India Strategy : How much supply of paper is there? Any large number By Kotak Institutional Equities

How much supply of paper is there? Any large number

The answer to this common question from investors will depend on (1) valuations of the market and stocks—the higher the valuations, the greater the supply and (2) strategies of majority shareholders—many may look to sell part or even all of their stake. Investors may recall the immortal line from The Godfather movie about ‘can’t-refuse’ offers.

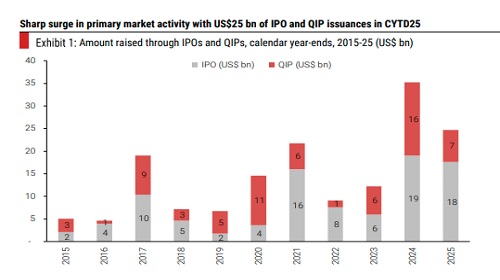

High valuations mean more supply

The continuous large supply of paper in India in the primary (see Exhibits 1-2) and secondary (see Exhibits 3-4) markets from private equity entities and promoters simply reflects high valuations across most sectors and stocks (see Exhibits 5-10). We expect the supply of paper to stay at high levels as long as (1) valuations remain high—owners have large incentive to monetize a part or even their entire shareholding in listed companies and (2) retail investors through DIIs continue to make ‘fantastic’ offers in the market through their price-agnostic purchases at all price points (see Exhibits 11-12).

Government should sell more—fiscal pressures, high valuations

In our view, the government can look to divest its holdings in PSUs, given (1) rising fiscal pressures (see Exhibits 13-14) and (2) high valuations of many PSU stocks (see Exhibit 15). The government owns more than 51% of many non-financial and financial PSUs (see Exhibit 16) and has been a reluctant seller in PSUs. It has consistently missed its divestment targets (see Exhibit 17) in the past few years. The sharp increase in dividends from the RBI has compensated for lower divestment revenues in FY2024-25, but FY2026-27E may see higher fiscal pressures, given the large GST rate cuts from September 2025.

PEs have every incentive to sell

We expect PE investors to sell at the ‘right’ valuations, as it is a straightforward business proposition for them. They hold substantial stakes in many listed companies (see Exhibit 18 for the total quantum of holdings by PEs, broken down by the top-20 positions of PEs by value), which will be sold eventually. We note that PE investors have sold large amounts of their stakes in companies through IPOs and secondary offerings (block deals) in the past few years, which suggests they find current market and stock valuations sufficiently attractive (high) to exit part of their positions.

Promoters can look to sell if the offer is tempting enough

We expect promoters (domestic and foreign) to opportunistically sell a portion of their holdings in companies. We note that promoters have been increasingly monetizing their holdings through secondary market or strategic transactions (see Exhibit 19)—the reasons may vary (diversification, generation change), but high valuations may help overcome ‘ownership’ hurdles. We wonder if promoters of Indian companies will increasingly treat their ownership in companies as investments and be willing to sell an even larger portion of their companies purely on commercial logic.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137

Tag News

Strategy: Day 2 of Chasing Growth 2026 by Kotak Institutional Equities