Indian government to revamp infrastructure lender IFCI, sources say

India will revamp operations of non-bank lender IFCI Ltd by shutting its lending operations following capital constraints and converting it into an infrastructure advisory firm, two government sources told Reuters on Tuesday.

IFCI, launched in 1949 soon after the country's independence, was asked to stop fresh lending in 2021-22 after bad loans soared, depleting the lender's capital and liquidity.

Indian government owns nearly 72% of IFCI.

The federal finance ministry and IFCI did not immediately respond to a request for comment. The sources remained anonymous as they were not authorised to speak to the media.

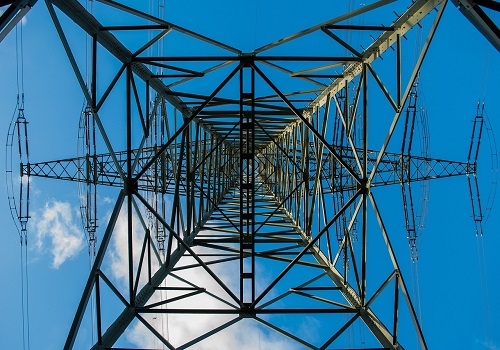

The revamp comes as the South Asian nation is rapidly investing in its infrastructure sector, increasing its spending more than three times in five years to 11.11 trillion rupees ($131.89 billion) for 2024/25.

As per the plan, IFCI will not resume lending, instead expanding the scope of its infrastructure advisory service to include evaluation for state governments infrastructure and green projects, the first source said.

They added that the government wants the company to replicate the project advisory practices of SBI Capital Markets, the investment banking arm of State Bank of India, the country's largest lender by assets.

The government plans to infuse 5 billion rupees into IFCI this year, and any further capital infusion will be to ensure there are no defaults in repayment commitments of IFCI, the two sources said.

IFCI's shares fell 0.8% on the day. They closed 11.3% higher on Monday, after the board approved its merger with its subsidiary StockHolding Corp. of India on Friday, based on the recommendation of the federal finance ministry.

The stock has gained 121% so far this year, compared to a 10% rise in the benchmark Nifty 50.

The revival plan also includes monetising IFCI's real estate assets and renting its office spaces, one of the sources added.

The non-bank lender earned 427 million rupees through rental income and earned a profit of 1.3 billion rupees in fiscal 2024.

($1 = 84.2375 Indian rupees)