2023-10-20 11:40:35 am | Source: Kedia Advisory

Gold trading range for the day is 59485-60795 - Kedia Advisory

Gold

Gold experienced a 0.41% increase yesterday, closing at 60,318 per ounce, primarily driven by growing tensions in the Middle East, which sparked safe-haven demand. This geopolitical instability often serves as a catalyst for investors to seek refuge in gold, given its historical role as a store of value during uncertain times. On the domestic front, the U.S. housing market displayed signs of possible stabilization, albeit at a lower level. Existing home sales decreased by 2% in the past month, reaching an annualized rate of 3.96 million units, the lowest since June 2020. These figures were released by the National Association of Realtors (NAR). In the international arena, Swiss gold exports faced a decline in September, marking a 15-month low. This drop was attributed to reduced deliveries to key gold-consuming nations like India and Turkey. Demand in India typically strengthens towards the end of the year due to traditional festivities and the wedding season. Meanwhile, the financial markets are closely monitoring the Federal Reserve's monetary policy. There's a 94% probability, according to the CME FedWatch tool, that the Fed will maintain interest rates at their current levels. From a technical perspective, the gold market is currently experiencing fresh buying interest. Open interest has increased by 1.97%, settling at 14,766 contracts. Gold prices have also risen by 245 rupees. Key support levels for gold are at 59,905, and a breach below this could lead to a test of 59,485. On the flip side, resistance is expected at 60,560, and a break above this level could pave the way for prices to test 60,795.

Trading Ideas:

* Gold trading range for the day is 59485-60795.

* Gold prices rose amid tensions in Middle East

* The U.S. housing market could be showing early signs of stabilizing as sales activity of existing homes falls to its lowest level since June 2020.

* Swiss gold exports fell to their lowest in 15 months in September due to lower deliveries to India and Turkey

Silver

Silver prices experienced a slight decline of -0.39% to settle at 71616 as profit-taking ensued, prompted by the search for guidance on inflation. This dip followed a recent surge driven by escalating tensions in the Middle East, notably the Gaza hospital blast, which drew widespread condemnation across the Arab world. Concurrently, the US dollar remained strong, while US Treasury yields reached 16-year highs, driven by remarks from the Federal Reserve. Fed Bank of New York President John Williams emphasized the need for restrictive interest rates "for some time" to bring inflation back to the 2 percent target. On the other hand, Fed Governor Christopher Waller suggested it's premature to gauge if further policy actions are necessary. These comments created uncertainty around the future direction of interest rates and their impact on precious metals like silver. Despite this, the US housing market faced headwinds, with a 2% decrease in existing-home sales in September 2023, marking the fourth consecutive monthly decline and reaching levels not seen since October 2010. From a technical perspective, the silver market saw a surge in open interest by 4.99%, settling at 19914, even as prices declined by -279 rupees. Silver's support is currently at 71080, with potential to test 70545 levels. Resistance is expected at 72175, and a breakthrough could lead to testing the 72735 range. These technical indicators reflect a market influenced by economic and geopolitical developments, with investors closely monitoring central bank policies and inflation concerns to determine silver's future price trajectory.

Trading Ideas:

* Silver trading range for the day is 70545-72735.

* Silver dropped on profit booking as investors looked for guidance on inflation.

* The dollar traded firm and U.S. Treasury yields jumped to 16-year highs

* However, downside seen limited amid escalating Middle East tensions.

Crude oil

Crude oil prices showed a 0.76% increase yesterday, settling at $73.30 per barrel. This uptick was driven by concerns that the Israel-Hamas conflict could escalate further in the Middle East, potentially disrupting oil supplies in the region. Furthermore, U.S. oil production from major shale-producing regions is projected to decline for the third consecutive month in November, reaching its lowest level since May 2023, according to the U.S. Energy Information Administration (EIA). In November, U.S. oil output is expected to decrease to 9.553 million barrels per day, down from 9.604 million barrels per day in October. The drop in production is attributed to various factors, including market dynamics and operational challenges. In terms of inventories, U.S. crude oil and fuel stocks experienced larger-than-expected declines. Refiners increased crude processing to meet strong domestic demand for distillate fuels, leading to reductions in stocks. Diesel and heating oil inventories have been hovering near record lows in anticipation of the winter season and continued to decline, with distillate stockpiles decreasing by 3.2 million barrels in the week ending October 13. From a technical perspective, the crude oil market is currently witnessing increased buying interest. Open interest has risen by 18.26%, settling at 3,245 contracts, and prices have seen a gain of 55 rupees. The key support level is at 7,190, with a potential test of 7,051 if it is breached. On the upside, resistance is expected at 7,406, and a move above this level could lead to prices testing 7,483.

Trading Ideas:

* Crudeoil trading range for the day is 7051-7483.

* Crude oil gains as Israel-Hamas conflict sparks Mid-East supply fears

* OPEC is not inclined to take up member Iran's call for an oil embargo on Israel after a huge explosion at a Gaza hospital.

* US oil output from top shale regions set to fall in November – EIA

Natural gas

Natural gas prices experienced a significant decline of -4.1% in the previous session, closing at 245.8, primarily due to a confluence of factors that impacted the market. Record-high natural gas production, mild weather conditions, and a larger-than-expected storage build were the key contributors to this bearish trend. The US Energy Information Administration (EIA) reported that US utilities injected 97 billion cubic feet (bcf) of natural gas into storage last week, surpassing market expectations of an 80 bcf increase. Furthermore, natural gas production reached 103.6 bcfd in October, surpassing the previous record of 103.1 bcfd in July, indicating an abundance of supply in the market. Exports to Mexico, which had hit record levels in September, declined in October, although there are expectations of an upturn with the commencement of liquefied natural gas (LNG) exports from New Fortress Energy's plant. Looking ahead, forecasts for mild weather conditions extending into early November are expected to keep heating and cooling demands subdued, further pressuring natural gas prices. On the technical front, the market has witnessed a notable increase in open interest, rising by 14.93% to settle at 32,758. Prices have declined by -10.5 rupees, indicating strong selling pressure. The support level for natural gas is currently at 241.5, with a potential test of 237.2 if this level is breached. Conversely, the resistance level is at 253.6, and a break above this point could lead to a test of 261.4.

Trading Ideas:

* Naturalgas trading range for the day is 237.2-261.4.

* Natural gas dropped pressured by record output, mild weather

* Pressure also seen after data showed a bigger-than-expected storage build last week.

* The latest EIA report showed US utilities added 97 billion cubic feet (bcf) of gas into storage last week

Copper

Copper, a vital industrial metal, experienced a modest 0.01% gain in its price, closing at 700.55 per ton. However, these gains were largely overshadowed by concerns stemming from a significant surge in copper inventories, reaching a two-year high of 191,675 tons in LME-registered warehouses. This increase in stockpiles was the primary factor putting downward pressure on copper prices. Amidst these inventory concerns, China's economic indicators provided a mixed picture. China's GDP grew by 4.9% in the third quarter, outpacing expectations, indicating that recent policy measures had contributed to a tentative economic recovery. This, in turn, supported consumption and industrial activity in September. However, China also saw a substantial 14.5% year-on-year increase in refined copper production in September, raising questions about oversupply. Antofagasta, a major Chilean copper miner, projected a production increase between 670,000 and 710,000 metric tons in 2024, citing progress in expanding its Los Pelambres mine. They reported a 4.1% YoY increase in copper production for the first nine months of 2023, partly due to improved water availability in their key mines. Copper inventories surged by nearly 50% in a single week, causing worries about future supply inadequacies. From a technical perspective, the market saw a decrease in open interest by -6.66%, settling at 6,392. Prices moved up by 0.1 rupees. Key support levels for copper are identified at 697.9, with a potential test of 695.2 if breached. On the upside, resistance is expected at 702.9, and a break above this level could push prices towards 705.2.

Trading Ideas:

* Copper trading range for the day is 695.2-705.2.

* Copper settled flat after LME inventories rose to a two-year high

* China's Sept refined copper output jumps 14.5% y/y

* Antofagasta expects copper output up to 710,000 t in 2024

Zinc

Zinc, a crucial industrial metal, faced a decline of -0.34% on the previous day, settling at 218.85. This drop can be attributed to growing concerns regarding global demand and anxieties surrounding China's property sector. In September 2023, China's refined zinc output witnessed a month-on-month increase of 3.31%, reaching 544,000 metric tonnes. While this might seem positive, it falls short of expectations. On a year-on-year basis, the output increased by 7.94%, also lower than anticipated. From January to September, the cumulative production of refined zinc in China reached 4.85 million metric tonnes, showing a year-on-year increase of 9.84%. Domestic zinc alloy production in China also saw a rise, reaching 88,200 metric tonnes in September, marking a 2,000 metric tonne increase from the previous month. However, the most significant revelation came from the International Lead and Zinc Study Group (ILZSG), whose statistics committee met recently. It revised its earlier assessment from April, which suggested a small supply deficit of 45,000 tonnes for the year. The latest assessment suggests that zinc supply will exceed usage by a substantial 248,000 tonnes, with the surplus projected to grow to 367,000 tonnes in 2024. From a technical perspective, the market is undergoing long liquidation, as indicated by a 3.83% drop in open interest, settling at 2,460. Prices are down by -0.75 rupees. Currently, zinc finds support at 218.2, and a breach below this level may test 217.4. On the other hand, resistance is expected at 219.6, and a move above this level could push prices towards 220.2.

Trading Ideas:

* Zinc trading range for the day is 217.4-220.2.

* Zinc prices dropped due to concerns about global demand.

* In September 2023, China's refined zinc output was 544,000 mt, a growth of 3.31% month on month

* ILZSG zinc supply will exceed usage by a hefty 248,000 tonnes with the surplus growing to 367,000 in 2024

Aluminium

Aluminium faced a slight setback yesterday, with a 0.07% decline, closing at 202.7. This dip can be attributed to concerns stemming from a hawkish Fed outlook and a slowdown in the Chinese economy, which have negatively impacted industrial sentiment. China, being the world's largest aluminium producer, took measures to prevent oversupply and increased energy consumption from outdated infrastructure. They halted the expansion of production capacity, keeping it at the current limit of 45 million tons. Nonetheless, China's primary aluminium output for September saw a 5.3% increase from the previous year, supported by strong demand and low inventories. Aluminium stocks on the Shanghai Futures Exchange dropped significantly to 79,194 tons, the lowest since March 2019 and down by 66% from the previous year. The National Bureau of Statistics reported that primary aluminium output for the first nine months of 2023 reached 30.81 million tons, a 3.3% increase from the same period in 2022. Looking ahead, it's anticipated that monthly output in the fourth quarter will remain in the range of 3.5 to 3.6 million tons. Su Yanbo, a researcher at industry consultancy Aladdiny, provided this insight. From a technical perspective, the market experienced long liquidation as open interest dropped by 7.25% to settle at 2660. Prices also saw a decline of 0.15 rupees. As for future price performance, Aluminium's support is at 202, and if it falls below this level, it may test 201.1. On the upside, resistance is likely to be encountered at 203.6, and a breakthrough could lead to a test of 204.3.

Trading Ideas:

* Aluminium trading range for the day is 201.1-204.3.

* Aluminium dropped as the outlook of a hawkish Fed and a slowing Chinese economy.

* China's primary aluminium output in September rose 5.3% from a year earlier

* Primary aluminium output totalled 30.81 million tons in the first nine months of 2023, up 3.3% from 2022

Cotton candy

Cotton candy futures experienced a notable uptick of 0.41% in the latest trading session, settling at 58,620. This gain can be attributed to significant developments in the cotton market, as outlined in the October WASDE report from the USDA. The report revealed a substantial cut in U.S. cotton production for the 2023/24 season, projecting a reduced output of 12.8 million bales. One of the most striking insights from the USDA report is the projection that Brazil's cotton production in 2023/24 is set to surpass that of the United States for the first time in history. Furthermore, it is anticipated that Brazil is on the brink of exceeding U.S. cotton exports, marking a significant shift from historical trends dating back to the 19th century. Australia's cotton exports to China saw a substantial increase in August, reaching 61,319 metric tons valued at $130 million. The Cotton Association of India (CAI) also released its final estimate for the 2022-23 cotton crop, revising it upward to 31.8 million bales, compared to initial estimates of 34.4 million bales. This contrasted with the government's third advance estimate of 34.3 million bales for the 2022-23 season and the industry's production estimate of 29.9 million bales for the previous season. CAI's revised estimate takes into account data from various sources and stakeholders, indicating the complexity of estimating cotton production accurately. In terms of technical analysis, the cotton market is currently witnessing fresh buying momentum. Open interest increased by 0.88% to 115, while prices surged by 240 rupees. Key support levels for Cottoncandy are at 58,360 and 58,110, with resistance likely to be encountered at 58,920 and, if breached, could lead to testing the 59,230 level. The technical indicators indicate a positive sentiment in the market, potentially paving the way for further price appreciation.

Trading Ideas:

* Cottoncandy trading range for the day is 58110-59230.

* Cotton prices gained as USDA cut U.S. production in 2023/24

* The USDA also said Brazil's cotton production in 2023/24 will exceed that of the United States for the first time

* Australia's exports of cotton to China ballooned to 61,319 metric tons worth $130 million in August

* In Rajkot, a major spot market, the price ended at 27397 Rupees dropped by -0.28 percent.

Turmeric

The turmeric market experienced a notable setback, with a 3.1% drop in prices, settling at 13,692 due to profit booking. This decline was primarily influenced by improved crop conditions thanks to favorable weather. However, the potential for yield losses in the upcoming unfavourable October weather limited the downward movement. The crop is currently in satisfactory condition and is expected to be ready for harvest between January and March. The Indian Meteorological Department (IMD) projects drier-than-average weather for October, which could negatively impact crop growth. Despite this, buying activity remains robust, and dwindling supplies are expected to maintain price stability. A key concern for the industry is the anticipation of a 20-25% decline in turmeric seeding, notably in regions like Maharashtra, Tamil Nadu, Andhra Pradesh, and Telangana, as farmers shift their priorities. The export data for April to August 2023 shows an 11.51% increase in turmeric exports compared to the same period in 2022. However, there was an 18.20% drop in turmeric exports in August 2023 compared to July 2023 and a 6.67% drop compared to August 2022. In Nizamabad, a significant spot market, turmeric prices ended at 13,679.15 Rupees, reflecting a marginal decline of 0.05%. From a technical perspective, the market has seen fresh selling, with a 4.08% increase in open interest, settling at 14,410. Prices have decreased by 438 rupees. Turmeric is currently finding support at 13,450, with the potential to test levels of 13,206, while resistance is expected at 14,054, with a chance of prices testing 14,414.

Trading Ideas:

* Turmeric trading range for the day is 13206-14414.

* Turmeric dropped due to profit booking amid improved crop condition due to favorable weather condition.

* However downside seen limited due to the potential for yield losses caused by the crop's anticipated unfavourable October weather.

* Support is also evident for improved export opportunities.

* In Nizamabad, a major spot market, the price ended at 13679.15 Rupees dropped by -0.05 percent.

Jeera

Jeera prices experienced a notable decline of -4.74% on the previous day, settling at 53,695 due to profit booking. This drop can be attributed to sluggish export demand, which has led to profit-taking by traders. However, there are limitations to the downside movement due to the constrained availability of high-quality crops. The global demand for Indian jeera has slumped, with buyers preferring alternative sources like Syria and Turkey due to the comparatively higher prices in India. Despite the decline in global demand, Indian jeera remains competitively priced in the international market, thereby restraining overseas demand. Unfortunately, this competitive pricing does not favor exporters at present, indicating subdued export activity in the weeks ahead. China, a significant buyer of Indian jeera, has reduced its purchases in recent months, exerting downward pressure on Indian exports. The potential for China to resume purchasing Indian cumin in October-November, just before the arrival of the new crop, adds further uncertainty to market dynamics. As for recent export data, jeera exports from April to August 2023 saw a significant drop of 23.76%, totaling 69,779.04 tonnes compared to 91,529.49 tonnes during the same period in 2022. From a technical perspective, the market is currently witnessing fresh selling, with open interest increasing by 3.02% and settling at 4,503. Jeera prices have fallen by -2,670 rupees. Support for jeera prices is anticipated at 52,260, and a breach of this level could lead to a test of 50,830. On the flip side, resistance is expected at 55,860, and a move above this level could result in prices testing 58,030.

Trading Ideas:

* Jeera trading range for the day is 50830-58030.

* Jeera dropped due to profit booking amid demand due to sluggish export demand.

* Global demand of Indian jeera slumped as most of buyers preferred other destinations like Syria and Turkey

* Export is likely to remain down in upcoming months as per the export seasonality.

* In Unjha, a major spot market, the price ended at 56871.65 Rupees dropped by -1.5 percent

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

67 pc HNIs and UHNIs firmly bullish on India?s growt...

Union Budget: Prime Minister Narendra Modi govt on r...

RBI may cut rates further if India-US trade deal is ...

Bajaj Finance loses over Rs 14,000 crore in market v...

India?s tax-to-GDP ratio reaches 19.6 pc, structural...

Half of economists forecast 1 pc growth range for S....

Why stock markets often trade lower ahead of Union B...

Foreign ownership of S. Korean stocks reaches highes...

Passenger traffic at Incheon airport reaches record ...

Vizhinjam Port Phase 2 launch puts Kerala firmly on ...

Top News

Persistent Systems trades jubilantly on reporting 30% rise in consolidated net profit

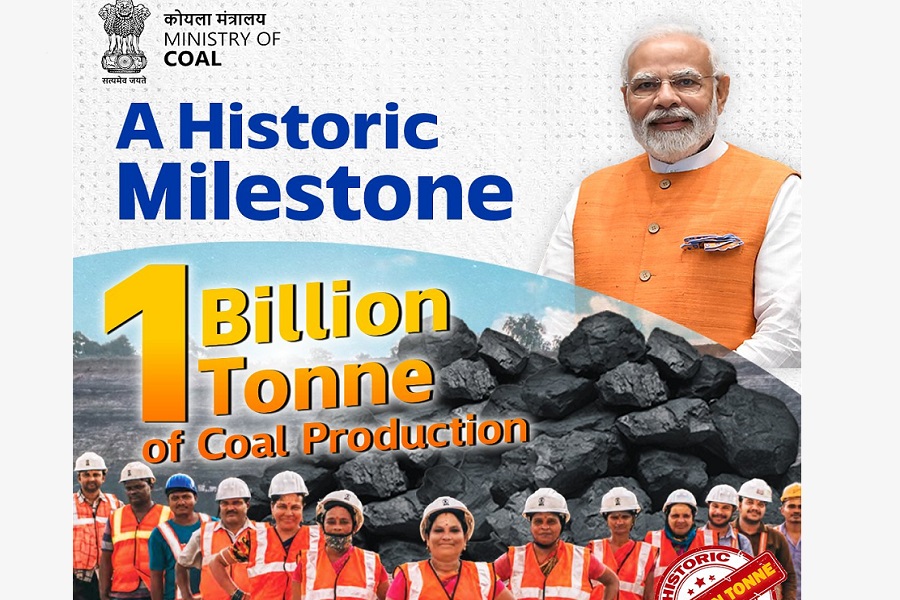

Prime Minister Narendra Modi says it`s a proud moment for India as coal production crosses 1 billion tonnes in 2024-25

GST reforms to stimulate consumption without derailing government`s fiscal consolidation: Moody`s

GDP data, US jobs numbers, Venezuela tensions likely to drive stock market next week