India`s CPI inflation edges up to 5.08 pc in June

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India’s consumer price inflation edged up to 5.08 per cent in June this year compared to the same month of the previous year as high prices of vegetables and pulses pushed up food inflation during the month, figures released by the Ministry of Statistics on Friday showed.

Vegetable prices shot up by as much as 29.32 per cent during the month as the scorching heat wave in the northern states hit production, while the prices of pulses rose by 16.07 per cent during the month.

The prices of cereals also increased by 8.65 per cent during the month.

Inflation had eased to a 12-month low of 4.75 per cent in May after having come down to 4.83 per cent in April, which was an 11-month low. The June figures mark a break from the declining trend that had set in during recent months.

However, the declining trend in cooking oil prices continued in June with a 2.68 per cent fall during the month. The price rise in spices slowed to 2.06 per cent from 4.27 per cent in May.

Food inflation, which accounts for nearly half of the overall consumer price basket, rose 8.36 per cent compared to 7.87 per cent in May.

The RBI has fixed a mid-term target of 4 per cent for retail inflation before it goes in for a cut in interest rates to rev up growth.

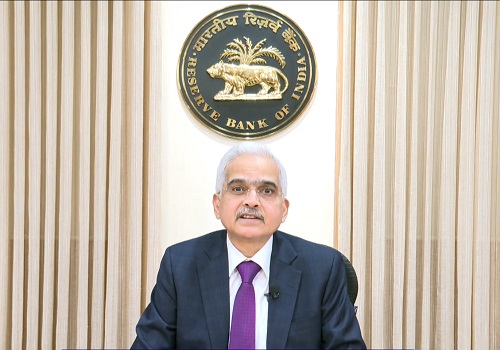

RBI Governor Shaktikanta Das said on Thursday that it is too early to talk on the interest rate cut due to uncertain economic environment and inflation remaining close to 5 per cent.

“The overall economic environment globally and in India is so uncertain to talk in terms of an interest rate cut. The CPI headline inflation continues to be close to 5 per cent and according to surveys done it is expected to close 5 per cent and I think it is too early to talk about the interest rate cut,” the Governor said.

The RBI is keen to keep inflation under control to ensure growth with stability and held the repo rate steady at 6.5 per cent for the eighth consecutive time in a row in its bi-monthly monetary policy earlier this month.

While the RBI has raised its projected GDP growth estimate to 7.2 per cent for 2024-25 from 7 per cent earlier, it has kept its projection for retail inflation at 4.5 per cent.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">