India Strategy Weekly IdeaMetrics : Market Health Check – Resilient earnings, rich valuations by Emkay Global Financial Services

Market Health Check – Resilient earnings, rich valuations

The markets continue to be strong, and the Nifty recovered 3.7% from the last low of 29-Aug-25. Much of the optimism is centered around GST 2.0, and we see signs of a strong consumption surge in 4QCY26, with most of the benefits being passed on to the customer. Earnings have stabilized, with consensus Nifty EPS forecasts holding steady, and we see room for upgrades in Discretionary and Industrials. Valuations are elevated, though, with the market running ahead of expected earnings upgrades. We remain optimistic about the markets and maintain our Nifty target at 28,000. In our model portfolio, we move to a Neutral on IT from UW, adding Coforge to the portfolio. We trim our Internet weightage, from 15% to 10%, after the strong run-up, while exiting Paytm. We raise our weights on auto OEMs.

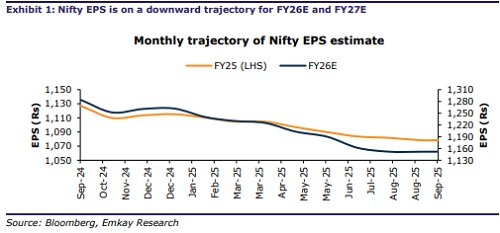

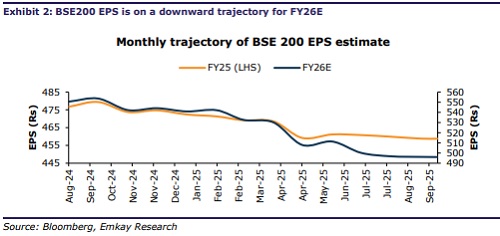

Earnings resilient and conservative

The earnings cycle has bottomed out and we see upside potential to FY26/FY27 Nifty EPS of 1,105/1,275 (9%/15% YoY growth). The positives from GST 2.0 are yet to be priced in – eg earnings revisions in autos/ancillaries have been muted at ~2% since 15-Aug-25 (Exhibit 11:). As it stands, Materials and Industrials are the key contributors across both years, with Energy the laggard. Consensus expects Financials and Staples to bounce back in FY27 after a weak FY26 (Exhibit 10:), though we are skeptical and see downgrade risks. On the other hand, Discretionary, Industrials, and Technology may see earnings upgrades for FY27.

Valuations starting to price in the upside

The optically-rich valuations are covering for the lag in sell-side upgrades. The Nifty is at 20.8x PER 1YF, near +1sd above 5Y LTA (Exhibit 12:). 40% of our consensus universe (504 stocks with >5 analyst coverage) are now trading at >1sd, well below the Oct-24 peak of 49%, albeit elevated nevertheless (Exhibit 18:). The Nifty SmallCap TTM PER has also pushed above 5Y LTA to 32% – the Midcap100 and SmallMid400 continue to trade at a discount though (Exhibit 16:). The market is, in our view, partially pricing in the cyclical upside from multiple stimuli – increase in welfare spending, income tax cuts in Feb-25, strong monetary easing, and now GST 2.0. We expect this to deliver a strong upturn in the consumption cycle and, therefore, the high valuations do not worry us.

Locals continue to offset FPI flows

FPIs remain sustained sellers with a further selling of Rs 350bn in Aug-25, though Sep25 (MTD) has been better (Exhibit 22:). Domestic flows, on the other hand, continue to be considerably strong, with a net inflow of Rs334bn in Aug-25 (Exhibit 23:). Promoter selling has cooled off since the Jun-25 peak, though it continues at a steady pace. FDI numbers remain anemic – the strong gross inflows (Rs 8bn) almost entirely offset by exits and selling. Primary issuances also cooled off in Aug-25, although the pipeline remains strong and we expect a steady flow over the rest of CY25.

Summary of EMP changes

Additions: Coforge – We move from UW to N on IT because of comfortable valuations and some earnings cushion from the recent weakness in the rupee. We pick Coforge because of comfortable relative valuation and an expected normalization after a weak Q1FY26.

Exits: One 97 Communications (Paytm) – We trim our Internet exposure after the strong run-up recently, and exit PayTM. We remain constructive on the name for the longer term, though we prefer Eternal because of its larger TAM and stronger moat. Valuations are not rock-bottom either.

Increased Weights: Maruti Suzuki and TVS Motor – We increase exposure to autos to play the GST theme. Early channel checks indicate a strong volume surge after 22-Sep and the companies have passed on the GST cuts aggressively.

The EMP performed in line with benchmark BSE-200 last week – Discretionary and Staples outperformed, while Financials and Industrials dragged.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Stock Insights : Bajaj?Finserv Ltd , Info?Edge Ltd, Ircon?International Ltd, JK?Paper Ltd, P...