MCX Crude oil June is likely to slip towards Rs 5120 level as long as it stays below Rs 5350 level - ICICI Direct

Bullion Outlook

• Spot Gold is expected to slip further towards $3265 level amid firm dollar and expectation of recovery in U.S. treasury yields. Further, demand for safe haven may ease on de-escalation of trade conflict after U.S. President Donald Trump decided to postpone tariffs on the European Union. Moreover, Fed policymakers are likely to hold rates steady at current levels until they don’t get more clarity on path of tariffs and its impact on prices and economic growth. Additionally, investors will keep a close eye on FOMC meeting minutes and speeches from Fed policymakers to get more insight on policy path

• Spot gold is likely to slip towards $3265 level as long as it stays below $3350 level. MCX Gold June is expected to slip further towards Rs 94,400 level as long as it stays below Rs 95,800 level

• MCX Silver July is expected to slip towards ?96,000 level as long as it trades below Rs 98,500 level. A break below Rs 96,000 level prices may slide further towards ?95,000 level

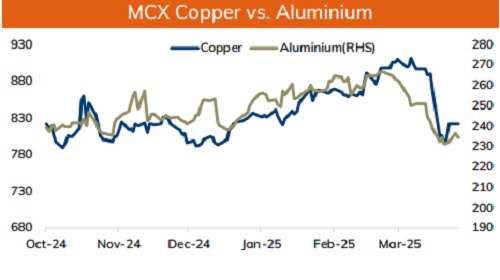

Base Metal Outlook

• Copper prices are expected to trade with negative bias on strong dollar and signs of weaker Chinese demand. Further, prices may dip on concerns about lack of progress on U.S. trade talks with major trading partners. Investors fear that this would have a negative impact on global economic growth, denting demand for industrial metal. Moreover, traders are also watching the passage of a spending and tax bill through the U.S. Senate that is expected to add trillions of dollars of debt. Meanwhile, sharp fall would be cushioned on news that Ivanhoe Mines has suspended its output forecast for this year after seismic activity at its giant mine in the Democratic Republic of Congo halted underground mining operations

• MCX Copper June is expected to slip further towards Rs 857 level as long as it stays below Rs 870 level. A break below Rs 857 level prices may slide further towards Rs 852 level

• MCX Aluminum June is expected to slip towards Rs 235 level as long as it stays below Rs 240 level. MCX Zinc June is likely to move south towards Rs 250 level as long as it stays below Rs 256.50 level.

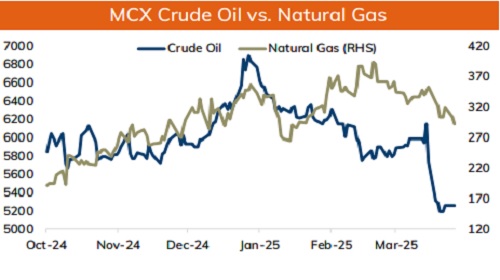

Energy Outlook

• Crude oil is likely to slip back towards $60 level on concern over rising supply as OPEC+ is likely to agree to further increase in oil output for July. Group had begun unwinding in April but in May and June made larger than expected hikes of 411,000 bpd and is expected to continue with its hike in July, with same pace. Additionally, U.S-Iran made little progress in nuclear talks. Investors expect any resolution between 2 countries could add more oil supply to the market. Meanwhile, sharp fall would be cushioned on expectation of fresh sanctions on Russia and as the U.S. barred Chevron from exporting crude from Venezuela under a new authorization on its assets

• MCX Crude oil June is likely to slip towards Rs 5120 level as long as it stays below Rs 5350 level. A break below Rs 5120 level prices may move further south towards ?5050

• MCX Natural gas June is expected to rise towards Rs 325 level as long as it stays above Rs 305 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631