Indian capital markets raised more IPO money in last 5 years than previous 20 $20 bn IPO issuance forecast by Equirus in calendar 2026

India’s capital markets have reached a major milestone, with the last five years witnessing record fundraising activity. According to new data from Equirus Capital, companies raised Rs 5,394 billion through initial public offerings (IPOs) between 2020 and 2025—exceeding the Rs 4,558 billion raised in the entire preceding two decades (2000–2020).

What makes this surge remarkable is that it was achieved with only 336 IPOs during the 2020–2025 period, compared with 658 issues from 2000 to 2020.

“One of the reasons behind this increased capital raising is that the average IPO size in the last 5 consecutive years has been Rs 1,605 crore vs Rs 692 crore between 2000-2020,” said Bhavesh Shah, Managing Director and Head Investment Banking, Equirus Capital - one of India’s leading investment banking and financial services powerhouse.

Rising OFS share and stronger monetisation opportunities

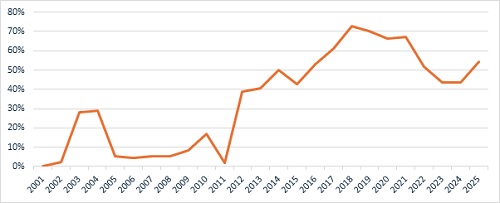

The rapid expansion of India’s capital markets has empowered promoters and financial sponsors to monetise equity holdings more effectively. This is reflected in the growing share of Offer for Sale (OFS) transactions within IPOs (see graph below).

“The increasing acceptability of Offer for sale IPO issues has helped Private Equity funds secure exits and aided partial monetization of promoter’s successful entrepreneurship,” said Shah.

Average Offer for Sale as % of Total Fund Raised

Private equity exit trends further reinforce this momentum. The first ten months of 2025 saw the share of secondary sales in PE exits more than double from 7% in 2024 to 16%. Although block deals remain the dominant exit method, their contribution has declined from 67% in 2024 to 56% in January–October 2025.

“This deal volume will only grow in the future as $165 billion worth of PE investments mature and reach disinvestment stage in future years,” added Shah.

Three major IPO themes shaping 2026

According to Equirus, three structural trends will define India’s IPO markets in 2026:

- Strong investor appetite for new-age and digital economy IPOs

- Large-size IPOs setting new benchmarks and deepening market liquidity

- Democratisation of capital markets, driven by rising issuances from Tier-2 and Tier-3 cities

“Issues from tier 2 and tier 3 cities now account for more than a quarter of the value of IPOs raised up from just 4% in 2021,” said Shah.

India’s economic momentum boosting market depth

India remains the world’s fastest-growing major economy, supported by a revival in manufacturing, the Make in India and Atmanirbhar Bharat initiatives, and a strong entrepreneurial base. “India is standing out as a place where investors can find sustainable growth,” said Shah.

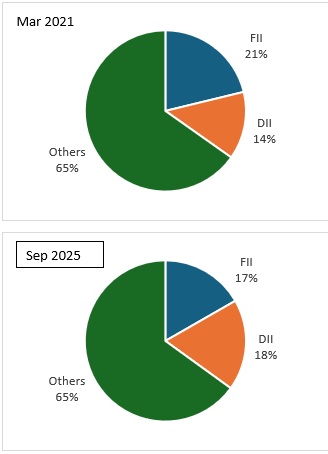

This momentum has also driven robust domestic flows into capital markets, with domestic institutional investors now surpassing FIIs in ownership of NSE-listed companies (see graph below).

Stake in NSE listed companies

“In 2026 we see a strong pipeline of IPO's and expect capital raising via this route to touch $20 billion,” concluded Shah.

Above views are of the author and not of the website kindly read disclaimer

More News

Lenskart IPO: Promoter Sumeet Kapahi`s degree, marksheets missing, shows DRHP