Gold Report As On 14032025 by Amit Gupta,Kedia Advisory

Strengths

* Gold makes an all time high of 87866 as uncertainty over tariffs persisted and dollar index dropped over 6% from high of 110.17 in Jan 2025.

* Cooler-than-expected U.S. inflation print also supported bullion by strengthening expectations of rate cuts.

* China's gold reserves rose to 73.61 million fine troy ounces at the end of February, above 73.45 million in the previous month.

* Global gold demand rose by 1% to a record high of 4,974.5 metric tons in 2024 - WGC

* Central banks, bought more than 1,000 tons of the metal for the third year in a row in 2024. – WGC

* Gold reserves in London vaults drop 0.68% in February - LBMA

Weaknesses

* India's Feb gold imports to hit 20 – year low, with demand sapped by record prices.

* Gold demand in India was subdued owing to near-record high prices and jewellers' reluctance to purchase at the financial year's end.

* India’s gold demand could dip to 700 to 750 metric tonne in the current year, as against 802.8 tonne during the last year.

* Weak consumer demand in China dampens gold's growth potential despite central bank purchases.

* Fed Chair Powell says Fed does not need to hurry further rate decisions.

Opportunities

* Trump's tariffs are widely expected to stoke inflation and economic uncertainty.

* Goldman Sachs raised its gold price forecast to $3,100 per ounce from $2,890 per ounce for end-2025.

* Citi upgraded its three month price target to $3,000 from $2,800.

* President Trump warned of additional tariffs on EU goods after EU and Canada retaliated against existing US trade barriers.

* Global gold ETFs saw significant inflows in February totalling US$9.4bn, the strongest since March 2022 – WGC

* Gold leasing rates in India have doubled within a month to a record high, following the overseas market.

Threats

* Rupee continued its downward trend, hitting an all-time low can impact domestic buying

* Geopolitical easing (peace talk between Russia and Ukraine) could diminish safe-haven demand, curbing gold’s upward momentum.

* Led by a dampening jewellery demand, India's gold consumption in 2025 is set to moderate from last year's nine-year peak.

* Fed is set to announce its policy decision next week, with markets widely expecting the central bank to keep rates unchanged.

* As per weekly chart, gold prices showing in overbought zone

Reasons Supporting Gold Prices

Escalating Trade War & Tariff Uncertainty – Trump’s 200% tariff threat on European alcohol, new levies on China, and retaliatory measures fuel economic instability, driving gold’s safe-haven appeal.

Record Central Bank Gold Accumulation – Central banks continue aggressive gold purchases in 2024 and are likely to increase their holdings in 2025, particularly in China.

Federal Reserve Rate Cut Expectations – Markets anticipate at least three Fed rate cuts in 2025, lowering borrowing costs and increasing gold’s attractiveness as a non-yielding asset.

Physical Gold Shortage & Supply Chain Disruptions – Over 151 tonnes of gold were withdrawn from London to New York in January alone, tightening physical supply and delaying deliveries.

Weakening U.S. Dollar & Declining Treasury Yields – The U.S. 10-year Treasury yield has dropped to 4.27%, while the Dollar Index (DXY) remains below 104, making gold a more attractive alternative.

Geopolitical Risks & Global Uncertainty – Ongoing Russia-Ukraine tensions, U.S.-China trade disputes, and Iran’s aggressive gold stockpiling (+300% YoY) are fueling demand.

Strong Physical Demand & ETF Inflows – Comex vaults now hold 1,250 tonnes of physical gold, while gold-backed ETFs recorded a 15% increase in inflows in 2024.

Inflationary Pressures & Currency Depreciation – While U.S. CPI cooled to 2.8%, tariffs and monetary easing could trigger inflationary pressures, further supporting gold as a hedge.

Stock Market Volatility & Recession Concerns – Major indices—Nifty (-16.29%), Dow Jones (-9.78%), S&P 500 (-10.48%), and Nasdaq (-14.07%)—continue to decline from recent highs amid slowing economic growth concerns.

Massive Gold Stockpiling by Governments – Iran has converted 20% of its foreign reserves into gold, highlighting rising global demand for bullion as a reserve asset.

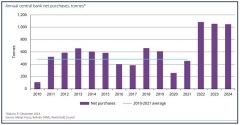

Central banks have been net buyers for 15 consecutive years

Record Central Bank Gold Buying in 2024

* Total gold purchases reached 1,045t, with 333t added in Q4 — the third consecutive year exceeding 1,000t.

* This far surpasses the 473t annual average from 2010-2021.

* 15th consecutive year of net central bank gold buying.

Top Central Bank Buyers in 2024

National Bank of Poland (NBP): +90t → Total 448t (17% of total reserves).

Reserve Bank of India (RBI): +73t (4x 2023’s total of 16t) → Total 876t (11% of total reserves).

People’s Bank of China (PBoC): +44t → Total 2,280t (5% of reserves).

Central Bank of Turkey (CBRT): +75t — no repeat of 2023 selling.

State Oil Fund of Azerbaijan: +25t (Q4 data pending) → Gold now 18% of its portfolio.

Central banks and investors drive market strength

* Total gold demand (including OTC investment) rose 1% y/y in Q4 to reach a new quarterly high and contribute to a record annual total of 4,974t.

* Central banks continued to hoover up gold at an eye-watering pace: buying exceeded 1,000t for the third year in a row, accelerating sharply in Q4 to 333t.

* Annual investment reached a four-year high of 1,180t (+25%). Gold ETFs had a sizable impact: 2024 marked the first year since 2020 in which holdings were essentially unchanged, in contrast to the heavy outflows of the prior three years.

* Gold jewellery was the clear outlier: annual consumption dropped 11% to 1,877t as consumers could only afford to buy in lower quantities. Nonetheless, spend on gold jewellery jumped 9% to US$144bn.

Above views are of the author and not of the website kindly read disclaimer