MCX Copper March is expected to slip towards Rs.892 level as long as it stays below Rs.908 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct further towards $3000 level amid strong dollar and rise in US treasury yields. Dollar and Yields may move north on fears that US tariffs will increase inflation in near term, giving more space for Federal Reserve to hold interest rate steady. So far the impact of new policies in US has not been captured in data, which will force Fed to adopt wait and watch approach before making any bold decision on interest rates. Meanwhile, sharp fall in prices may be cushioned on safe haven buying following escalating geopolitical tension in Middle East and economic uncertainties

* Spot gold is likely to correct back towards $3000 level as long as it stays below $3050 level. Only break below $3000 level prices may slip further towards $2980/$2960 levels. MCX Gold April is expected to dip towards Rs.87,200 level as long as it stays below Rs.88,500 level. A break below Rs.87,200 level prices may correct further towards 86,700 level

* MCX Silver May is expected to slip further towards Rs.96,000 level as long as it trades below Rs.99,000 level.

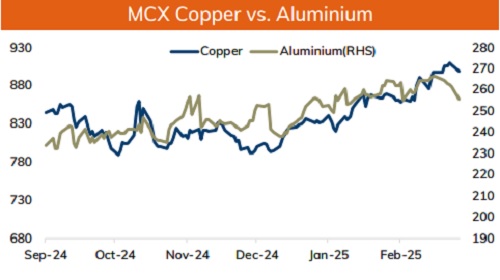

Base Metal Outlook

* Copper prices are expected to trade with negative bias on strong dollar and weak global market sentiments. Additionally, US President Donald Trump administration is using trade levies to narrow trade deficit with economic rivals and plans to introduce reciprocal tariffs on countries globally on 2 nd April. Investors fear that this may lead to retaliation from trading partners fueling global trade war, weighing on global economic growth and denting demand for Industrial metal. Even heightening economic uncertainty in the wake of ramped up US tariffs on its trading partners may force major central banks across globe to refrain from making any changes in monetary policy in near term

* MCX Copper March is expected to slip towards Rs.892 level as long as it stays below Rs.908 level. A break below Rs.892 level prices may slide further towards Rs.888 levels

* MCX Aluminum March is expected to slip further towards Rs.252 level as long as it stays below Rs.259 level. MCX Zinc March is likely to move further south towards Rs.272 level as long as it stays below Rs.278 leve

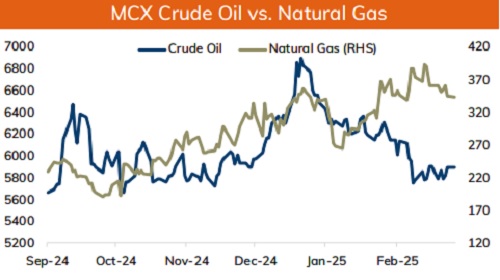

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rally further towards $70 level on fears over supply tightness after US imposed new sanctions on Iran and new OPEC+ plan for 7 members to cut output further to compensate for producing more than agreed levels. Additionally, risk premium may increase on escalating geopolitical tension in Middle East after Israel announced an escalation in air, land and sea strikes on Gaza, ending 2 month cease fire. Meanwhile, sharp upside may be capped as investors will keep an close eye on manufacturing and services PMI data across major economies to gauge economic health and get cues on future rate path

* MCX Crude oil April is likely to hold support near Rs.5780 level and rise towards Rs.6000 level. A break above Rs.6000 prices may rally further towards ?6050/?6100 level.

* MCX Natural gas April is expected to hold the support near Rs.340 level and recover back towards Rs.360 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

SELL DHANIYA JAN @ 10200 SL 10400 TGT 10000-9800. NCDEX - Kedia Advisory