MCX Natural gas Sep is expected to dip towards Rs.253 level as long as it stays below Rs.268 level - ICICI Direct

Bullion Outlook

* Spot Gold is likely to correct further towards $3600 level on strong dollar and rise in U.S treasury yields across curve. Dollar and Yield may move further north as US Fed delivered expected rate cut but warned on sticky inflation seeding doubts over the pace of future policy easing. US Fed Chair Powell statements signaled that central bank is in no hurry to lower borrowing cost quickly in coming months. Additionally, improved economic data from U.S would continue to weigh on gold prices. Meanwhile, demand for safe haven may increase on escalating geopolitical tensions in Middle East and Eastern Europe, political uncertainty in France and Japan and concerns over U.S Fed independence

* MCX Gold Oct is expected to slip towards Rs.108,500 level as long as it stays below Rs.109,800 level

* MCX Silver Dec is expected to slip towards Rs.125,000 level as long as it trades below Rs.128,000 level.

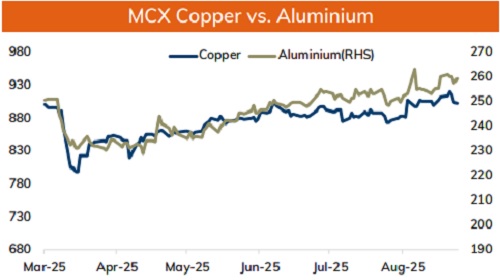

Base Metal Outlook

* Copper prices are expected to trade with a negative bias on strong dollar, solid supply outlook and muted demand from China. Dollar is gaining strength as U.S Fed Chair Powell ruled out more aggressive easing going forward. Further, investors are worried that U.S tariff may have negative impact on global economic growth, denting demand for industrial metal. Moreover, higher metals output in China would weigh on prices.

* MCX Copper Sep is expected to slide towards Rs.895 level as long as it stays below Rs.910 level. A break below Rs.895 level prices may plunge further towards Rs.890 level

* MCX Aluminum Sep is expected to rise towards Rs.261 level as long as it stays above Rs.258 level. MCX Zinc Sep is likely to move south towards Rs.276 level as long as it stays below Rs.280 level.

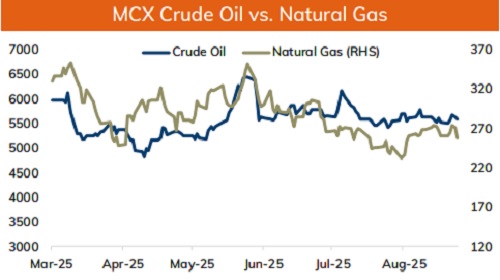

Energy Outlook

* Crude oil is likely to trade with negative bias and slip further towards $62.0 level on strong dollar and concern over fuel demand in U.S. Further, renewed calls by US President Donald Trump for lower oil prices to pressure Russia to end the war in Ukraine, signals trump prefer low prices over sanctions on Russia, easing fears over supply disruption. Donald Trump also repeated calls for countries to stop buying oil from Russia. Meanwhile, US Fed lowered its interest rate by 25bps and signaled more rate cuts by year end, lower borrowing cost may boost economic growth and demand for oil

* WTI crude oil is likely to dip towards $62.00 level as long as it trades below $64.20. MCX Crude oil Oct is likely to slide towards Rs.5500 level as long as it stays below Rs.5680 level.

* MCX Natural gas Sep is expected to dip towards Rs.253 level as long as it stays below Rs.268 level. Gas price may slip further due to a larger than expected build in weekly EIA natural gas inventories

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631