India Economics: RBI's bold double down: rate cut & liquidity by Elara Securities India

RBI's bold double down: rate cut & liquidity

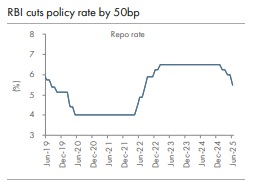

The RBI Monetary Policy Committee (MPC) cut the policy repo rate by 50bp to 5.5% vs our and consensus expectation of a 25bp. Today’s policy signals bias toward a higher growth trajectory through lowering of cost of funds. To accelerate the pace of transmission and give the banking system comfort of a durable liquidity, the RBI cut the cash reserve ratio (CRR) by 100 bp to 3.0% in a staggered fashion starting on September 6, 2025. The policy stance was changed to Neutral, suggesting a data-dependent response from the RBI hereafter. If FY26E inflation print is below 3.7% or risks to growth emerge, another 25bp cut cannot be ruled out. But the RBI is likely to wait for the Monsoon to conclude along with developments related to trade deals to determine course of further action, if warranted. We see India’s 10-year yield at 6.1% by March 2026E and expect further moderation in money market rates amid comfortable liquidity. Today’s move is positive for lending financials and is expected to traction the performance of other rate sensitives like auto, real estate and consumer discretionary sectors.

Monetary policy prioritizing growth: The comfort of moderating inflation along with the desire to push growth to aspirational level of 7-8% allowed the MPC to front-load the policy repo rate cut through an outsized rate cut of 50bp. This along with the necessity to reduce cost of funding and provide comfort of durable liquidity for credit offtake led the RBI to cut CRR by 100bp in a staggered way starting from September 6, 2025 till November 29, 2025. In recent months, a softer USD has provided EM central banks a window to undertake monetary policy easing that supports growth without compromising on local financial conditions. The front-loading of cuts from the RBI thus seems justified.

Policy to become data-dependent hereafter: Front-loading of rates and the shift to a Neutral stance suggests the RBI will be data-dependent hereafter and will likely stay in a wait and watch mode until conclusion of the Monsoon. Should downside risks to growth materialize and/or inflation eases below 3.7% projection by RBI for FY26, room may open for another rate cut of 25bp.

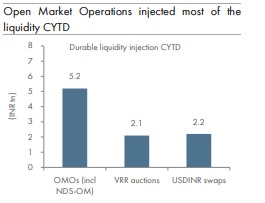

CRR cut to aid in liquidity and banks NIM: The RBI MPC also reduced the CRR to 3.0% of net demand and time liabilities (NDTL) from 4.0%, infusing INR 2.5tn of primary liquidity in the banking system. Assuming 11.5-12.0% credit growth in FY26E, our calculation suggests a positive impact of 4-5bp on NIM for banks this financial year with the benefit getting more pronounced from FY27E.

A 100bp CRR cut may help the RBI to manage liquidity tightness that is likely to arise from a possible unwinding of RBI’s short position in FX forward book of USD 52bn. The lowering of CRR should also aid in transmission to lending rates. Data indicates weighted average lending rate (WALR) on fresh rupee loans and outstanding rupee loans have declined by 6bp and 17bp, respectively, during February-April 2025, when the repo rate cut of 50bp was undertaken and INR 9.5tn worth of durable liquidity was injected (starting January 2025).

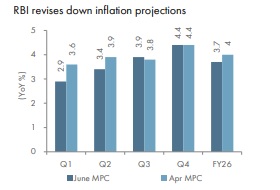

Inflation outlook revised down; growth kept steady: The RBI lowered inflation projection for FY26 to an average of 3.7% (from 4.0% and our estimates of 3.4%) with distribution of inflation skewed higher toward Q4FY26. Normal Monsoon, and steady Kharif & Rabi crop outlook to ensure adequate supply of food items in RBI’s view is likely to keep food inflation in check. Tariff- and weather-related concerns are key uncertainties to FY26 inflation outlook. On the growth front, RBI held projection steady at 6.5% (vs previous projection and our estimates of 6.5% each) which the RBI Governor labeled as “lower than our aspirations”. Signals from the press conference and the statement indicate the monetary policy throughout FY26 will remain accommodative to push and keep growth rate sustainably in the range of 7-8% YoY.

Outlook – another 25bp cut still possible: Today’s RBI MPC meet was bold and skewed toward growth. The front-loading of 50bpcut helps the RBI to extract policy space to counter near-term uncertainty emanating from trade and tariffs. Globally, we expect the Developed Markets (DM) central banks to slow their pace of rate cuts facing the same uncertainty, and we expect the Federal Reserve to postpone its the first rate cut to Q4CY25.

Domestically, we expect inflation to remain around 3.4% (FY26E average) with risks on the downside. On the growth front, given the tax cuts and assuming the rate cut gets transmitted with minimal lags, we expect private spending to do the heavy lifting along with public capex.

If FY26E inflation print is below RBI’s estimate of 3.7% or risks to growth emerge, another 25bp cut cannot be ruled out. But the RBI is likely to wait for the Monsoon to conclude along with developments related to trade deals to determine course of further action, if warranted.

Above views are of the author and not of the website kindly read disclaimer