MCX Silver Sep is expected to dip towards Rs 111,500 level as long as it trades below Rs 114,800 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to dip further towards $3320 level on strong dollar and rise in U.S treasury yields. Further, investors are worried that higher tariff rates risk stocking inflationary pressures, giving more room for Fed to hold rates steady for longer duration than previously thought. Additionally, market will keep an eye close eye on consumer price inflation data for any signs that price pressures are accelerating again. Moreover, investors will remain cautious ahead of FOMC members speeches to get more clarity on interest's rate trajectory. Meanwhile, sharp fall may be cushioned on concerns over rising U.S fiscal deficit and whether Trump will replace Powell as he continued to criticize him for delaying interest rate cuts

• Spot gold is likely to slip towards $3320 level as long as it stays below $3380 level. MCX Gold Aug is expected to slip towards Rs 97,200 level as long as it stays below Rs 98,500 level

• MCX Silver Sep is expected to dip towards Rs 111,500 level as long as it trades below Rs 114,800 level.

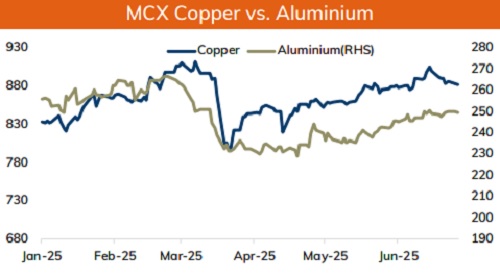

Base Metal Outlook

• Copper prices are expected to trade with a negative bias on strong dollar expectation of weak economic data from China and on fears of renewed trade tension after U.S President Doanld Trump slapped new tariffs on Canada, Mexico and EU. Further, investors fear that tit for tat approach increased the risk of broader global trade war, which may have adverse effect on economic growth denting demand for industrial metal. Additionally, prices may slip further amid rise in inventories at LME registered warehouses. Furthermore, more than 26,000 tons of copper that were due to leave the LME system in Asia was re-warranted

• MCX Copper July is expected to slip further towards Rs 874 level as long as it stays below Rs 890 level. A break below Rs 874 level prices may slide further towards Rs 870level

• MCX Aluminum July is expected to dip towards Rs 246 level as long as it stays below Rs 250 level. MCX Zinc July is likely to move south towards Rs 256 level as long as it stays below Rs 260 level.

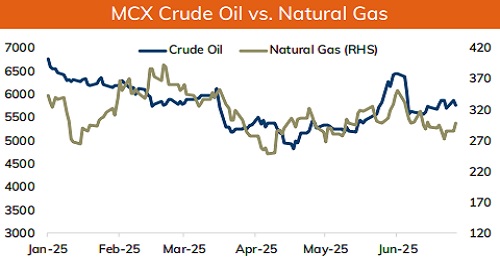

Energy Outlook

• Crude oil is likely to slip further towards $65.5 amid strong dollar and weak global market sentiments. Further, prices may dip on renewed concerns over trade war as it jeopardizes global economic growth and sap global fuel demand. Additionally, China's economy is likely to have cooled in the second quarter after a solid start to the year amid trade tensions and a prolonged property downturn, weighing on oil prices. Moreover, concerns over disruption in oil supply eased after Trump threatened sanctions on buyers of Russian exports unless Moscow agrees to a peace deal in 50 days.

• MCX Crude oil Aug is likely to slip further towards Rs 5550 level as long as it stays below Rs 5800 level.

• Natural gas prices likely to continue with its up move on forecasts for hotter weather over the next 2-weeks. MCX Natural gas July is expected to rise towards Rs 305 level as long as it stays above Rs 290 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631