Indian Markets Unfazed; Nifty Posts Third Consecutive Monthly Gain

The global economy enters June clouded by two intensifying undercurrents: ballooning government debt and deepening geopolitical fractures. From the U.S. to Japan, debt levels are at historic highs, limiting fiscal flexibility just as interest costs rise. Meanwhile, wars, tariffs, and the unraveling of global supply chains are reshaping trade and policy dynamics. This combination of strained balance sheets and geopolitical uncertainty makes for a volatile, harder-to navigate world.

Market outlook

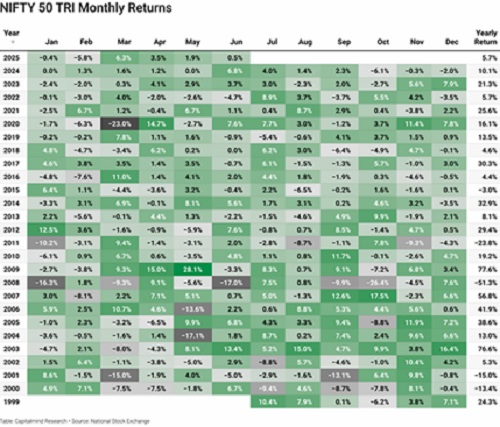

* NIFTY 50 has remained nearly flat in June; May sees modest gains

* 2025 has been a mixed bag for NIFTY 50 TRI after a strong March (+6.3%), gains have slowed. February (-5.8%) and January (-0.4%) dragged performance, but recent months show cautious optimism. With a YTD return of +5.7%, the index is up but treading carefully.

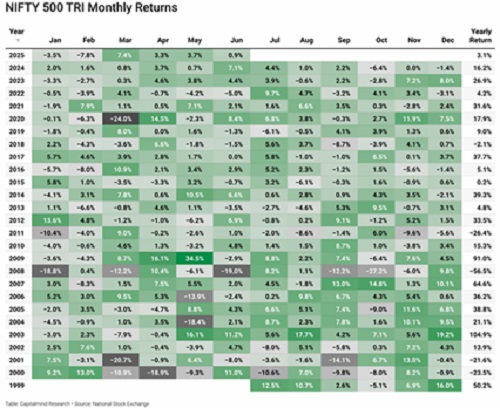

* NIFTY 500 picks up in May after rough start; June holds steady

* After tumbling in Jan (-3.5%) and Feb (-7.8%), the NIFTY 500 TRI bounced back with a strong March (+7.4%) and steady gains in April and May. June has been relatively flat (+0.9%), bringing the 2025 YTD return to +3.1%—a slow but stabilizing recovery.

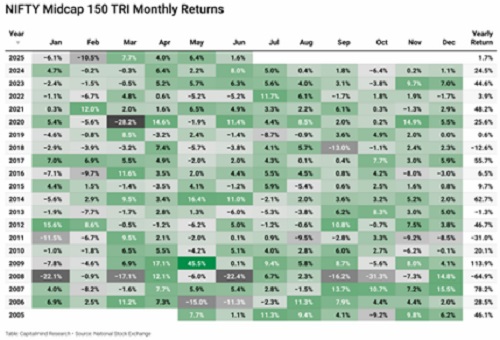

* Midcaps rebound sharply after brutal start; June holds mild gains

* The NIFTY Midcap 150 TRI saw sharp losses in Jan (–6.1%) and Feb (–10.5%), but bounced back strongly in March (+7.7%), followed by steady recovery in April and May. June’s modest +1.6% reflects cooling momentum, with YTD gains at just +1.7%.

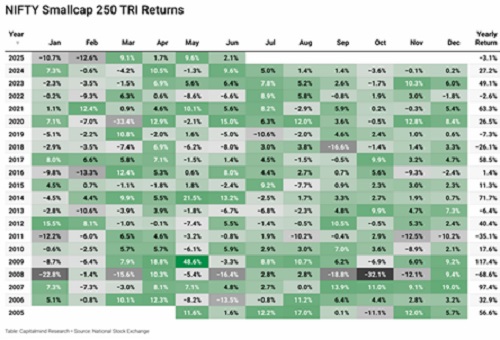

* Smallcaps still negative for the year; green shoots appearing

* The NIFTY Smallcap 250 TRI plummeted in Jan (–10.7%) and Feb (–12.6%) but rebounded in March (+9.1%) and May (+9.6%). June is modest so far (+2.1%), but YTD remains negative at –3.1%, highlighting volatility and tentative recovery in the smallcap segment.

Commodity outlook

* Oil prices edge up—and may surge if Iran-Israel tensions escalate

* Brent crude has risen to $73, up from recent lows, and may climb further amid rising Iran-Israel tensions. A broader conflict could disrupt Gulf oil flows, risking a price shock like in 2022. That said, it still remains lower than the peaks seen post-pandemic.

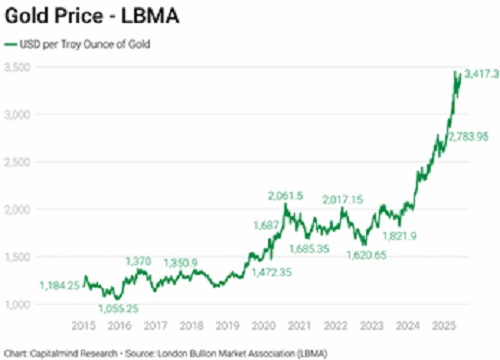

* Gold is rallying

* Gold prices have skyrocketed to $3,417 per troy ounce, doubling in just two years. Geopolitical tensions, a weakening dollar, fears of U.S. fiscal instability, and strong central bank buying have fueled demand. Gold is reasserting its role as the ultimate hedge against crisis, inflation, and systemic risk.

Above views are of the author and not of the website kindly read disclaimer