India Economics : Weekly round-up of macro-economic events by JM Financial Services

THIS WEEK'S HIGHLIGHTS

* In the week that passed, China officially confirmed the broad details of the framework of the trade deal with US. China is expected to review and approve items under export controls while US will uplift restrictive measures. Top priority for US here has been to ensure the supply of the rare earths.

* Trump also hinted on reaching an agreement on the trade deal with India. However he indicated that as trade deals with every country would not be possible, letters will be sent detailing the applicable tariffs.

* In his testimony before the congress, Powell reiterated his data dependent approach and dashed market hopes of accelerated rate cuts. However market chatter around the appointment of new Fed chairman raised hopes of easy policy, which reflected in the benchmark yields (UST 10yr) which eased 24bps to 4.28%.

* NATO alliance agreed to more than double their defense spending from 2% to 5% of GDP by 2035. This 5% figure would include 3.5% of GDP spent on pure defense while the rest would be spent on critical infrastructure.

* India’s Finance Minister urged Public Sector Banks to boost credit growth with a focus on MSME and support the financial inclusion efforts of the government. Net NPAs of PSBs have further declined to 0.52% as of May-25.

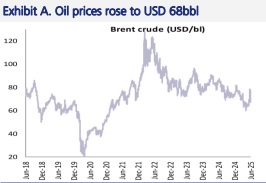

* The announcement of ceasefire between Iran and Israel led to a sharp fall of 11.5% in Brent crude oil price. This led to an improvement in market sentiments. Nifty gained 2.1%, however it underperformed the EM and DM basket.

* After the negative deviation at the start of the month, the progress in monsoon has been noteworthy. On a cumulative basis, deviation in rainfall turned positive in the last week of June (10.3% as on 27th Jun). However rainfall in Marathwada and Vidarbha in Maharashtra is still deficient.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361