India`s ETF AUM Grows More Than 5x in 5 Years, Retail folios Surge 11x: Zerodha Fund House

A new study by Zerodha Fund House reveals that ETFs in India, though still in early stages, have registered significant growth. Since May 2014, the mutual fund Industry has witnessed steady inflows and increase in the AUM (Assets Under Management) as well as the number of investor folios (accounts). Over time, the financial landscape saw further innovation in how these diversified investment portfolios were structured. This evolution led to the emergence of Exchange-Traded Funds (ETFs)

Global ETF Landscape

ETFs have a large market globally. At the end of March 2025, there were almost 14,000 ETFs listed globally, with a total ETF size of over USD 15 trillion. Globally, a record US$1.9 trillion was invested in ETFs in 2024.

ETF Penetration in India

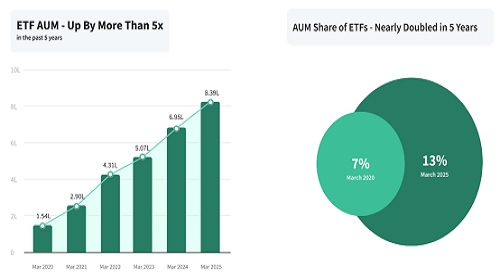

The total AUM of ETFs have grown by close to 5.5x over the last 5 years from March 2020 to March 2025. The sustained growth over five years highlights a consistent trend in Indian ETFs.

This expansion likely has broader implications for capital markets, asset allocation strategies, and the investment landscape as a whole. The asset base of ETFs reflects a significant shift in the evolving investor preferences.

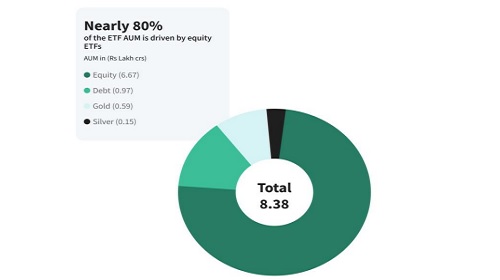

AUM Share of ETFs - Nearly Doubled in 5 Years, as of March 2025. ETFs constituted ?8.38 lakh crore in AUM, about 13% of the total ?65.74 lakh crore Indian mutual fund industry whereas in March 2020, ETFs accounted for roughly 7% of total Indian mutual fund AUM.

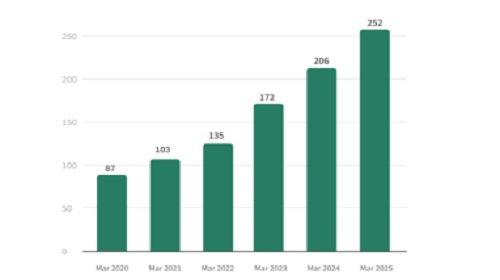

Total number of ETFs - Up by nearly 3x in 5 Years:

The ETF landscape in India has witnessed substantial expansion in this period. The near tripling of the total number of ETFs available in India reflects a significant increase in the variety of investment instruments. This expansion includes the introduction of new commodity ETFs backed by Silver in 2022, broadening the options available to investors.

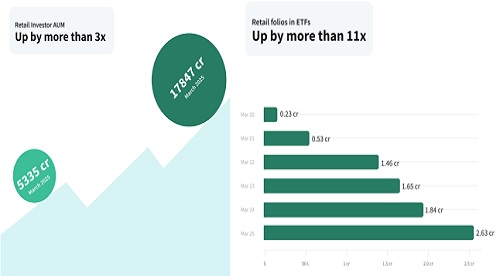

Retail AUM has more than tripled in 5 years As of March 2020, the retail investor AUM was about 5,335 Cr. In the 5-year period, as of March 2025, the AUM has crossed more than 17,800 Cr. The number of retail investor folios in ETF schemes has seen significant growth, reaching about 2.63 crore as of March 2025, a substantial rise from 23.22 lakh in March 2020 - more than tenfold expansion in retail participation. Also, more than 97% of all ETF investor folios are from the retail segment. This retail interest suggests a broadening awareness and understanding of ETFs as an investment avenue suitable for various financial objectives and risk tolerances.

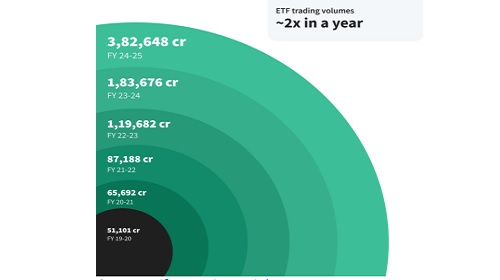

Trading Volumes have more than doubled in a year

The trading volume of ETFs in India has increased dramatically, from ?51,101 crore in FY 19-20 to ?3.83 lakh crore in FY 2024-25, marking an increase of more than 7 times. In fact, it has also more than doubled in the last 1 year. Higher liquidity is a significant advantage for investors, as it generally allows for smoother and more efficient trading. Having said that, trading volume can vary across different ETF asset classes.

Nearly 80% of the ETF AUM is driven by equity ETFs

This number has roughly remained around 80% on an average over the last 5 years from March 2020 to March 2025. The consistent share for Equity ETF AUM indicates a preference for equity investments through the ETF route, highlighting the effectiveness of these instruments for gaining exposure to the stock market.

Speaking on the findings, Vishal Jain, CEO, Zerodha Fund House said, “This study highlights the new era for Indian ETFs, marked by surging retail participation and expanding product diversity reflected in higher resultant volumes.” An ETF is a mutual fund scheme that trades like a stock on a stock exchange. The Indian ETF market, while still relatively young, has demonstrated growth across multiple dimensions: AUM, investor base, product diversity, and trading volumes. As investors seek lower-cost, transparent, and liquid investment options, ETFs may be positioned to become a core component of Indian portfolios.

For more information on the schemes, please visit: https://www.zerodhafundhouse.com

Above views are of the author and not of the website kindly read disclaimer

Tag News

SBI Mutual Fund announces the launch of SBI Quality Fund