India`s L&T slides most in four years on elusive margin growth

Shares of Larsen and Toubro tumbled as much as 7% on Wednesday, in their steepest drop in nearly four years, as India's largest infrastructure company struggled to improve its profit margins.

L&T's core margins in infrastructure projects, its biggest business, contracted to 5.5% in the third quarter, from 7.7% a year earlier, which it blamed on continuing cost pressures in a few legacy projects that are now nearing completion.

This forced L&T to further cut its full-year margin forecast to 8.25%-8.50% from 8.5%-9.0% earlier, Amar Kedia, vice president of institutional equity research at Ambit Capital, said in a note.

"Margin improvement remains elusive and we believe the company struggles with the difficult choice of maintaining growth, margins and capex at the same time," said Kedia, who has a "sell" rating on L&T's stock.

The weakening margins in the infrastructure business, which accounts for about half of total revenue, led to L&T's profit missing market expectations for the first time in a year.

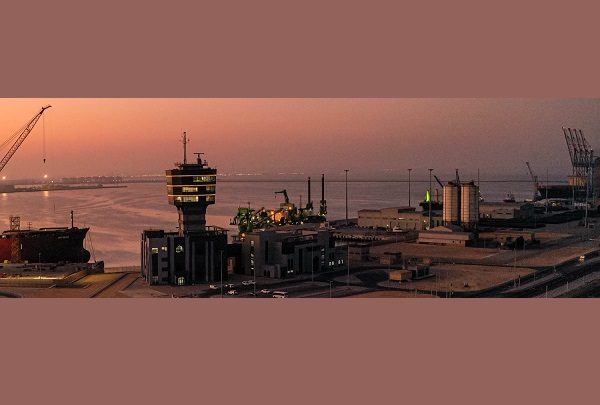

The company also cautioned that it expects domestic orders to slow down in the next two quarters in the lead-up to India's general elections, while its international logistics costs could rise due to disruptions in the Red Sea shipping lane.

L&T gets about 44% of its revenue from overseas.

The stock was down 4.3% at about 3,476 rupees at noon and weighing down the benchmark Nifty 50 index.

Only two analysts, including Kedia, recommend selling L&T's shares, while 28 analysts have a "buy" rating on the stock, according to LSEG data. Their median price target suggests the stock will rise a further 8% in the next 12 months.

L&T's shares have surged 65% in the last 12 months, nearly triple the gain in the Nifty 50 index.

Tag News

IIP data, Fed minutes and FII moves likely to guide Indian stock market this week