Life Insurance New Business Premium Growth Hits a 20-Month High in December 2025 by CareEdge Ratings

Overview

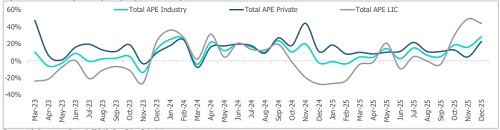

In December 2025, India’s life-insurance industry maintained its double-digit growth momentum for the fourth consecutive month, recording the highest monthly growth rate in the past 20 months. New-business premiums rose significantly by 39.5% year-on-year (y-o-y) to Rs 42,150.8 crore. This marks a strong recovery from the 5.2% contraction seen in August 2025 and a clear turnaround from the steep 21.5% decline recorded in December 2024. The rebound was driven by broad-based growth aided by a significant surge in group premiums and policy issuances, with LIC outperforming private insurers. A favourable base and postGST-waiver adjustment in individual life policies supported the industry’s growth. The industry’s Annual Premium Equivalent (APE) in December 2025 rose by 28.3% y-o-y, led by LIC’s 44.1% y-o-y rise and steady gains of 22.8% y-o-y from the private insurer. On a YTDFY26 basis, APE grew by 12.8% y-o-y.

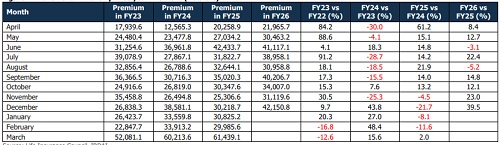

Figure 1: Movement in Monthly First-year Premium (Rs crore)

Figure 2: First-year Premium Growth of Life Insurance Companies (Rs crore)

India’s life insurance industry reported a strong performance in December 2025, with first-year premiums rising 39.5% y-o-y, marking one of the strongest monthly performances in FY26 so far. Growth was well diversified across segments and significantly stronger than last year, supported by the low base of December 2024. LIC maintained its leadership position and significantly outperformed private insurers, with group single premiums growing 73.8% y-o-y for LIC, as against 33.5% y-o-y growth for private insurers in December 2025. Individual non-single premium growth underscored the stability of recurring premium inflows, while a pickup in group business reflected improving institutional activity. For YTDFY26, cumulative first-year premiums recorded a steady 13.0% y-o-y growth. This performance was largely driven by private insurers and reflects a return to normal growth following the one-off impact of recent regulatory changes.

Figure 3: Movement in Premium Type of Life Insurance Companies (Rs crore)

In December 2025, the life insurance industry saw a significant revival in single-premium business, with premiums rising 50.6% y-o-y, reversing the steep 34.5% decline recorded a year earlier. This recovery was largely driven by the normalisation of demand following the base effect from the implementation of revised surrender-value regulations in late 2024, along with improved traction in individual single-premium products. Non-single premiums also grew by 25.5% y-o-y. Private insurers continued to gain ground in the individual non-single segment. At the same time, LIC retained its dominance in the single-premium business, supported by its strong presence in group business offerings.

Figure 4: Movement in Premium Type of Life Insurance Companies (Rs crore)

In December 2025, growth in life insurance premiums was driven by a significant acceleration in the group segment, which rose 61.6% y-o-y, rebounding strongly from the previous year, when premiums had fallen 41.9%. Individual premiums also recorded healthy growth of 22.5% y-o-y, significantly higher than the 6.8% increase seen a year earlier, supported by strong momentum in the individual single-premium segment, where private insurers continued to gain market share. At the same time, the contribution of single-premium policies to overall collections moderated slightly, declining from about 70% in FY25 to 67% in YTDFY26.

Figure 5: Movement in Individual Non-Single Policies of Life Insurance Companies (in Lakhs)

In December 2025, individual non-single policies grew significantly by 35.5% y-o-y, reversing a 19.9% decline in the same month last year. This recovery was led by LIC, which recorded a 52.3% increase, largely aided by a favourable base effect, while private insurers delivered steady growth of 15.2% y-o-y. The strong December performance may indicate a revival in the individual recurring premium segment, supported by robust demand and a broader range of product offerings. While year-to-date individual non-single policies volumes for YTDFY26 remain only slightly above last year’s levels, the steady addition of policies by private insurers and the strong December momentum indicate improving traction and a gradual strengthening in policy uptake, further supported by the impact of GST rate reductions, which increase policy affordability.

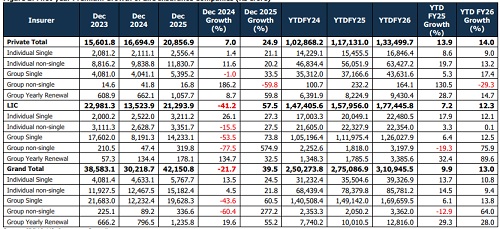

Figure 6: Movement in APE of Life insurance companies (Rs crore)

The life insurance industry’s APE recorded a strong rebound in December 2025, rising 28.3% y-o-y, reversing the marginal contraction of 2.3% seen in December 2024. The recovery was driven by a turnaround in LIC’s APE, which grew 44.1% y-o-y after a steep decline in the previous year (due to the impact of surrender value regulations), alongside continued steady growth of 22.8% y-o-y among private insurers. On a year-to-date basis for FY26, industry APE increased by 12.8% y-o-y, reflecting a broad-based expansion, supported by improved demand conditions and the impact of the recent GST waiver on individual insurance products.

Figure 7: Total APE growth (on a y-o-y basis, in %)

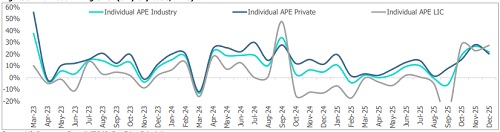

Figure 8: Individual APE growth (on y-o-y basis, in %)

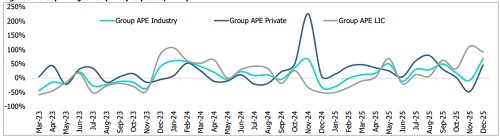

Figure 9: Group APE growth (on a y-o-y basis, in %)

CareEdge Ratings’ View

According to Sanjay Agarwal, Senior Director, CareEdge Ratings, “India’s life insurance industry saw a strong recovery in December 2025, with APE growth picking up to 12.8% y-o-y. While this was marginally lower than the 13.8% y-o-y growth recorded a year earlier, it indicates that demand is normalising, supported by renewed customer engagement following the GST waiver on individual life and health insurance premiums. The tax relief has improved affordability and encouraged renewed traction, particularly in recurring premium products. The increase in policy issuances has been accompanied by broad-based participation across customer segments, indicating that the industry has largely navigated the distribution challenges that followed the revision in surrender value norms last year. CareEdge expects the life insurance industry to grow at a steady 8%–11% CAGR over the next two years, supported by regulatory backing, product innovation, digital adoption, and improved service delivery.”

According to Saurabh Bhalerao, Associate Director, CareEdge Ratings, “Life insurers reported a significant acceleration in new business premiums in December 2025, with collections rising 39.5% y-o-y to Rs 42,150.8 crore, supported by strong traction across both individual and group segments. LIC led the growth, outperforming private insurers on the back of a strong revival in group single premiums. With private insurers deepening their regional footprint and with digitalfirst initiatives like Bima Sugam, part of the broader Bima Trinity rolling out, the market is well-positioned for a sustained recovery and long-term growth.”

Above views are of the author and not of the website kindly read disclaimer