Market Watch : US futures up, but expect volatility to persist - Geojit Financial Services Ltd

ASIA

Asian markets rebounded with Nikkei surging 6% on Tuesday in a broadbased rally, bouncing back from a 1.5-year low reached in the previous session, as traders evaluated the robust performance of U.S. technology stocks. Gift Nifty suggests a gap-up opening for Indian markets.

US & EUROPE

US markets ended lower on Monday following a volatile session, as investors grew increasingly concerned about an economic slowdown and rising inflation. President Donald Trump remained firm on tariffs, indicating he might further escalate levies on China. European markets also declined on Monday, with no signs of the US President easing his aggressive trade stance.

COMMODITIES

Oil prices dropped to their lowest level since 2021 yesterday, while most commodity markets, including metals and coffee, also declined as the escalating trade war between the United States and China sparked concerns over demand for raw materials. Gold prices fell on Monday as investors sought refuge in the dollar, following sweeping US tariffs that heightened fears of a global recession.

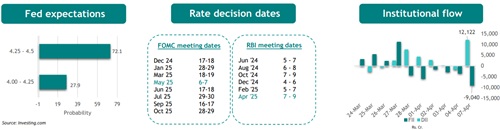

* Events today: Japan current account, India RBI MPC meeting continues.

* Exchange debut: Infonative Solutions, Spinaroo Commercial (SME)

* BEL has signed a contract with the Ministry of Defence valued at Rs 2,210 crore for the supply of an electronic warfare (EW) suite for Mi-17 V5 helicopters of the Indian Air Force.

* KPI Green has terminated the order from Sai Bandhan Infinium for the 66.20 MW hybrid power project under the captive power producer (CPP) segment due to changes in project technical requirement

Nifty Outlook

We had refrained from pencilling any levels beyond 21800 yesterday, as we were eying the possibilities of a swing higher. Having achieved the first objective of 22165, we are encouraged to persist with the 22522 objective as well. That said, given the near 70% rise in VIX yesterday, expect turbulence, and a fair tendency to slip towards 22320 after initial rise. We do not see yesterday’s gains being given up completely, or filling the previous day’s downside gap right away. This puts a consolidation inside 22660-22320 as the preferred play.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345