MCX Natural gas Oct is expected to hold above Rs 297 level and rise towards Rs 312 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to hold its ground near $3820 per ounce and move back towards $3900 per ounce level on concerns over US Government shutdown. A delay in the funding deal may cause further uncertainty over US economic growth and increase the bets of monetary easing from US Federal Reserve. Meanwhile, most of the economic data release from US will be delayed. Bullions prices would also get support from geopolitical concerns and persistent buying from the central banks and strong ETF inflows. Meanwhile, investors will eye on speeches from Fed members and progress on US funding deal to end the Government shutdown.

• MCX Gold December is expected to rise towards Rs118,600 level as long as it stays above Rs116,800 level

• MCX Silver Dec is expected to remain volatile and rise towards Rs 145,800 level as long as it holds above Rs140,000 level.

Base Metal Outlook

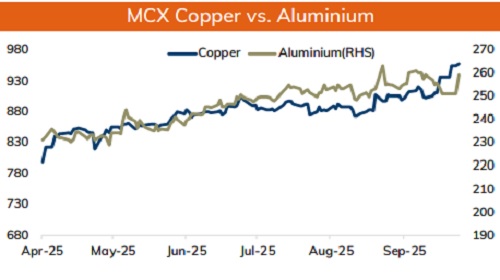

• Copper prices are expected to hold its ground and trade with a positive bias amid supply concerns from Chile and Indonesia. Further, decline in inventories at LME registered warehouses and increased demand of refined metals would support the metal to hold firm. Prices would also get support amid soft dollar and growing bets of further monetary policy easing from the US Fed. Meanwhile, US government shutdowns and National Day holiday in China may check its upside.

• MCX Copper Oct is expected to hold its gains and move back towards Rs 965 level as long as it stays above Rs 946 level. A move above Rs 965 it would open the doors towards Rs 974 level

• MCX Aluminum Oct is expected to rise towards Rs 261 level as long as it stays above Rs 257 level.

• MCX Zinc Oct looks to rise towards Rs 294 as long as it holds key support at Rs 287

Energy Outlook

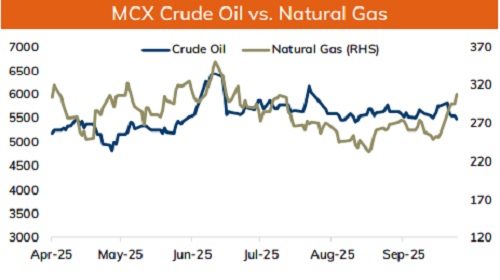

• Crude oil is likely to remain under pressure on expectation of another output hike form OPEC+ from November. OPEC in its upcoming meeting is likely to announce an increase in November output by 500,000 bpd to reclaim its market share. Additionally, concerns over US government shutdown could hurt economic activity and demand prospects of oil. Moreover, restart of Kurdish oil exports from Iraq likely to weigh on prices. On the other hand, supply concerns from Russia on fears over sanction from NATO nations could limit its downside.

• MCX Crude oil Oct is likely to dip towards Rs 5380 level as long as it stays under Rs 5620 level. A move below Rs 5380 it would open the doors towards Rs 5250. NYMEX crude oil is likely to slip towards $60, as long as it trades under $63 per barrel mark. A move below $60 per barrel would weaken further towards $58 per barrel mark.

• MCX Natural gas Oct is expected to hold above Rs 297 level and rise towards Rs 312 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631