MCX Crude oil Dec is likely to rise towards Rs 5370 level as long as it stays above Rs 5120 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4180 level on weak dollar and decline in US treasury yields across curve. Further, prices may rally on rising expectations of a December interest rate cut by the Federal Reserve following dovish comments from Fed officials. As per CME FedWatch tool traders are now pricing almost 81% chance of a rate cut in December, up from 71% a day ago and about 42% a week ago. Furthermore, investors will remain cautious ahead of key economic data that were delayed due to the government shutdown, including U.S. retail sales, jobless claims and producer price figures. If data continues to show weakness in the economic condition, it may pave the way for another rate cut in December meeting

* MCX Gold Dec is expected to rise towards Rs 124,500 level as long as it stays above Rs 123,000 level.

* MCX Silver Dec is expected to rise towards Rs 156,000-Rs 157,000 level as long as it stays above Rs 152,000 leve

Base Metal Outlook

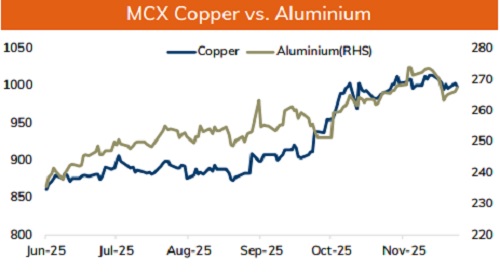

* Copper prices are expected to trade with a positive bias amid weak dollar and rise in risk appetite in the global markets. Further, prices may rally on growing prospects of a December U.S rate cut following dovish signals from central bank officials. Meanwhile, investors will remain cautious ahead of key economic data from US and China to gauge economic health of the country and demand outlook. Additionally, Yangshan copper premium, a gauge of Chinese appetite for imported copper is at $34 a ton, down from a peak of above $100 in early May this year.

* MCX Copper Dec is expected to rise towards Rs 1015 level as long as it stays above Rs 1002 level. A break above Rs 1015 level prices may rise further towards Rs 120 level

* MCX Aluminum Dec is expected to rise towards Rs 270 level as long as it stays above Rs 267 level. MCX Zinc Nov is likely to hold the support near Rs 295 level and rise back towards Rs 300 level

Energy Outlook

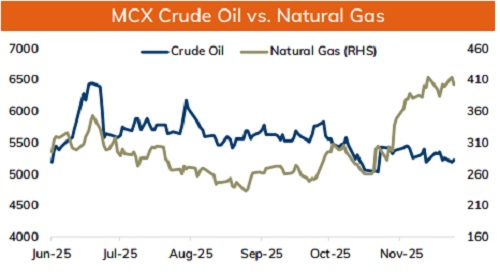

* Crude oil is likely to trade with positive bias and rise towards $59.50 level on weak dollar, U.S sanctions on Venezuela and optimistic global market sentiments. Further, prices may rally on growing expectation of another rate cut by US Federal Reserve in December meeting following disappointing economic data from US and dovish statement from Fed officials. Lower borrowing cost could boost economic growth and oil demand. Meanwhile, sharp upside may be capped as investors will remain cautious ahead of developments related to a potential peace deal between Russia and Ukraine to end the war. Investors are of opinion that a peace deal may increase the chances of lifting sanctions on Russian crude exports

* MCX Crude oil Dec is likely to rise towards Rs 5370 level as long as it stays above Rs 5120 level.

* MCX Natural gas Dec is expected to slip towards Rs 405 level as long as it stays below Rs 425 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631