MCX Copper Sep is expected to rise towards Rs.918 level as long as it stays above Rs.906 level - ICICI Direct

Bullion Outlook

* Spot Gold is likely to rise further towards $3800 level on weak dollar and softening of U.S treasury yields. Further, persistent demand for safe haven amid escalating geopolitical tensions in Eastern Europe and Middle East would be supportive for the prices. On top of it, US President Donald Trump said Ukraine could regain its lost territory from Russia with the help of NATO. Furthermore, prices may move up on expectations of 2 more rate cuts this year despite of cautious tone from Fed Chair Powell on further easing. As per CME FedWatch tool market is pricing in 92% probability of another 25bps cut at the central bank's October meeting. Additionally, demand for investment may increase on political uncertainty in France and Japan and concerns over U.S Fed independence.

* MCX Gold Oct is expected to rise towards Rs.114,200 level as long as it stays above Rs.113,000 level

* MCX Silver Dec is expected to face stiff resistance near Rs.136,000 level and correct towards Rs.133,000 level.

Base Metal Outlook

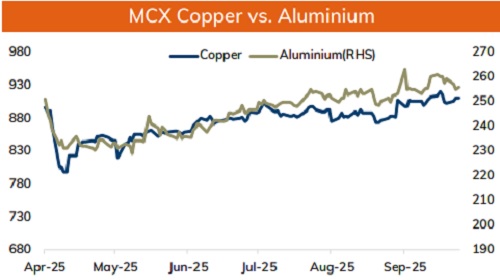

* Copper prices are expected to trade with a positive bias on weak dollar, concerns over supply disruption and signs of improving demand from China. Additionally, Yangshan copper premium a gauge of China's appetite for importing copper rose to $58 a ton. Production remains suspended at Freeport Indonesia's Grasberg mine, following an incident in early September. Codelco's EL Teniente mine will take longer time to return to full production than previously forecasted. Meanwhile, sharp upside may be capped on concern over global economic growth. OECD warned that full impact of U.S. tariff hikes has yet to hit. It raised forecast for 2025 to 3.2% but expect momentum to slowdown in 2026. OECD forecasts a slowdown in growth to 2.9% in 2026

* MCX Copper Sep is expected to rise towards Rs.918 level as long as it stays above Rs.906 level.

* MCX Aluminum Sep is expected to slip towards Rs.253 level as long as it stays below Rs.257 level. MCX Zinc Sep is likely to move north towards Rs.281 level as long as it stays above Rs.276 level.

Energy Outlook

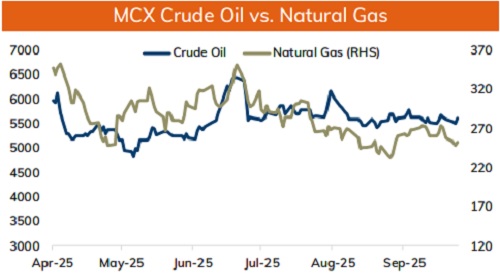

* Crude oil is likely to trade with positive bias and rise further towards $64.5 level amid weak dollar and escalating geopolitical tensions. Further, prices may move up on concerns over supply disruption as Ukraine has intensified drone strikes on Russia’s energy facilities. Moreover, Russia has extended gasoline ban until end of September and is likely to extend into October if shortages persist. Moreover, industry report showed U.S. crude inventories declined last week, signaling demand. Additionally, apparent shift in strategy by U.S to end war in Ukraine raised concerns over new sanctions on Russia and its buyers. Furthermore, concerns about oversupply reduced after a deal to resume exports from Iraq's Kurdistan stalled

* MCX Crude oil Oct is likely to rise towards Rs.5800 level as long as it stays above Rs.5540 level.

* MCX Natural gas Oct is expected to rise towards Rs.287 level as long as it stays above Rs.272 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631