India Strategy : Foreign fund flow tracker by Kotak Institutional Equities

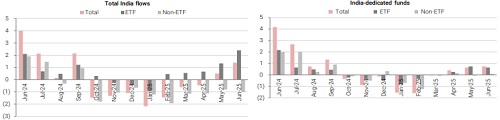

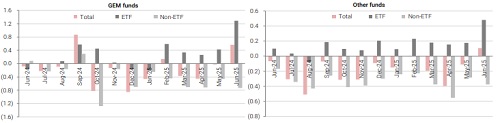

Listed funds witnessed inflows for the second consecutive month. The inflows were driven by ETFs, which attracted US$2.4 bn, offset by non-ETF outflows of US$1 bn. GEM funds saw US$563 mn of inflows, led by ETF inflows of US$1.3 bn, offset by US$727 mn of non-ETF outflows. India-dedicated funds witnessed inflows of US$726 mn (US$633 mn of ETF inflows and US$93 mn of non-ETF inflows).

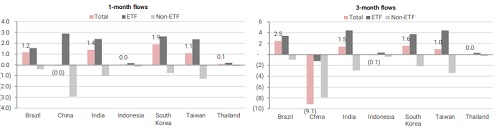

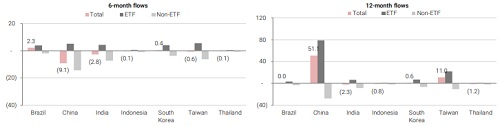

* Emerging market flows. Listed emerging market fund flows were positive for most countries, except for China. South Korea, India, Brazil and Taiwan saw inflows of US$1.9 bn, US$1.4 bn, US$1.2 bn and US$1 bn, respectively. China witnessed outflows of US$36 mn. Total FPI and EPFR activity showed a similar trend for India, South Korea and Taiwan.

* Country allocations. Allocations to China and India constitute 40% of the average Asia ex-Japan fund portfolio. Asia ex-Japan fund allocations to India declined marginally to 16.3% in June from 16.4% in May, whereas allocations to India by GEM funds declined to 18.7% in June from 19% in May. Allocations by Asia ex-Japan non-ETFs remained stable at 18.4%. Allocations to India by GEM non-ETFs declined to 16.7% in June from 17% in May.

Product description and methodology. KIE’s foreign fund flow tracker gives a comprehensive view of the market flow by listed funds into India and its emerging market (EM) peers. These market participants are further classified based on their investment styles—passive (ETFs) or active (non-ETFs)—in an attempt to understand the intent and sentiments governing the flow. Please note that there is a difference between EPFR-reported fund flows and FPI flows reported by NSDL. EPFR fund flow data primarily tracks mutual funds, ETFs, closed-end funds and variable annuity funds/insurance-linked funds, whereas NSDL-reported FPI flows also capture investments from hedge funds, proprietary desks and sovereign wealth funds.

Monthly total, ETF and non-ETF flows for India

India-dedicated funds saw inflows of U$726 mn, whereas GEM funds saw inflows of US$563 mn

Monthly India total, ETF and non-ETF flows broken down into different geo-focus funds (US$ bn)

EPFR flows into emerging markets

China saw outflows of US$2.9 bn of ETF inflows and US$2.9 bn of non-ETF outflows

EPFR fund flows into emerging markets (US$ bn)

Above views are of the author and not of the website kindly read disclaimer

.jpg)