MCX Silver is expected to rise further towards 73,000 level as long as it sustains above 71,500 level - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Metals Outlook

Bullion Outlook

Spot gold is likely to rise back towards $1935 levels as long as it sustains above $1910 levels amid expectation of correction in dollar and US treasury yields. Further, market participants will look forward for more clarity on interest rate outlook from Fed meeting this week, in which central bank is widely expected to hold rates unchanged MCX Gold prices is likely to move further north towards 59,300 level as long as it trades above the support level of 58,700 levels

MCX Silver is expected to rise further towards 73,000 level as long as it sustains above 71,500 level

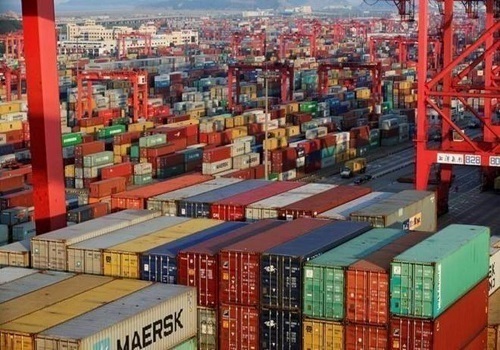

Base Metal Outlook

Copper prices are expected to trade with positive bias amid expectation of correction in dollar and as upbeat economic data from China showed signs that its economy is stabilizing. Further, prices may rally on hopes that major central banks across globe are done with their rate hike cycle. Meanwhile, rising inventories at LME registered warehouses may cap sharp upside in prices. Copper stocks are at their highest since October 2022

MCX Copper may rise back towards 740 levels as long as it trades above 730 levels

MCX aluminium is expected to move downward towards 200.50 level as long as it stays below resistance level of 203.00 level

Energy Outlook

NYMEX Crude oil is expected to rise further till $92 amid expectation of correction in dollar and ongoing concerns over tighter global oil supply. Further, prices may rally on hopes that energy demand in China will improve, as several stimulus from China will aid economic recovery. Additionally, prices may rally on expectations that major central banks are nearing the end of rate hike cycle

MCX Crude oil October is likely to rise further towards 7600 level as long as its sustains above 7340 levels

MCX Natural gas is expected to move downwards towards 210 level as long as it stays below 225 level on forecast for cooler US temperatures next week

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">