Infosys Ltd 4QFY25 Result Quick Take by Equirus Securities

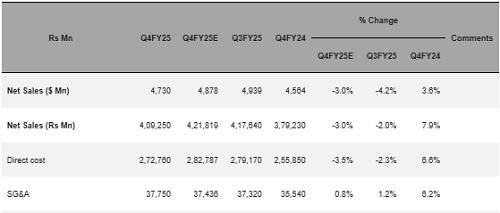

4Q US$ Sales: US$ revenues down by 4.2% qoq and up 3.6% yoy to US$ 4730mn and were 3.0% below EE (US$ 4,878 mn).

4QFY25/FY25 US$ Sales – miss on guidance: US$ sales down qoq by 3.5% in CC terms (+4.8% yoy in CC terms) vs. implied qoq CC growth guidance of negative 0.2% to negative 2.2% and vs. our expectations of 0.7% qoq decline in CC terms. Excluding pass through sales, decline being at 1.7% qoq in CC terms based on our estimates - await clarity. Growth in Top 5/Top 6-10 clients was at (-) 1.2%/+1.1% qoq in 4Q on a base of (-) 6.4% / +0.9% qoq in US$ terms vs. reported dip of 4.2% in US$ terms in 4Q. Except Communication & Hi-Tech all segments registered qoq dip in CC in 4Q. In FY25, Infosys reported CC US$ Sales growth of 4.2% (including inorganic contribution of around 0.7% based on our estimates) vs. guided growth of 4.5-5.0%. We await clarity regarding any non-recurring elements in sales.

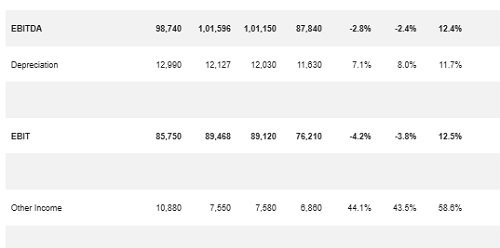

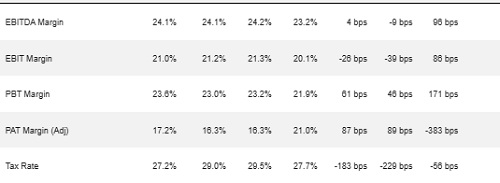

4QFY25/FY25 EBIT margins: EBIT margins came at 21.0% (+90bps yoy) vs 21.3% qoq and our expectations of 21.2% (key headwinds in the quarter included wage hikes for certain employees and visa cost). It seems there are certain non-recurring cost for which we await more details in the earnings call. Onsite efforts came at 23.6% vs. 24.0% qoq while utilisation including trainees came at 81.9% from 83.4% qoq. Sub-con cost came at 8.0% vs. 7.9% qoq 3rd party item bought for delivery cost came at 7.9% vs. 9.6% qoq. We await clarity regarding any non-recurring elements in margins. Infosys reported EBITM of 21.1% in FY25 vs. 20.7% in FY24.

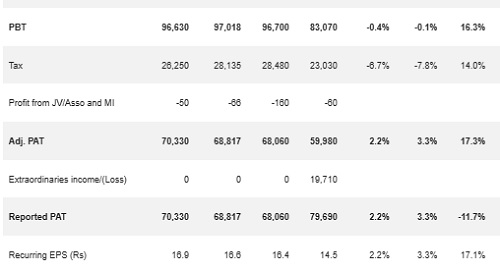

Reported PAT at Rs. 70.33bn up 3.3% qoq and down 11.7% yoy, 2.2% above EE of Rs.68.82bn led by higher-than-expected other income, lower tax expenses partially offset by lower revenue and lower EBITM.

Large deal signings: : Came at $2.637bn vs. US$2.495bn qoq and US$4.454bn yoy. New business TCV at 63.4% of total large deal TCV win of 4Q. i.e US$1672mn vs US$1562mn qoq and US$1964mn yoy. In FY25 Infosys reported large deal TCV of US$11.647bn (incl. new business TCV worth US$6.580bn) vs. FY24 total large deal TCV worth US$17.664bn (incl. new business TCV worth US$9.231bn) with FY24 included many mega deals.

Operating data:

- BFSI/Retail/Communication/E&U, Resources & Services/Mfg /Hi-Tech/Life Sciences/Others grew +12.6%/-2.6%/flat/+1.5%/+14.0%/-1.1%/-3.4%/-2.8% respectively in CC terms YoY.

- North America/Europe/ROW/India grew -0.4%/+15.0%/-2.2%/+43.7% respectively in CC term YoY.

- Employee/headcount and attrition trends: Voluntary LTM IT Services attrition came at 14.1% vs. 13.7% qoq and 12.6% yoy. Employee base increase qoq by 199 qoq @ +0.06% of 3QFY25 base (on base of +1.8% qoq addition in 3Q / +0.8% qoq in 2Q / 0.6% qoq dip in 1Q / +2.0% in FY25 / 7.6% dip in FY24).

- FCF generation: FCF at 110% in 4Q with final dividend worth INR 22/share announced.

FY26E Sales guidance: i) FY26E CC US$ sales growth guidance came at 0-3% (await clarity whether two new announced M&A included in guidance) vs. our expectation of 1.5-4.5% growth guidance, ii) this implies cqoq growth of 0.4% to 1.6% in US$ sales from 1Q-4QFY26E in CC terms, iii) as expected FY24E EBIT margin guidance unchanged at 20-22% (vs. 4QFY25 at 21.0% / 21.1% in FY25 / 20.7% in FY24).

View and Valuation: Overall results are weak both on Sales (even on Sales excl. pass through) and EBITM (seems certain one-time cost) and implies miss on sales guidance for 4QFY25/FY25 – await clarity. Weak exit on FY25 Sales resulting into weak FY25E CC Sales growth guidance of 0-3% in CC terms (await clarity whether guidance includes two newly announced M&A with 4Q results). Also, new business TCV fails to cheer at US$1.67bn in 4Q vs. US$1.56bn qoq / US$1.64bn yoy. We await more details in the earnings call scheduled on 17th Apr 2024 @ 5.30pm India time (Dial in: +91-22-6280 1168 / +91-22-7115 8069).

At CMP of Rs.1419 stock trades at FY26E/27E P/E of 19.9x/18.1x respectively based on EPS before 4QFY25 results.

Last Published Financials

Quarterly Result Summary:

Above views are of the author and not of the website kindly read disclaimer