Jeera Report 05th Feb 2025 by Amit Gupta, Kedia Advisory

Fundamental Support Meets Strong Technical Resistance

Key Highlights

January rally driven by acreage decline, delayed sowing, and seasonal export demand.

Prices faced rejection near long-term resistance, triggering consolidation

Technical structure signals recovery phase but with capped upside.

Ramzan demand and rupee depreciation support near-term sentiment.

Post-harvest arrivals may create pressure despite positive medium-term tone.

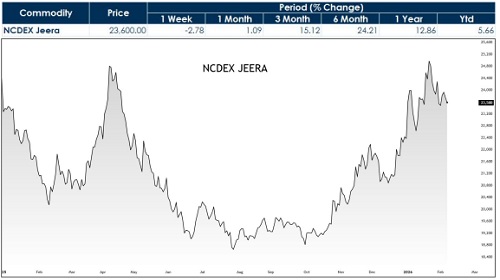

Jeera futures witnessed a sharp turnaround in January 2026, reflecting a blend of tightening supply expectations and seasonal demand strength. Prices opened the month near Rs.23,450 and rallied to a high of Rs.25,130, revisiting levels last seen in April 2025. This move was fundamentally driven by a decline in area under cultivation, delayed sowing across key producing regions, and concerns that weather consistency could impact yields. In addition, January traditionally marks the beginning of stronger export demand, as Ramzan-related buying starts building during this period.

However, the rally lost momentum near higher levels. After testing the Rs.25,130 zone, prices corrected back towards Rs.23,500. This pullback coincided with clarity on the US–India trade deal, which removed earlier uncertainty surrounding spice exports. With confirmation that Indian exports to the US would attract an 18% duty, profit-booking emerged, leading to short-term pressure on prices.

In February so far, Jeera futures opened around Rs.23,480, touched a high of Rs.24,180, and are currently trading near Rs.23,600, indicating consolidation after January’s sharp move. From a demand perspective, the backdrop remains supportive. Ramzan demand is expected to peak from March onwards, while China continues to be an important export destination around the Lunar New Year period. That said, demand from China has remained relatively muted, as its cumin production last year was comfortable, limiting immediate import urgency.

Technical View

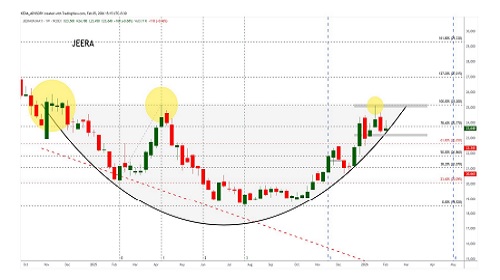

On the weekly chart, Jeera appears to be forming a medium-term recovery structure after bottoming near Rs.18,500 in July. Prices have moved above key short-term averages, indicating improving momentum. However, the long-term 200-week moving average, placed near the Rs.29,000– Rs.29,300 zone, remains a major overhead resistance, clearly highlighted on the chart. This suggests that while the trend has turned positive, the upside remains capped in the near term.

Momentum indicators also support a cautiously bullish bias. RSI has recovered from oversold zones and is stabilising in the mid-range, indicating improving strength without overheating. MACD is trending upward, reflecting a gradual shift towards positive momentum, though not yet signalling an aggressive breakout.

Outlook

For February, prices are expected to trade in a broad range. Immediate support is seen near Rs.22,500, while resistance lies around Rs.25,400– Rs.25,500. Delayed harvest arrivals should lend support on dips, but comfortable carryover stocks may restrict sharp upside. Traders are advised to keep positions light with a positive bias. Once harvest gains pace, short-term weakness towards Rs.20,000– Rs.20,500 cannot be ruled out. Overall, Jeera’s medium-term tone remains constructive, though Rs.25,000– Rs.25,500 is likely to act as a strong cap in the coming weeks.

Above views are of the author and not of the website kindly read disclaimer