MCX Copper January is expected to hold support near Rs.1260 and move higher towards Rs.1325 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to move in a tight range as most global markets will remain close for New year holiday. Prices would get support from increasing prospects of further monetary policy easing from the US Fed and safe haven buying. As per the CME Fed-watch tool March rate cut probability gone above 50%. Further, geopolitical uncertainty in Middle East and rising frictions between the US and Venezuela continue to underpin gold’s defensive appeal. In the domestic market gold prices move would depend on the USDINR.

* MCX Gold Feb is likely to move in a wider range of Rs.134,500 and Rs.137,200. Only a move below Rs.134,500, it would correct towards Rs.132,500.

* MCX Silver March is expected to move in the range of Rs.231,000 and Rs.243,000. Below Rs.231,000 it would turn bearish towards Rs.228,000

Base Metal Outlook

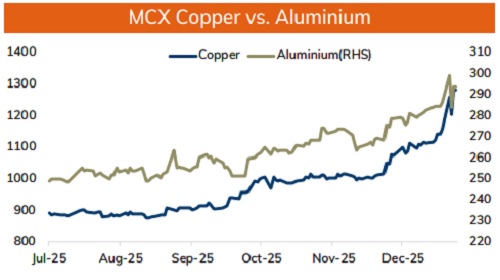

* Copper prices are expected to hold its ground and move higher, driven by acute supply tightness and robust demand from both China and the United States. Further, better than expected manufacturing activity from China would also bring optimism in prices. Rising copper premiums and planned output reduction for 2026 by China's leading copper smelters would support prices to move higher. Prices would also get support on concerns over potential US tariff reviews in 2026, which would again increase supply tightness in the global markets. Meanwhile, profit booking could limit its upside.

* MCX Copper January is expected to hold support near Rs.1260 and move higher towards Rs.1325 level. Only move below Rs.1260 level it may fall towards Rs.1200 level.

* MCX Aluminum Jan is expected to hold support near Rs.294 and move towards Rs.301 level. Only a move below Rs.294 it would slip towards Rs.289-290 zone. MCX Zinc is likely to remain the band of Rs.304 and Rs.310. Only a move below Rs.304 it would turn bearish towards Rs.300.

Energy Outlook

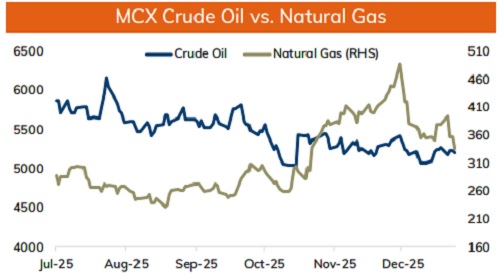

* NYMEX crude oil is expected to face hurdle near $58 per barrel and move lower towards $56 on sign of supply improvement and higher inventory levels in US. Meanwhile, renewed tension in the Middle East and ongoing geopolitical tension in Venezuela could counter improved supply outlook. Venezuela reportedly began shutting wells in a key oilrich region amid a US blockade aimed at financially pressuring the country. On the other hand, expectation of rising inventory levels in US could also check its upside.

* On the data front, a strong put base at $55 would act as strong support. On the upside a strong call base at $60 would act as major hurdle. MCX Crude oil Jan is likely to face hurdle at Rs.5300 and move lower towards Rs.5100 level. Only move above Rs.5300 it would rise towards Rs.5380.

* MCX Natural gas Jan is expected to face hurdle near Rs.350 and move lower towards Rs.320 level. Forecast of warmer than expected weather in US could hurt its demand outlook.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Sell COTTONCANDY JUL @ 54700 SL 55000 TGT 54400-54100. MCX - Kedia Advisory