MCX Silver Dec is expected to hold support near Rs 144,500 level and rise towards Rs150,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to remain volatile amid economic uncertainty and delay in release of US economic data. Prices would get support from the prospects of lower interest rate in this year. Latest FOMC meeting minutes suggest most of the Fed members were in support of 2 rate cuts in this calendar year. Further, extension to US Government shutdown would help the yellow metal to hold its ground. Meanwhile, easing geopolitical concerns in the Middle East and higher treasury yields could bring profit booking the yellow metal.

* Spot gold is likely to remain in the range of $3940 and $4050. Only a move below $3940 it would turn weaker towards $3900. MCX Gold December is expected to hold the key support near ?120,000 level and move higher towards Rs 122,800 level. Only a move below Rs120,000 it would turn weaker.

* MCX Silver Dec is expected to hold support near Rs144,500 level and rise towards Rs150,500 level.

Base Metal Outlook

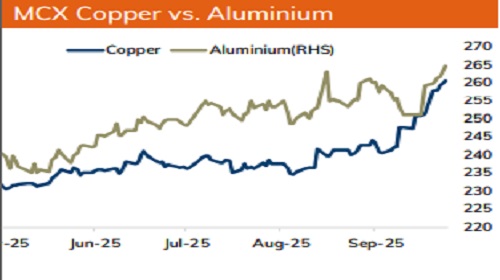

* Copper prices are expected to trade with a positive bias amid ongoing mine disruptions. Reduced production guidance from Freeport-McMoRan has fueled the supply concerns. The International Study group has changed its forecast for a surplus in 2026 to 150k deficit due to lower availability copper concentrate. Further, drop in LME inventory levels by almost 11% last month indicates tightness in the physical market. Meanwhile, investors will eye on key economic numbers from China. New loans in China are expected to show sign of improved money supply.

* MCX Copper Oct is expected to hold support near Rs990 and move back towards Rs1020 level. Only a move below Rs990 it could turn weaker towards Rs984.

* MCX Aluminum Oct is expected to rise towards Rs268 level as long as it stays above Rs263 level.

* MCX Zinc Oct looks to rise towards Rs 298 as long as it holds key support at Rs292. Depleting inventory levels in LME would provide support to prices.

Energy Outlook

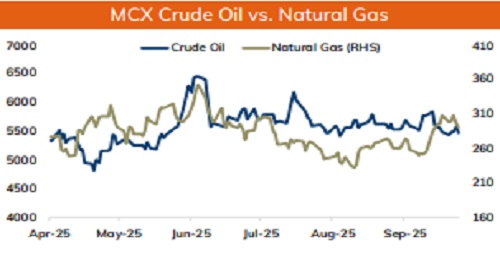

* Crude oil is likely to trade lower on easing Middle East tension. Optimism over an agreement between Israel and Hamas to end the Gaza conflict has eased the risk premiums. Additionally, larger than expected build-up in US crude oil inventories and growing prospects of improved supplies from the OPEC+ nations would weigh on prices. Meanwhile, fresh sanction on Iran by US could cause supply concerns. Moreover, escalating tension between Ukraine and Russia could hurt oil supplies and limit its downside.

* MCX Crude oil Oct is likely to face key hurdle at Rs 5560 level and move lower towards Rs 5400 level. NYMEX crude oil is likely to slip towards $60.50 per barrel as long as it trades under $63.50 per barrel mark.

* NYMEX Natural Gas is expected to trade lower on mild US weather forecast. Further, rising inventory levels and forecast of higher gas production would also weigh on price. MCX Natural gas Oct is expected to slide towards Rs 282 level as long as it trades under 300 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631