India Strategy : Credit cycle bottoming out, led by retail By Emkay Global Financial Services

Credit cycle bottoming out, led by retail

We see a strong credit cycle recovery over the next 2-3 years, primarily led by retail albeit with improved growth from wholesale too. We see significant growth headroom for retail, with worries over penetration and customer leverage overplayed. Wholesale faces some challenges like low inflation and disintermediation, though the RBI measures of 1-Oct-25 should help cushion that. The best way to play the cycle is via autos, which is a strong second-order beneficiary. Within BFSI, we prefer NBFCs and mid-size banks, with strong unsecured/auto exposure over the larger banks. Our top ideas from this theme are Maruti Suzuki, Shriram Finance, Bajaj Finance, and IDFC First Bank.

Bounce-back in retail credit

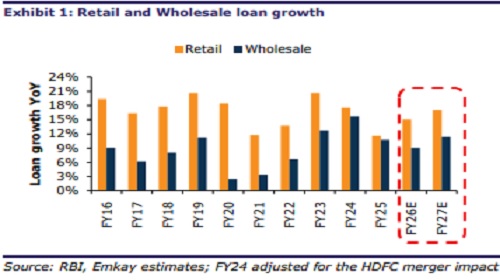

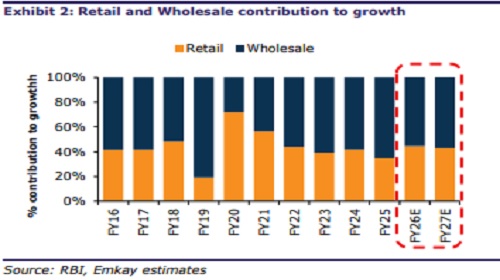

We expect aggregate loan growth to accelerate modestly to 11% in FY26E, at an implied credit multiplier (loan growth/GDP growth) of 1.4x. We see retail growth accelerating from 12% in Aug-24 to ~15% in FY26, though wholesale should remain weak at around 8-9% from here. We expect a stronger recovery (13.3%) in FY27E, with retail accelerating to 17% as the consumption cycle accelerates and wholesale recovers to 10%. There is some upside (100-150bps) from the liberalization moves by the RBI.

We see three key drivers for the retail credit recovery: a) the RBI’s change in liquidity stance should drive higher M3 growth and, consequently, loan growth; b) the relaxation of lending restrictions will further improve lenders’ propensity to lend; and c) improved consumer demand from the fiscal stimuli creating a positive feedback loop.

Wholesale will continue to lag. i) The corporate capex cycle is recovering steadily, though dependency on debt is on the wane. ii) Banks face disintermediation by capital markets. iii) Banks’ risk aversion is a hindrance to growth. iv) Low inflation is an additional headwind, for the next 3-4 quarters. iv) MSME growth may slow down, from ~15% due to NPL issues, though GST reform is a long-term catalyst. The RBI liberalization of 1-Oct25 is, however, a strong positive and could offset some of these challenges.

Supply constraints drove the slowdown

The slowdown in retail credit growth has been caused primarily by tight liquidity and deposit growth. The problem was exacerbated by the RBI’s regulatory tightening between Nov-23 and Nov-24, to ward off a potential NPL crisis. The sharp slowdown in nominal GDP growth (down by 224bps YoY to 9.78% in FY25) was an effect rather a cause of the credit slowdown. The delta in the growth came from retail – overall retail growth slowed by 596bps to 11.6% in FY25, while non-retail slowed by 496bps to 10.7%.

Retail: No significant demand challenges

We see significant headroom for retail loan growth and believe that retail loan/GDP will rise further from the FY25 level of 55%. i) The share is still low compared to global peers, ii) Despite a contra narrative, the stress in the system was minuscule in FY25, with balance-level 90+dpd peaking at 1.5-2% for unsecured loans in Sep-24. iii) There is great credit discipline in the system, with secured lending still dominant and an effective credit bureau system in place. iv) Lenders are keeping risk metrics stable through growth cycles, as evident from the stable share of ‘subprime’ borrowers at ~28% over 5Y.

NBFCs cornering market share

Banks’ share of total corporate credit has dropped by 580bps to 49% over the past five years, reflecting structural disintermediation. This is mainly driven by risk aversion, consequent to the banking crisis of the late teens – the slack being picked up by the bond market for corporates and by NBFCs for retail. We see banks’ share slipping further – bond markets offer better yields for borrowers in a low-rate environment because of MCLR rules, and NBFCs are more aggressive in retail lending.

Play through consumption and NBFCs

The credit revival is a big incremental positive for lenders, though it may not translate into stock performance. First, banks will see margin pressures due to fundamental assetliability mismatches. Second, the growth recovery will be limited by the banks’ own riskaversion and will not resolve the fundamental growth-valuation mismatches. Consumer discretionary is a better play, as we see a consumption revival driven by the acceleration in retail lending. This is further boosted by lower inflation and the tax cut in the Union Budget 2025.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354