Hospitals Sector Upadate : Hospitals to Benefit from CGHS Hike by Choice Broking Ltd

CGHS rates’ revision to benefit hospitals across the board

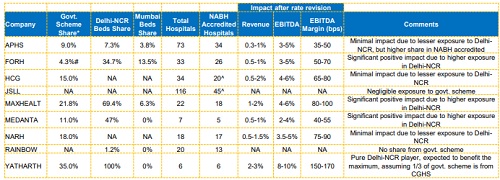

Our Initial Analysis: For our coverage companies, government schemes account for around 10–35% of revenues, with CGHS contributing 20– 35% of govt. scheme share (CIE assumption). We anticipate that other schemes will align with the revised rates in the near future. Delhi-NCR and Mumbai remain the key cities with the highest number of beneficiaries.

Our recent discussion with the few management indicate that the revised rates could lead to a 0.5–3% increase in revenue, with most of this benefit flowing through to EBITDA and PAT; EBITDA margin is expected to improve by 35–170bps. We expect a partial impact in H2FY26 and a full impact from FY27. Should other schemes adopt similar rates, the positive impact on ARPOB and revenue would be even greater.

We expect the rate revision to benefit companies, such as MEDANTA, MAXHEALT, NARH and YATHARTH. Earlier, the strategic focus was on reducing CGHS dependence so as to improve cash flows and safeguard margin, but we expect hospitals to change this approach, going forward. What has happened

Exhibit 1: Impact expected after rate revision

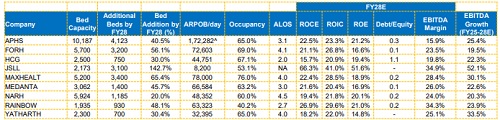

Exhibit 2: Comparative analysis of performance across coverage universe

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Tag News

Realty Sector Update :Developers, Flexible Office Space and Construction by Choice Institut...

More News

Bulls & Bears : India Valuations Handbook By Motilal Oswal Financial Services Ltd