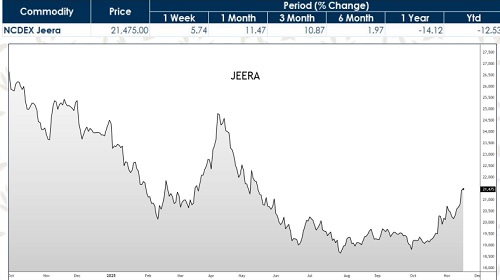

Jeera Report As On 20th Nov 2025 by Kedia Advisory

Highlights

* Price Surge: Jeera prices jumped over 10% this month on tight supply.

* Delayed Sowing: Uneven rainfall continues to slow field preparation and sowing.

* Gujarat Lag: State faces one of its slowest cumin sowing seasons in years.

* Low Arrivals: Unjha market arrivals remain extremely low, supporting higher prices.

* Export Pickup: Gulf and China demand improved slightly but stays price-sensitive.

* Premium IPM: IPM-grade cumin receives 20–25% premium amid limited supply.

* Tariff Relief: U.S. removed tariffs on spices, improving trade sentiment.

* Wedding Boost: 2025 season to generate ?6.5 lakh crore from 46 lakh weddings.

* Sowing Jump: Gujarat sowing reached 40,012 ha, up 126.22% YoY.

* Global Tightness: Weather/logistic issues in India & Middle East reduce supply.

* GST Cut: 5% GST rate supports FMCG exports and domestic demand.

* Lower Output: India’s production seen at 90–92 lakh bags vs 1.10 crore earlier.

* Geo Risk: Instability in Syria, Turkey, Afghanistan cuts global cumin supply.

* Export Dip: Apr–Aug 2025 exports down 17.02% YoY.

* Monthly Rise: Aug 2025 exports up 3.24% to 12,951 tonnes.

Fundamentals

Gujarat’s Jeera Sowing Sees Sharp Jump Despite Weather Challenges

Gujarat is facing one of its slowest cumin sowing years due to excess soil moisture, yet sowing reached 40,012 hectares, up 126% from last year. Short weather improvements allowed farmers to accelerate planting, though uneven field preparation continues to slow progress.

Rajasthan Jeera Sowing Begins Slowly Amid Excess Moisture

Rajasthan has officially started Jeera sowing, but excess moisture from recent rainfall is delaying field preparation and early operations. Farmers are waiting for soil conditions to improve before speeding up sowing. The slow progress raises concerns about final acreage, though quicker drying could help recovery in the coming days.

Jeera Export Trends Mixed as Global Buyers Stay Price-Sensitive

Demand from Gulf nations and China has improved slightly, but buyers remain highly price-sensitive. August 2025 exports rose 3.24% to 12,951 tonnes, showing mild recovery. However, April–August exports fell 17.02% year-on-year, reflecting high prices and global supply concerns that continue to impact trade sentiment.

ASTA Welcomes Tariff Relief for Spices Under New U.S. Executive Order

ASTA praised President Trump’s decision to remove reciprocal tariffs on several imported spices. The association said the move will reduce costs for U.S. manufacturers and consumers. Since spices like cinnamon, nutmeg, cloves, and vanilla cannot be grown commercially in the U.S., ASTA sees tariff removal as essential for ensuring an affordable and reliable spice supply.

Wedding Season Sparks Major Surge in India’s Spice Demand

India’s 10–14 million annual weddings create a strong seasonal rise in spice demand from November to February. Multi-day menus require heavy use of jeera, turmeric, chilli, and masala blends, prompting caterers to stock 30–40% more. Rising incomes and growing preference for premium and ready-to-use spice mixes further support demand.

Dark Stores Transform FMCG and Spice Demand in India

Dark stores have expanded rapidly—from under 150 in 2019 to over 4,000 in 2024—boosting FMCG and spice consumption. Platforms like Blinkit and Zepto rely on them to supply high-frequency items. Instant delivery has increased sales of masalas and ready-to-cook mixes. With 6,000+ dark stores expected by 2026, branded spice demand will grow further.

Marriage Season Expected Demand

India’s 10–14 million annual weddings create a sharp seasonal surge in spice demand, especially during November–February. Multi-day wedding menus require large quantities of jeera, turmeric, chilli, garam masala, and regional blends, prompting caterers to stock 30–40% extra. Rising incomes and richer cuisines also boost demand for premium, organic, and ready-to-use spice mixes.

* Weddings create major seasonal spikes in spice procurement across India.

* Caterers stock 30–40% more spices during peak marriage months.

* Multi-day menus drive high use of jeera, turmeric, chilli blends.

* Rising incomes boost demand for premium and organic spice varieties.

* Regional wedding cuisines increase consumption of specialized spice mixes.

Dark Stores Focus

The rapid rise of dark stores—from under 150 in 2019 to over 4,000 in 2024—has significantly boosted FMCG and spices demand in India. Quick commerce players like Blinkit, Zepto, and Instamart now rely on dark stores to push high-frequency categories such as packaged foods, snacks, oils, and spices. Faster delivery cycles have increased consumption of masalas, ready-to-cook mixes, and regional spice blends. With 6,000+ dark stores expected by 2026, FMCG penetration and branded spice sales will accelerate further.

* Dark stores drive higher demand for FMCG and daily-use essentials.

* Instant delivery boosts sales of packaged spices and masala blends.

* Quick commerce increases frequency of grocery and spices purchases.

* Branded, premium, and ready-to-cook spices see rapid adoption.

* Expansion to 6,000+ dark stores by 2026 strengthens FMCG distribution.

Weather

GUJARAT

For the next 1-2 months (November and December 2025), weather conditions in the jeera (cumin) sowing areas of Gujarat are expected to be generally dry and cool, which is favorable for the crop's growth, following earlier delays caused by unseasonably high temperatures.

Temperature and Rainfall Outlook (November-December 2025)

* Temperature: Minimum temperatures are expected to be in the range of 10-16°C across most jeera-growing regions of Gujarat and Kutch, which is considered below normal and ideal for the rabi crop. Maximum temperatures are likely to be in the range of 25-32°C. The cooler weather is a positive sign after a period of higher-than-normal temperatures in October/early November caused some initial germination issues and delayed sowing.

* Rainfall and Humidity: Dry weather conditions are very likely to prevail, with minimal to no precipitation expected in the region. Cumin is highly sensitive to rain and high humidity, especially during the later stages of growth and harvesting, so a dry spell is beneficial. The low humidity forecast further supports healthy crop development by reducing the risk of fungal diseases like fusarium wilt.

* Sunshine: The region is expected to experience ample sunshine, with average daily sun hours around 10, which aids in the crop's development.

RAJASTHAN

For the next 1-2 months (November and December 2025), jeera (cumin) sowing areas in Rajasthan are expected to experience cool, dry, and clear weather conditions, which are highly favorable for the rabi crop. The cooler temperatures, in particular, are expected to benefit the crop after earlier delays due to higher-than-normal temperatures.

Temperature and Rainfall Outlook (November-December 2025)

* Temperature: Temperatures are gradually falling and expected to be in the cool and pleasant range.

* Daytime Highs: Ranging between 25-30°C (77-86°F) in November and dropping further in December.

* Nighttime Lows: Ranging between 10-16°C (50-61°F) in November, potentially dropping to 5°C (41°F) or below in parts of the desert region in December. These cooler conditions are ideal for the crop's vegetative growth stage.

* Rainfall and Humidity: Dry weather is anticipated, with minimal to no rainfall (around 2mm precipitation for November). Cumin requires a dry environment and is highly sensitive to moisture and cloudy weather, especially during flowering, so a clear sky is beneficial.

* Sunshine: Ample sunshine is expected, with around 10 hours of daily sunlight, which is conducive to healthy plant development.

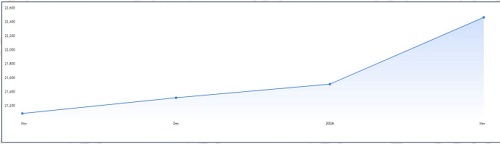

Forward Curve

The forward curve below can help you understand how reasonable it is to buy the contract now and what it might cost in the future. It represents the current commodity's price based on the future possible bid and ask by showing the relationship between the contract's price and the time of its maturity.

Jeera Dhaniya Ratio

Jeera Turmeric Ratio

VOLATILITY

RSI

MACD

VORTEX

MOVING AVERAGES

Outlook

Conclusion

Price Performance: Jeera gained over 10% this month, supported by extremely low arrivals and delayed sowing across Gujarat and Rajasthan. Weather disruptions, uneven rainfall and unstable field conditions restricted acreage expansion, while improved Gulf and Chinese buying helped sustain firmness despite overall price-sensitive export sentiment.

Supply–Demand Balance: India’s cumin production estimate stands sharply lower at 90–92 lakh bags compared to 1.10 crore bags last year. Unjha arrivals remain minimal, and IPM-grade cumin commands a 20–25% premium. Gujarat sowing, though up sharply YoY, still lags normal season progress.

Macro & Trade Drivers: Global supplies remain tight as Syria, Turkey and Afghanistan face weather and geopolitical disruptions. GST cut to 5% is expected to support FMCG demand. Still, April–August exports fell 17% YoY, reflecting price-sensitive overseas buying, although monthly exports showed slight improvement.

Open Interest: Open interest trends reflect steady accumulation as traders position for tight supply expectations. Rising OI alongside elevated prices suggests strong participation from both hedgers and momentum buyers, indicating confidence in the broader bullish structure even as near-term corrective dips may unfold.

Technical Indicators: RSI signals sustained momentum, MACD remains in buying territory and Vortex reflects strength in positive trend. Volatility is elevated but supportive, while moving averages show a firm upward slope, reinforcing an overall bullish outlook despite temporary price declines during sowing progress.

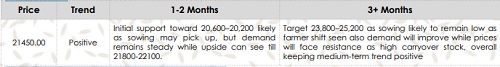

Price Outlook

Above views are of the author and not of the website kindly read disclaimer

.jpg)

More News

Commodity Research- Daily Key Price Levels Report - 21-Nov-2025 by Kotak Securities

.jpg)