India Strategy : Indian markets log new record as investor optimism builds by Motilal Oswal Financial Services Ltd

* The Nifty hit an all-time high, while India’s overall market cap remained flat YoY as broader markets are yet to catch up. India’s market cap stood at USD5.3t, below its previous peak in Sep’25.

* India’s share in global market cap declined sharply to 3.6%, down from the Sep’24 high of 4.7%, as global markets recovered and outperformed India by a wide margin.

* Nifty-50’s 12-month rolling return has remained range-bound over the past year and below the LTA.

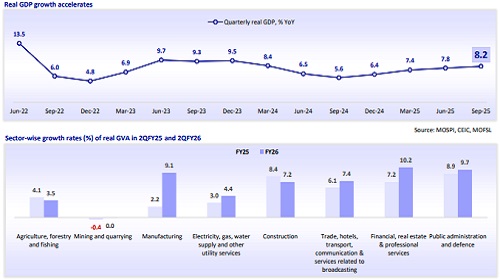

India’s real GDP growth surges 8.2%; nominal GDP growth at 8.7% YoY

* Higher-than-expected growth was attributed to the low GDP deflator (0.5% YoY), similar to 1QFY26 (deflator at 0.9% YoY).

* Sector-wise the highest growth of 10.2% YoY was led by ‘Financial, Real Estate & Professional Services’ (PSU banks, capital markets, fintech, large private banks, and insurance companies). The second-best sector was manufacturing, with 9.1% YoY growth.

* Despite the adverse impact of US tariffs on India’s manufacturing sector, domestic demand has so far managed to hold the strong growth trajectory. The GST cut-led pickup in consumption in 2Q and the rise in govt. spending in 3Q should provide the necessary boost to offset weak exports.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed positive with gains of 0.37% at 25751 levels by Mo...