MCX Copper March is expected to slip further towards Rs.868 level as long as it stays below Rs.885 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to bounce back towards $2915 level on persistent weakness in dollar and softening of US treasury yields. Dollar and Yields are expected to move lower as disorganized implementation of tariff policies by US President Donald Trump administration has increased uncertainty over when and how long tariffs may remain in place. Investors fear that US tariffs on its major trading partners and retaliation from them would fuel global trade war hurting economic growth. Additionally, traders are betting that US Fed would again lower the borrowing cost in June if economic downturn befalls. Meanwhile, all eyes will be on job data from US to get more cues on interest rate trajectory.

* Spot gold is likely to hold the support near $2860 level and rise towards $2915 level. MCX Gold April is expected to rise towards Rs.85,900 level as long as it stays above Rs.85,000 level.

* MCX Silver May is expected to slip further towards Rs.95,500 level as long as it trades below Rs.97,100 level.

Base Metal Outlook

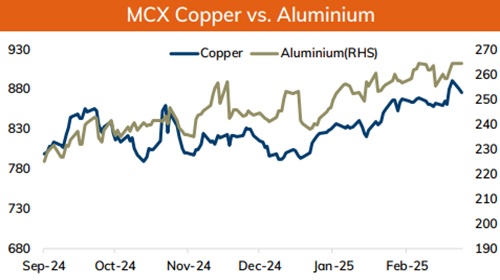

* Copper prices are expected to trade with negative bias on weak global market sentiments following fears about a tariff driven slowdown in US economic growth. Further, prices may slip as disappointing economic data from China signals uncertain economic outlook. Moreover, demand for industrial metal would be hurt amid weak domestic demand and escalating trade war with US. Additionally, investors fear that US Federal government cost cutting and layoffs would further hurt consumer confidence and dent economic growth.

* MCX Copper March is expected to slip further towards Rs.868 level as long as it stays below Rs.885 level. A break below Rs.868 level copper prices may slip further towards Rs.863 level

* MCX Aluminum March is expected to face stiff resistance near Rs.266.50 level and slip towards Rs.262 level. MCX Zinc March is likely to slide further towards Rs.269 level as long as it stays below Rs.273 level

Energy Outlook

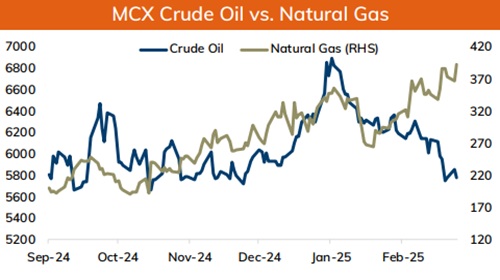

* NYMEX Crude oil is expected to trade with negative bias and slip further towards $64.50 level on risk aversion in the global markets following concerns of simmering trade tensions. Additionally, investors fear that US tariffs on its major trading partners and retaliation from them would fuel global trade war hurting economic growth and dent oil demand. Further, OPEC+ decision to increase oil output will continue to weigh on oil prices. Moreover, if US ease sanctions on Russia’s energy sector if it agrees to end its war with Ukraine then it would add more supply in the market.

* MCX Crude oil March is likely to face stiff resistance near Rs.5900 level and slip further towards Rs.5650 level. A break below Rs.5650 prices may dip further towards Rs.5550 level.

* MCX Natural gas March is expected slip back towards Rs.380 level as long as it stays below Rs.400 level. A break below 380 level prices may slip further towards 375 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631