MCX Aluminum July is expected to rise towards Rs.251 level as long as it stays above Rs.247 level - ICICI Direct

Bullion Outlook

* Spot Gold is expected to rise further towards $3350 level on weakness in dollar and softening of U.S treasury yields. Further, demand for safe haven may increase on concerns over rising U.S government debt and uncertainty over trade deals between U.S and its major trading partners ahead of 9 th July deadline. Meanwhile, sharp upside may be capped as investors will remain cautious ahead of slew of economic data from U.S to gauge economic health of the country and get cues on interest rate trajectory. Strength in labor market will give central bank leeway to hold off on cutting interest rates until US Fed officials gets better sense of impact of U.S President Donald Trump tariffs on inflation

* Spot gold is likely to rise towards $3350 level as long as it stays above $3280 level. MCX Gold Aug is expected to rise towards Rs.96,700 level as long as it stays above Rs.95,300 level

* MCX Silver Sep is expected to rise towards Rs.107,500 level as long as it trades above Rs.105,500 level.

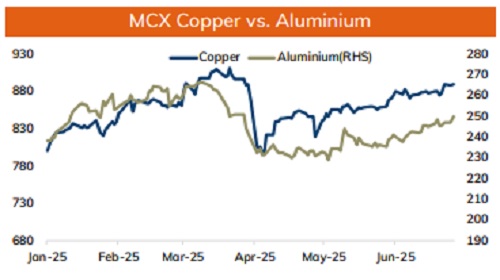

Base Metal Outlook

* Copper prices are expected to trade with positive bias on weakness in dollar and rise in risk appetite in the global markets. Further, prices may rally as disappointing economic data from China fueled expectations for more stimulus package from government. Additionally, prices may rally on persistent decline in inventories at LME registered warehouses. Furthermore, some signs of progress in trade negotiations with China and EU will support prices. On top of it, Canada scrapped its digital services tax in a bid to advance stalled trade negotiations with the U.S.

* MCX Copper July is expected to rise further towards Rs.900 level as long as it stays above Rs.889 level. On contrary, a break below Rs.889 level prices may slip further towards Rs.885 level

* MCX Aluminum July is expected to rise towards Rs.251 level as long as it stays above Rs.247 level. MCX Zinc July is likely to move south towards Rs.256 level as long as it stays below Rs.260.50 level.

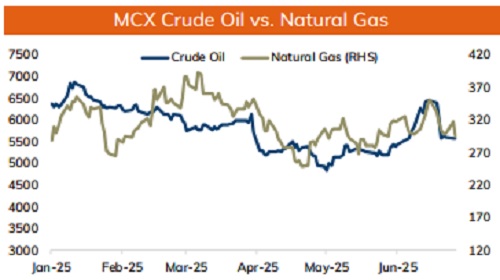

Energy Outlook

* Crude oil is likely to slip further towards $63 level amid ease in worries over supply disruption from Middle East and prospect of another OPEC+ output hike in August. OPEC+ is likely to increase output by 411,000 barrels per day in August, similar to hikes made in May, June and July bringing total supply increase from OPEC+ to 1.78 million bpd so far this year. Moreover, sluggish manufacturing pmi data from China raised concerns over slowing demand. Additionally, uncertainty about U.S tariffs and their impact on global economic growth may weigh on prices

* MCX Crude oil July is likely to slip towards Rs.5500 level as long as it stays below Rs.5700 level. A break below Rs.5500 level prices may slip further towards Rs.5440 level

* MCX Natural gas July is expected to slip towards Rs.285 level as long as it stays below Rs.306 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631