Market Buzz : SC Ruling Hits Airtel, Lupin Restructures, Havells Expands; India`s Growth Outlook Surpasses China – Fitch` by GEPL Capital

Stocks in News

* BHARTI AIRTEL: The Supreme Court has dismissed Bharti Telemedia Ltd.'s appeal, upholding high court rulings to levy entertainment tax on DTH services, resulting in an estimated liability of ?585 crore.

* TVS SRICHAKRA: Eurogrip Tyres, TVS Srichakra's two- and three-wheeler tyre brand, has opened a branded retail store in Hyderabad.

* LLOYDS ENGINEERING WORK: The company secured a Rs.21 crore order from Cochin Shipyard to supply fin stabiliser systems.

* GARWARE HI TECH: The company has re-appointed Sarita Garware Ramsay as Joint Managing Director for a three-year term starting May 26.

* LUPIN: Lupin’s US unit has converted a $41 million loan and $3.3 million in interest into equity in Lupin Oncology, making it a step-down subsidiary of the company.

* SALZER ELECTRONIC: The company has received a Rs.192 crore order to install a centralised control and monitoring system for street lights in Bengaluru.

* SUN PHARMA: The company will invest $25 million in US-based Pharmazz.

* ZYDUS LIFESCIENCES: The company received USFDA approval for Isotretinoin Capsules USP in 10 mg, 20 mg, 25 mg, 30 mg, 35 mg, and 40 mg strengths.

* HAVELLS: The company will invest Rs.340 crore to expand cable manufacturing capacity at its Alwar plant, increasing total annual capacity to 41.45 lakh km.

* BAJAJ AUTO: The company’s arm has a Call Option agreement with Pierer Konzerngesellschaft mbH and Pierer Industrie AG to purchase shares held by Pierer Industrie AG in Pierer Bajaj AG.

Economic News

* India's growth to surge by 0.2% to 6.4% while China's projection reduced by 0.3%: Fitch Ratings has increased India's medium-term growth potential to 6.4%, citing a rise in labor force participation. Conversely, China's growth projection has been reduced to 4.3% due to property market adjustments and a declining labor force. This reflects a shifting economic dynamic, with India showing stronger potential compared to China.

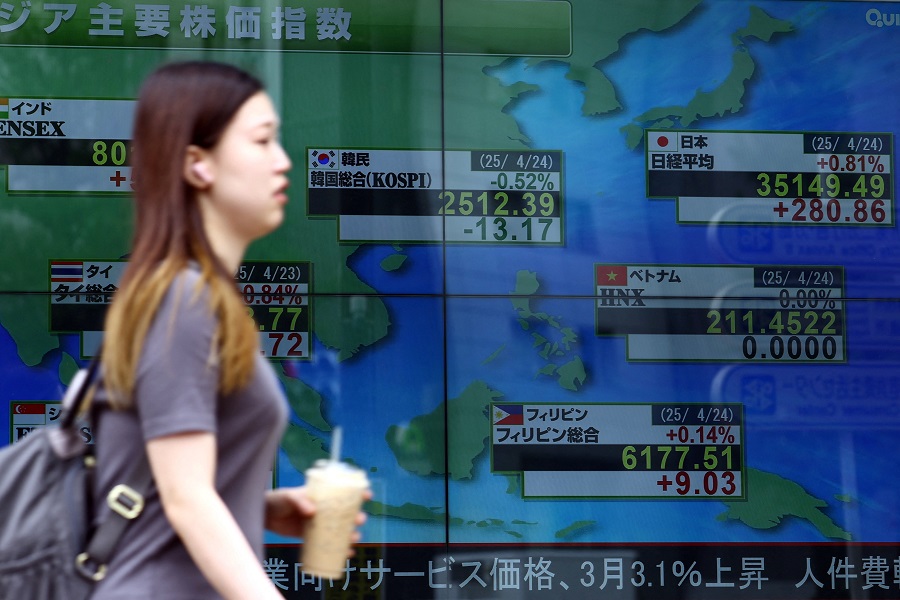

Global News

* Apple’s shift to India faces hurdles; U.S. production costly despite Trump’s push: U.S. President Donald Trump openly criticized Apple’s decision to shift iPhone assembly from China to India, urging the company to manufacture in the U.S. instead. However, moving production to the U.S. could raise iPhone costs by about 25% due to higher labor expenses, adding roughly $160 per device. While India is emerging as a manufacturing hub, it faces significant challenges like infrastructure gaps, low productivity, and a nascent supply chain. Apple’s automation efforts further reduce labor needs, limiting job creation. Additionally, India currently earns only $30 per iPhone assembled, much subsidized by government incentives, which may hinder deeper local component manufacturing. Ultimately, India must improve infrastructure and manufacturing capabilities to attract investment, as reshoring to the U.S. remains costly and complex for Apple.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer