MCX Aluminum Feb is expected to hold its ground near Rs.250 level and move towards Rs.256 level - ICICI Direct

Bullion Outlook

* Gold is likely to trade with positive bias amid safe haven buying. Trade war concerns has sparked the demand for safe assets and it is expected to support the bullions to make new highs. Further, increasing premiums in the futures market indicates a high risk premium. On Monday premium on COMEX futures over spot has widened again to $40. Meanwhile, demand in the Asian markets remain muted amid higher prices. Spot gold is expected to hold the support of $2770 and move higher towards $2840. Closure of OI in OTM call strikes indicates short covering which might push prices further higher.

* MCX Gold April is expected to rise back towards Rs.84,000 level as long as it stays above Rs.82,700 level. Only a move below Rs.82,700 level prices may slip sharply towards Rs.82,000 level

* MCX Silver March is expected to find its support near Rs.93,000 and rally towards Rs.95,000 level. On contrary if prices break above Rs.93,000 level then prices may decline towards Rs.91,800 level

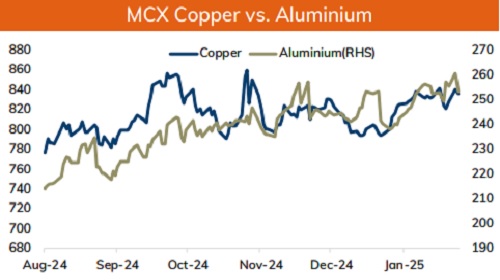

Base Metal Outlook

* Copper prices are expected to trade with positive bias on improved demand optimism after US manufacturing activity expanded for the first time in 26 months. Further, depleting inventory levels in LME and return of China after long holiday break would bring back bullish momentum in prices. Meanwhile, pause in tariffs on Canada and Mexico for a month could improve risk sentiments and improve demand outlook for industrial metal.

* MCX Copper February has formed a bullish engulfing pattern on the daily chart indicates prices to trade higher. For the day, it is likely to rise towards Rs.842 level as long as it stays above Rs.828 level. Only below Rs.828 level copper prices may slip towards Rs.821 level

* MCX Aluminum Feb is expected to hold its ground near Rs.250 level and move towards Rs.256 level. MCX Zinc Feb is likely to rise towards Rs.270 level as long as it stays above Rs.262 level

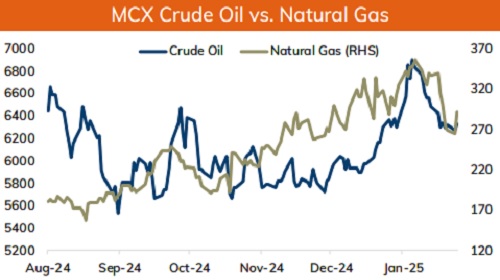

Energy Outlook

* Crude oil is expected to trade with negative bias on reports that US President administration has agreed to pause the proposed tariffs on Mexico and Canada for a month. Canada and Mexico are the two largest crude oil exporters to the United States. While, OPEC+’s decision to not change its oil production plans in the first quarter may limit more downside in prices.

* On the data front, addition of fresh OI in ATM and OTM call strikes indicates prices to face stiff resistance near $75 and weaken it further towards $71. Further, formation of a bearish engulfing pattern would also weaken oil prices. MCX Crude oil Feb is likely to face the hurdle near Rs.6460 level and slide towards Rs.6200 level. Below Rs.6200 level it would open the doors towards Rs.6100 level

* MCX Natural gas Feb is expected to hold the support near Rs.281 level and rebound towards Rs.300 level

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631