide some support to the bullions. For the day all eye will remain on US PCE price index, the Fed’s preferred inflation measure. Moreover, comments from the Fed members would also bring price volatility.

* Gold price is near the 20 day EMA at $2880. A move below would weaken it towards $2860. An increasing call base near 2925 strike suggest prices may face resistance near $2925. MCX Gold April is expected to dip towards 20 day EMA at Rs.84,600, as long as it trades under Rs.85,800 level. Only below Rs.84,600 it would open the doors towards Rs.84,000.

* Spot Silver, is expected to face the hurdle of 20 day EMA at $31.75 and move lower towards $30.70. MCX Silver May is expected to face resistance near Rs.96,600 and move lower towards Rs.94,200.

Base Metal Outlook

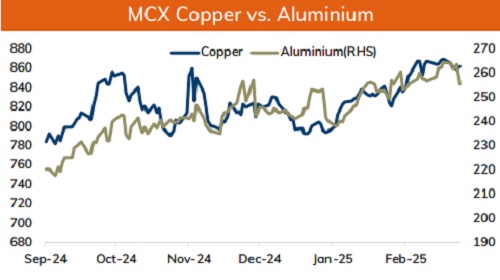

* Copper prices are expected to remain volatile amid tariff threats. Tariffs on Mexico and Canada from next week would weigh on the risk sentiments. Global trade war would be bearish for the metal. Further, ample stocks in China would also reduce supply concerns. Meanwhile, supply disruption in Chile due to power cut has forced some major units to stop operation, which could limit the its downside. MCX Copper March is expected to hold the support at Rs.858 and move towards Rs.870.

* MCX Aluminum March is expected to face the hurdle near Rs.262 level and move lower towards Rs.257 level. Weaker than expected economic numbers from US and a strong dollar would weigh on prices.

* MCX Zinc March is likely to slip towards Rs.265, as long as it stays under Rs.271.

Energy Outlook

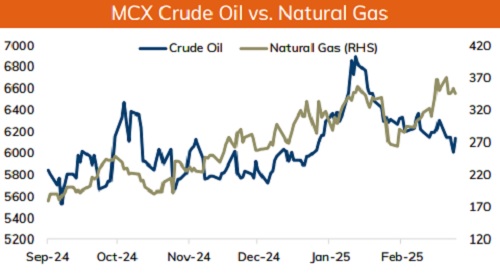

* NYMEX Crude oil is likely to face the hurdle near $71 and move lower towards $68 amid uncertainty over global economic growth. Trade war fear and slow down in US economy would outweigh supply concerns. Further, increasing bets of a peace deal between Russia and Ukraine would improve oil supplies. Meanwhile, sanctions on Iran and supply concerns form Venezuela would limit the downside in oil prices.

* On the data front, unwinding of OI has been observed in ATM and OTM call strike, which suggests a recovery in prices. But, a strong call base near 70 and 71 strike would act as immediate hurdle. On the downside $68 would act as immediate support. MCX Crude oil March is likely to face stiff resistance near Rs.6200 and move lower towards Rs.5950.

* MCX Natural gas March is expected to move lower towards Rs.338, as long as it trades under Rs.358. Forecast of warmer US weather would reduce heating demand.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631