MCX Crude oil Oct is likely to face key hurdle at Rs 5650 level and move lower towards Rs 5400 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to hold support near $4000 per ounce and trade higher amid economic uncertainty and a dovish Federal Reserve. The latest Fed minutes showed that policymakers showed willingness to cut interest rates this year due to fragility in the labor market. Further, extension to US Government shutdown and political uncertainty in France would help the yellow metal to trade higher. Additionally, central bank buying and strong ETF inflows would fuel its rally. Meanwhile, easing geopolitical concerns in the Middle East could bring profit booking in the yellow metal. At the same time investors will eye on comments from the US Fed chair Jerome Powell to get more clarity in quantum of rate cuts this year.

• MCX Gold December is expected to remain volatile and move towards Rs 124,000 level as long as it stays above Rs 121,800 level

• MCX Silver Dec is expected to hold support near Rs 147,800 level and rise towards Rs 151,500 level

Base Metal Outlook

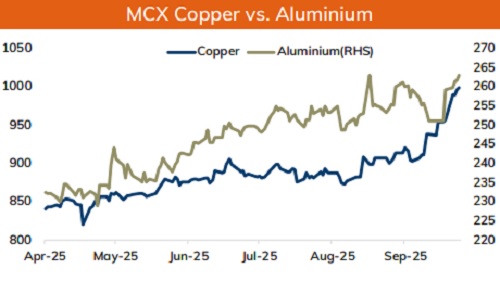

• Copper prices are expected to hold its ground and trade with a positive bias amid ongoing mine disruptions. Prolonged supply disruption in Indonesia and Chile has fueled persistent shortage concerns. Further, drop in LME inventory levels by almost 11% last month indicates tightness in the physical market. Prices would also get support amid growing bets of further rate cut hopes from the US Federal reserve. Meanwhile, investors will eye on key economic numbers from China.

• MCX Copper Oct is expected to hold support near ?990 and move back towards Rs 1005 level.

• MCX Aluminum Oct is expected to rise towards Rs 264 level as long as it stays above ?260 level.

• MCX Zinc Oct looks to rise towards Rs 298 as long as it holds key support at Rs 292. Depleting inventory levels in LME would provide support to prices.

Energy Outlook

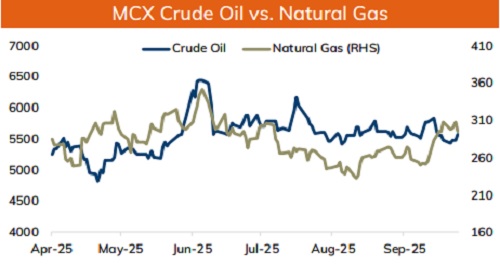

• Crude oil is likely to trade lower on easing Middle East tension. An agreement between Israel and Hamas to end the Gaza conflict has eased the risk premiums. A confirmation to first phase of a peace plan could end the two-year war. Additionally, larger than expected build-up in US crude oil inventories and growing prospects of improved supplies from the OPEC+ nations would weigh on prices. Meanwhile, escalating tension between Ukraine and Russia could hurt oil supplies and limit its downside.

• MCX Crude oil Oct is likely to face key hurdle at Rs 5650 level and move lower towards Rs 5400 level. NYMEX crude oil is likely to slip towards $60.50 per barrel as long as it trades under $63.50 per barrel mark.

• NYMEX Natural Gas is expected to trade lower on mild US weather forecast. Further, rising inventory levels and forecast of higher gas production would weigh on price. MCX Natural gas Oct is expected to slide towards Rs 290 level as long as it trades under 310 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Buy Gold Feb @ 79400 SL 79200 TGT 79700-79900. MCX - Kedia Advisory