Invest in India's Manufacturing Growth with Baroda BNP Paribas Manufacturing Fund

Baroda BNP Paribas Mutual Fund announced the launch of Baroda BNP Paribas Manufacturing Fund on June 10, 2024. The Baroda BNP Paribas Manufacturing Fund will capitalize on the growth potential of India's vital manufacturing sector. The portfolio seeks to invest in companies that : directly engage in manufacturing activity, aim to replace India's imports by manufacturing domestically, export goods produced in India, invest in new manufacturing plants and facilities, support the development of new-age technology solutions, offer allied services related to the entire manufacturing lifecycle, and are listed in India while having manufacturing facilities outside the country or vice versa.

Manufacturing has been a key driver of economic growth worldwide, significantly aiding the development of emerging economies. Government initiatives are significantly boosting the manufacturing sector, with a target to expand the manufacturing base from 17% to 25% of GDP. Additionally, positive Foreign Direct Investment (FDI) flows and India's low manufacturing costs, combined with a large pool of educated young talent, make India a competitive option for global companies. These factors position India to become a leading manufacturing hub.

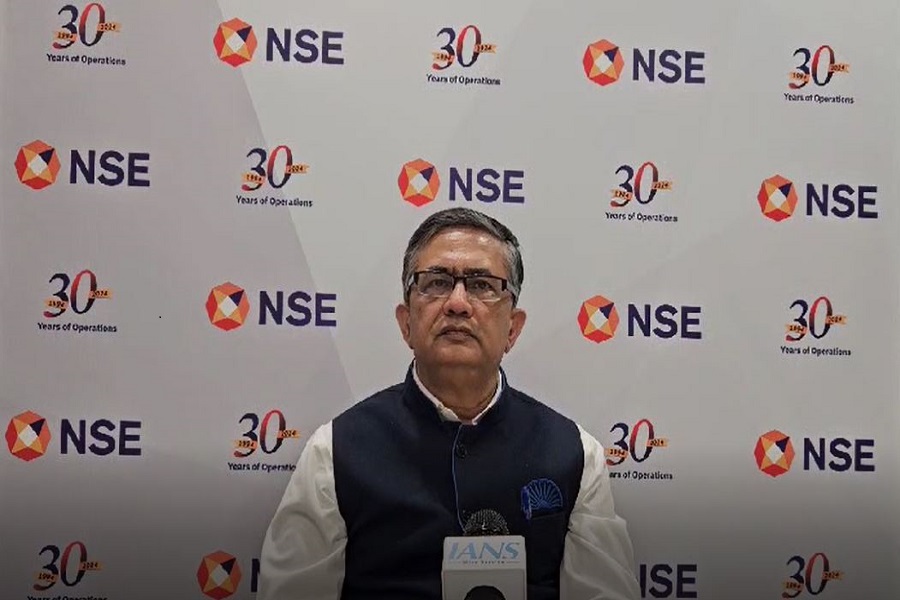

Commenting on the NFO launch, Suresh Soni, CEO, Baroda BNP Paribas Mutual Fund, said: "We are thrilled to launch the Baroda BNP Paribas Manufacturing Fund. The scheme offers a compelling investment opportunity as the manufacturing sector is poised for multi-decade growth fuelled by growing consumption, investments, exports, changing geopolitical dynamics and favourable government policy.”

Baroda BNP Paribas Manufacturing Fund is tailored for investors who are seeking growth opportunities with focused exposure to promising manufacturing companies. This open-ended equity scheme will invest predominantly in equity and equity related securities of companies engaged in manufacturing activities. The scheme will be managed by Mr. Jitendra Sriram. The NFO opens on June 10, 2024 and will close for subscription on June, 24, 2024.

Above views are of the author and not of the website kindly read disclaimer