LG Electronics India gets SEBI nod for IPO, to raise funds via offer for sale

LG Electronics India Limited on Tuesday announced that it has received approval from the Securities and Exchange Board of India (SEBI) to launch its initial public offering (IPO) which is expected to be around Rs 15,000 crore.

The company, a wholly-owned subsidiary of South Korean giant LG Electronics Inc., had filed its draft red herring prospectus (DRHP) with SEBI on December 6, 2024.

With the final observation from the regulator, the company can now proceed with the offering, according to its statement.

The IPO will be entirely an offer for sale (OFS), where LG Electronics Inc. will sell up to 10.18 crore equity shares.

Each share has a face value of Rs 10. This means that the IPO will not raise fresh capital for the company but will allow the parent company to offload its stake.

While the company has not disclosed the total issue size, it has reportedly pegged the IPO at around Rs 15,000 crore.

The IPO will be managed by investment banks Morgan Stanley India, JP Morgan India, Axis Capital, BofA Securities India, and Citigroup Global Markets India. KFin Technologies will serve as the registrar for the issue.

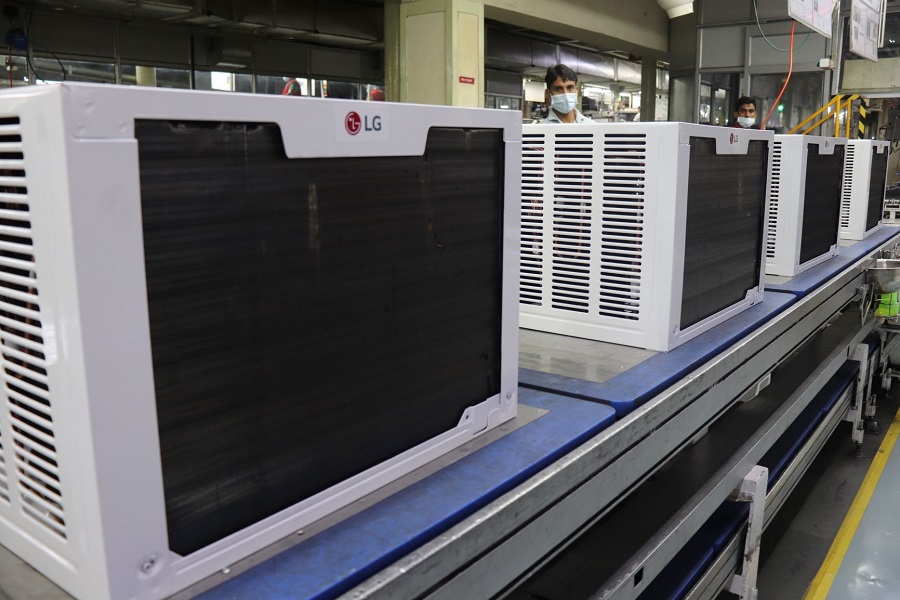

LG Electronics India has been a dominant player in the Indian home appliances and consumer electronics market.

According to a Redseer Report cited in the DRHP, the company has maintained its position as the market leader in offline sales by value for 13 consecutive years, from 2011 to 2023.

Financially, LG Electronics India has performed better than several listed competitors. In the financial year 2024, the company reported a revenue of Rs 21,352 crore, up from Rs 19,868.24 crore in the previous year.

Its profit after tax also saw a rise of 12.35 per cent, reaching Rs 1,511.07 crore from Rs 1,344.93 crore. In the quarter ending June 30, 2024, the company recorded a revenue of Rs 6,408.80 crore and a profit after tax of Rs 679.65 crore.

Meanwhile, Hyundai Motor India launched its Rs 27,870.16 crore public offering last year, which stands as India's largest public offering to date.

The subscription window was open from October 15 to October 17, with a price band set between Rs 1,865 and Rs 1,960 per share.

The IPO was entirely an offer for sale (OFS) of 14.22 crore shares, with no fresh issue component.