Gold trades near record highs as investors eye tech valuations and US rate outlook - HDFC Sescurities Ltd

GLOBAL MARKET ROUND UP

* Gold is trading little changed near record levels, as investors focus on two key areas of uncertainty: the valuation of technology stocks and the future path of US interest rates. Gold initially rose but stabilised after a broad "risk-off" move on Monday saw traders taking profits, especially from major artificial intelligence stocks. The metal is often viewed as a hedge against equity downturns. Crucially, the outlook for gold prices will be heavily influenced by expectations for Federal Reserve interest rate cuts in the coming year. A weak US non-farm payrolls report (due later on Tuesday) would be seen as a sign for more aggressive rate reductions, providing a tailwind for non-yielding gold.

* Oil prices are hovering near their lowest levels since 2021, with WTI trading near $57 a barrel and Brent crude near $60. The primary factor weighing on the market is the prospect of a ceasefire in Ukraine, with US President Donald Trump stating a deal is "closer than ever.“ Traders fear that an end to the conflict could pave the way for an increase in Russian crude flows, exacerbating the problem in an already oversupplied global market. The potential lifting of sanctions on Russian oil would reduce the geopolitical risk premium, further pressuring prices downwards.

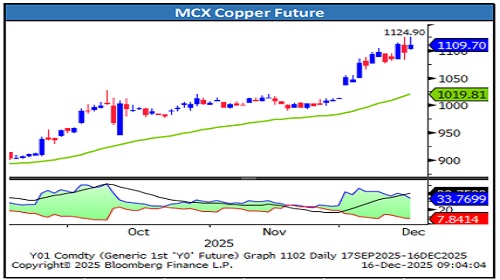

* Copper prices edged lower, falling below $11,600 a ton in London, as investors grew cautious ahead of key US economic data—specifically the jobs report—which will influence expectations for future interest rate decisions. While a weak jobs report could support looser monetary policy and potentially aid copper, stocks and other risk assets also weakened before the release. Despite this recent dip, copper has seen a significant rally this year, surging by about a third and setting records, largely driven by supply disruptions at major mines and the anticipation of a potential tariff on refined metal by the Trump administration, which has tightened global inventories

* Stocks drifted lower and the dollar hovered near two-month lows as investors stayed cautious ahead of key US economic data that may signal where interest rates are headed.

Gold

* Trading Range: 130100 to 133600

* Intraday Trading Strategy: Sell Gold Mini Jan Fut at 132,200 SL 132,800 Target 131,200

Silver

* Trading Range: 192,500 to 201,000

* Intraday Trading Strategy: Sell Silver Mini Feb Fut at 196,000 SL 197,200 Target 193200

Crude Oil

* Trading Range: 4980 to 5250

* Intraday Trading Strategy: Sell Crude Oil Dec Fut on bounce at 5170 SL 5250 Target 5050

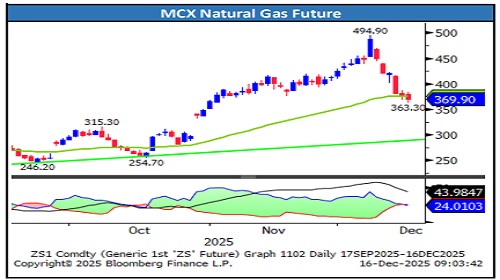

Natural Gas

* Trading Range: 350 to 380

* Intraday Trading Strategy: Sell Natural Gas Dec Fut on bounce at 369 SL 376 Target 360

Copper

* Trading Range: 1070 to 1110

* Intraday Trading Strategy: Sell Copper Dec Fut at 1105 SL 1125 Target 1080

Zinc

* Trading Range: 298 to 315

* Intraday Trading Strategy: Sell Zinc Dec Fut above 309 SL 313 Target 303

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133