Gold Outperforms as Equity Momentum Softens, Signalling a Strategic Shift in Markets by PL Asset Management

PL Asset Management, the asset management arm of PL Capital Group (Prabhudas Lilladher), in its latest report ‘PMS Strategy Updates and Insights’, noted that Indian equity markets are navigating a phase of consolidation marked by global uncertainty, uneven participation and cautious investor sentiment. While domestic macro fundamentals remain structurally strong, near-term equity performance has been constrained by external headwinds, resulting in market returns being driven by a narrow set of stocks rather than broad-based participation.

Market breadth has remained persistently weak over the past year, with a limited group of large-cap stocks supporting headline indices even as broader participation stayed muted. Technical indicators suggest that only a small proportion of stocks have consistently traded above their long-term moving averages, highlighting the fragility beneath index-level resilience. This divergence indicates that while Indian equities remain fundamentally sound, the market has yet to transition into a durable, broad-based uptrend.

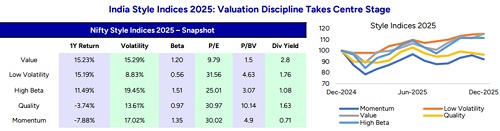

This consolidation was also evident across major equity style factors. Value and High Beta strategies posted positive returns in 2025, while Momentum underperformed, highlighting a market driven more by selectivity than by sustained trends. Value stocks drew investor interest due to compelling valuations and stable earnings visibility, serving as a preferred refuge amid elevated volatility. High Beta strategies delivered modest gains, indicating calibrated risk-taking rather than a broad risk-on stance. Meanwhile, repeated trend reversals limited the effectiveness of momentum-based approaches, reflecting narrow market breadth and fragmented leadership. Overall, investor behaviour in 2025 leaned toward caution, with capital favouring stocks that combined valuation support with controlled risk. The style factor landscape in 2025 was defined by the strong performance of contrasting factors, driven largely by sector- and stock-specific moves. Market breadth remained narrow and momentum was weak, reinforcing a selective and low-risk appetite investing environment.

Against this backdrop, precious metals have significantly outperformed Indian equities, reinforcing their role as effective portfolio stabilisers during periods of equity consolidation. Gold and silver have benefited from a combination of global factors, including sustained central bank demand, currency volatility and persistent geopolitical uncertainty. Silver has additionally been supported by its dual role as a precious and industrial metal amid constrained supply conditions.

PL Asset Management’s analysis indicates that Indian equities are currently trading near multi-cycle relative lows compared with gold and silver. Historically, such valuation divergences between financial and real assets have coincided with phases where diversification beyond pure equity exposure has helped investors preserve capital and manage volatility more efficiently. Importantly, this does not signal a structural shift away from equities, but rather highlights the importance of balance during transitional phases of the market cycle.

Market sentiment indicators suggest that the worst of pessimism may be behind us. Internal sentiment and risk metrics point to a gradual improvement from recent cycle troughs, supported by resilient domestic macro data and an improving earnings outlook. Notably, the high–low beta spread turning positive towards the latter part of 2025 indicates early signs of risk appetite returning, although the recovery is expected to be measured rather than linear.

Mr. Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management, said, “Markets are currently in a phase where outcomes are being driven more by asset allocation than by broad-based equity rallies. While India’s long-term growth fundamentals remain intact, near-term volatility is inevitable. Gold and silver have once again demonstrated their relevance as portfolio stabilisers, helping investors manage risk and stay invested through periods of market consolidation.”

Above views are of the author and not of the website kindly read disclaimer