MCX Natural gas Oct is expected to hold above Rs 290 level and rise towards Rs 310 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to trade higher on concerns over US Government shutdown and safe haven buying. Senate Democrats again blocked the seven-week stopgap spending bill, which would further stretch the government shutdown this week. A delay in the funding deal may cause further uncertainty over US economic growth and increase the bets of monetary easing from US Federal Reserve. Meanwhile, most of the economic data release from US will be delayed and investors will eye on comments from the Fed members to get more clarity in quantum of rate cuts this year. Moreover, strong ETF inflows and persistent central bank buying would push the spot gold to rally towards $3950 per ounce.

• MCX Gold December is expected to rise towards Rs 119,400 level as long as it stays above Rs 117,800 level

• MCX Silver Dec is expected to remain volatile and rise towards Rs 148,800 level as long as it holds above Rs 142,500 level.

Base Metal Outlook

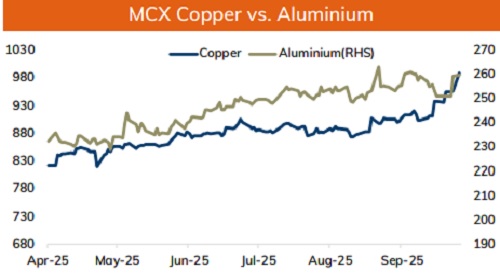

• Copper prices are expected to trade with a positive bias amid supply concerns from Chile and Indonesia. In its latest statement the Grasberg mine has lowered its annual supply by 3% and expect that the mine will return to full capacity after 2027. Further, drop is Chile’s production in August almost by 10% YoY would likely to weigh on supply concerns. Prices would also get support amid soft dollar and growing bets of further monetary policy easing from the US Fed. Meanwhile, US government shutdowns and National Day holiday in China may check its upside.

• MCX Copper Oct is expected to hold its gains and move towards Rs 1000 level as long as it stays above Rs 982 level.

• MCX Aluminum Oct is expected to rise towards Rs 262.50 level as long as it stays above Rs 258 level.

• MCX Zinc Oct looks to rise towards Rs 298 as long as it holds key support at Rs 290

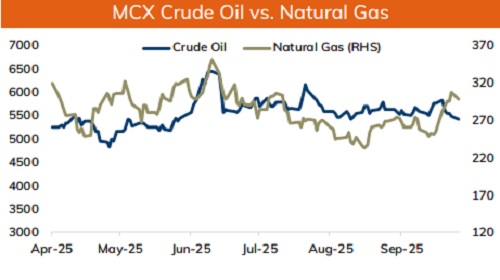

Energy Outlook

• Crude oil is likely to take a pause in its decline and rebound towards $63 per barrel amid smaller-than-expected production hike from OPEC+. In its recent meeting OPEC group has agreed to raise its production output by 137,000 bpd in November. A modest hike for the 2 nd month in a row has eased concerns over oversupply. Further, geopolitical concerns and escalating tension between Russia and Ukraine would also provide support to oil prices. Meanwhile, extension of US Govt. shutdown could hurt economic activity and demand prospects of oil. Moreover, focus will also remain on peace negation between Hamas and Israel.

• MCX Crude oil Oct is likely to hold Rs 5380 level and move back towards Rs 5620 level. A move above Rs 5620 would open the doors towards Rs 5750. NYMEX crude oil is likely to hold $60 per barrel and rally towards $63 per barrel mark.

• MCX Natural gas Oct is expected to hold above Rs 290 level and rise towards Rs 310 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631