MCX Crude oil April is likely to hold support near Rs.5790 level and rise towards Rs.6000 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct further amid strong dollar and surge in US treasury yields. Dollar and Yields are moving up on hawkish comments from Fed officials and as data showed US business activity picked up in March. Further, prices may slip on reports that US President Donald Trumps tariff plan is expected to be more targeted that previously thought, increasing hopes that tariffs set to take on 2 nd April may be softer. Meanwhile, all eyes will be on slew of economic data from US to gauge economic health and get cues on interest rate trajectory

* Spot gold is likely to correct back towards $3000 level as long as it stays below $3035 level. Only break below $3000 level prices may slip further towards $2980/$2960 levels. MCX Gold April is expected to dip towards Rs.87,000 level as long as it stays below Rs.87,900 level. A break below Rs.87,000 level prices may correct further towards Rs.86,700/ Rs.86,500 level

* MCX Silver May is expected to slip further towards Rs.96,000 level as long as it trades below Rs.99,000 level.

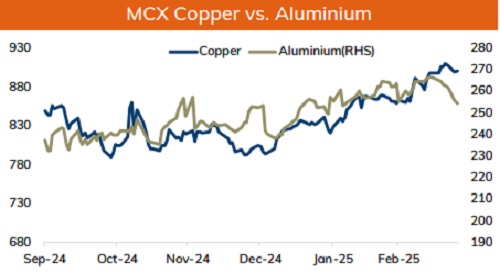

Base Metal Outlook

* Copper prices are expected to trade with positive bias on optimistic global market sentiments, tighter Asian supplies and signs of improving Chinese demand. Further, prices may move up on signs that US President Donald Trumps tariffs will be more targeted than anticipated. Additionally, China’s renewed stimulus measures will be supportive for the industrial metal. China’s Yangshan premium, an indicator of import demand, rose to $75 per ton, indicating recovery in demand

* MCX Copper April is expected to rise back towards Rs.912 level as long as it stays above Rs.898 level. A break above Rs.912 level prices may rise further towards Rs.917 levels

* MCX Aluminum April is expected to slip further towards Rs.254 level as long as it stays below Rs.258 level. MCX Zinc April is likely to move north towards Rs.279 level as long as it stays above Rs.274 level

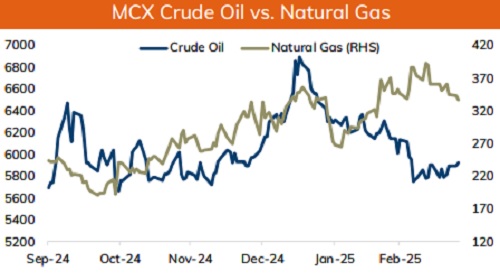

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rally further towards $70 level on optimistic global market sentiments and concerns over tighter supply. Further, US President Donald Trump warned that he may impose 25% tariff on countries that will buy oil and gas from Venezuela. Moreover, US has imposed new sanction on Iran to hit its oil exports. Additionally, prices may move up on signs the Trump administration is taking a measured approach on tariffs against its trading partners. Trump also urged Fed to lower interest rates. Meanwhile, OPEC+ will likely to proceed with planned May oil output hike

* MCX Crude oil April is likely to hold support near Rs.5790 level and rise towards Rs.6000 level. A break above Rs.6000 prices may rally further towards Rs.6050/Rs.6100 level.

* MCX Natural gas April is expected to face stiff resistance near Rs.350 level and slip towards Rs.330 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631