MCX Natural gas Feb is expected to rise towards Rs.365 level as long as it stays above Rs.335 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with negative bias on strong dollar and rise in US treasury yields. Further, prices may slip as US President Donald Trump and Democratic leaders reached a deal to avoid a partial government shutdown. Additionally, US Federal Reserve hit a pause on its interest rate cutting cycle and offered no hint about when another rate cut might come. We expect Fed to monitor the upcoming economic data and see how economy evolves before taking any further decision. Most likely rate cut would be seen at Powell’s successor term. Moreover, investors will remain cautious ahead of economic data from US to gauge economic health of the country and get the cues on interest rate trajectory. Meanwhile, demand for safe haven may be seen on escalating trade and geopolitical tensions. MCX Gold April is expected to slip towards ?175,000-?170,000 level as long as it stays below ?189,000 level.

* MCX Silver March is expected to slide towards ?380,000-?370,000 level as long as it stays below ?405,000 level.

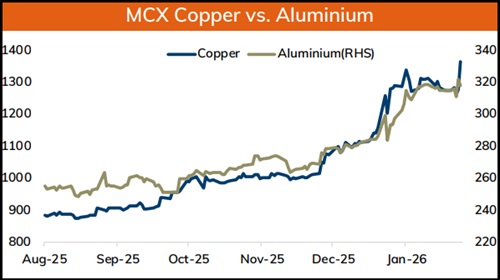

Base Metal Outlook

* Copper prices are expected to trade with negative bias on strong dollar and rise in risk appetite in the global markets. Further, prices may slip on persistent rise in inventories at LME registered warehouses and profit booking. Further, investors fear that renewed trade war between US and major economies will hurt global economic growth and dent demand for industrial metal. Furthermore, investors will remain cautious ahead of data from major economies to gauge economic health of the country and get cues on interest rate trajectory

* MCX Copper Feb is expected to slip towards ?1360 level as long as it stays below ?1430 level. A break below ?1360 level may open doors for ?1350-?1330 level

* MCX Aluminum Feb is expected to slip towards ?335 level as long as it stays below ?347 level. MCX Zinc Feb is likely to face stiff resistance near ?347 level and slip towards ?334 level

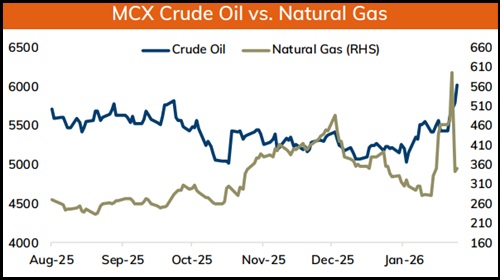

Energy Outlook

* NYMEX Crude oil is likely to trade with positive bias and rise back towards $66 level on supply concerns. On geopolitical front tension in Middle are escalating amid possible US attack on Iran, stoking fears about potential disruption. US President Trump threatened another attack on Iran unless it negotiates a nuclear deal. In Response Iran threatened to strike back. The Strait of Hormuz has come back in focus. Iran’s Revolutionary Guard naval forces will carry out live-fire exercises in the Strait of Hormuz, fueling fears of potential closure of waterway that carries approximately 20% of world oil supply. Crude oil will also find support from API and EIA report, which showed that crude oil inventories declined

* On MCX Crude oil Feb is likely to rise back towards ?6100-?6150 level as long as it stays above ?5800 level.

* MCX Natural gas Feb is expected to rise towards ?365 level as long as it stays above ?335 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Commodity Research- Daily Evening Track - 13 -Feb-2026 by Kotak Securities