MCX Silver Dec is expected to slip towards Rs 152,000-Rs151,000 level as long as it stays below Rs 157,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the negative bias and slip towards $4000 level on strong dollar. Further, prices may slip as release of delayed job report from U.S painted mixed picture of labor market conditions, reinforcing expectation that US Fed may hold off on cutting rates at its upcoming meeting in December. Additionally, Fed officials are signaling caution over further easing, citing worries about inflation. Moreover, job data for October and November will not come before Fed policy meeting, forcing traders to cut bets on interest rate cut next month. As per CME FedWatch tool traders are now pricing almost 39% chance of a rate cut in December, down from about 50% a week ago.

* MCX Gold Dec is expected to slip back towards Rs 121,000 level as long as it stays below Rs 124,000 level. A break below Rs 121,000 will open doors for Rs 120,500 level

* MCX Silver Dec is expected to slip towards Rs 152,000-Rs151,000 level as long as it stays below Rs 157,000 level

Base Metal Outlook

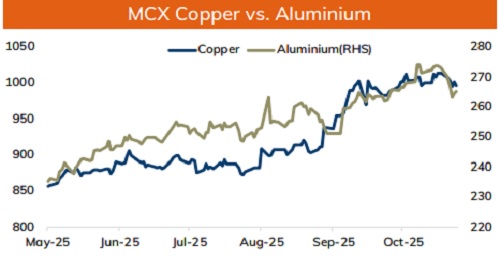

* Copper prices are expected to trade with a negative bias on strong dollar, risk aversion in the global markets and rise in copper inventories at LME registered warehouses. Market sentiments are hurt as much anticipated US jobs data failed to provide clarity on interest rate. Additionally, prices may slip on concern over soft demand in China. As per custom data, China imported 279,944 tons of copper cathodes in October, down 22.1% year on year and 15.7% on a monthly basis. Moreover, expectation of disappointing economic data from major economies will weigh on prices. Manufacturing PMI data is forecasted to show that activity in the sector contracted in major countries, hurting demand for industrial metal

* MCX Copper Nov is expected to slip towards Rs 989 level as long as it stays below Rs 1005 level.

* MCX Aluminum Nov is expected to slip towards Rs 263 level as long as it stays below Rs 267 level. MCX Zinc Nov is likely to face stiff resistance near Rs 307 level and slip back towards Rs 300.50 level

Energy Outlook

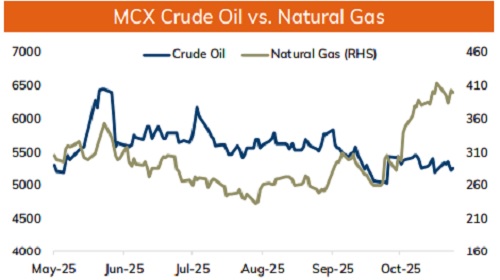

* Crude oil is likely to trade with negative bias and slip further towards $57.50 level on strong dollar and ease in geopolitical tension. Further, U.S. is again trying to push to end war in Ukraine and has drafted a framework for it. Ukrainian President Zelenskiy said he would agree to work on a peace plan drafted by the US and Russia. End of war between Russia and Ukraine may lead to an end to sanctions on Russian energy exports, raising concerns over oversupply. Moreover, rise in US gasoline and distillate stockpiles, signal slowing consumption. Additionally, delayed job report from U.S painted mixed picture of labor market conditions, reinforcing expectation that US Fed may put a pause on rate cut

* MCX Crude oil Dec is likely to slip towards Rs 5100 level as long as it stays below Rs 5400 level.

* MCX Natural gas Dec is expected to slip towards Rs 405 level as long as it stays below Rs 425 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631